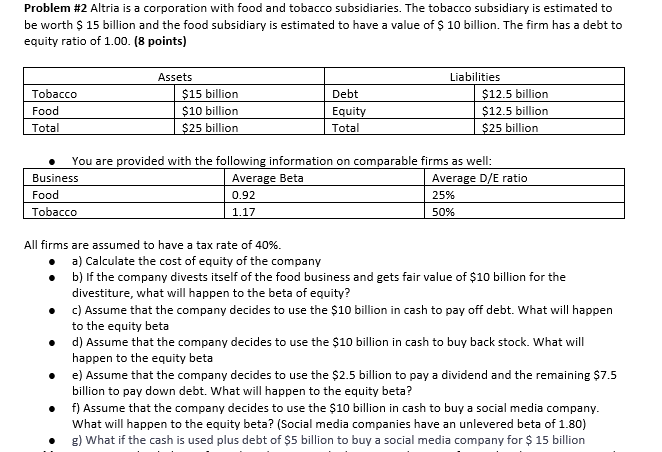

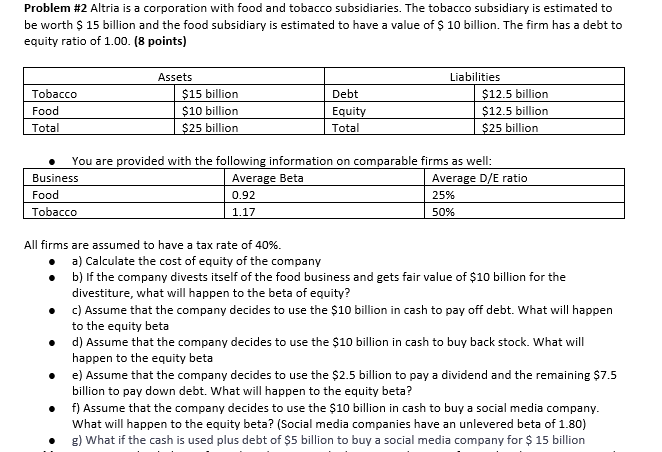

Problem #2 Altria is a corporation with food and tobacco subsidiaries. The tobacco subsidiary is estimated to be worth $ 15 billion and the food subsidiary is estimated to have a value of $ 10 billion. The firm has a debt to equity ratio of 1.00. (8 points) Tobacco Food Total Assets $15 billion $10 billion $25 billion Debt Equity Total Liabilities $12.5 billion $12.5 billion $25 billion You are provided with the following information on comparable firms as well: Business Average Beta Average D/E ratio Food 0.92 25% Tobacco 1.17 50% All firms are assumed to have a tax rate of 40%. a) Calculate the cost of equity of the company b) If the company divests itself of the food business and gets fair value of $10 billion for the divestiture, what will happen to the beta of equity? C) Assume that the company decides to use the $10 billion in cash to pay off debt. What will happen to the equity beta d) Assume that the company decides to use the $10 billion in cash to buy back stock. What will happen to the equity beta e) Assume that the company decides to use the $2.5 billion to pay a dividend and the remaining $7.5 billion to pay down debt. What will happen to the equity beta? f) Assume that the company decides to use the $10 billion in cash to buy a social media company. What will happen to the equity beta? (Social media companies have an unlevered beta of 1.80) g) What if the cash is used plus debt of $5 billion to buy a social media company for $ 15 billion Problem #2 Altria is a corporation with food and tobacco subsidiaries. The tobacco subsidiary is estimated to be worth $ 15 billion and the food subsidiary is estimated to have a value of $ 10 billion. The firm has a debt to equity ratio of 1.00. (8 points) Tobacco Food Total Assets $15 billion $10 billion $25 billion Debt Equity Total Liabilities $12.5 billion $12.5 billion $25 billion You are provided with the following information on comparable firms as well: Business Average Beta Average D/E ratio Food 0.92 25% Tobacco 1.17 50% All firms are assumed to have a tax rate of 40%. a) Calculate the cost of equity of the company b) If the company divests itself of the food business and gets fair value of $10 billion for the divestiture, what will happen to the beta of equity? C) Assume that the company decides to use the $10 billion in cash to pay off debt. What will happen to the equity beta d) Assume that the company decides to use the $10 billion in cash to buy back stock. What will happen to the equity beta e) Assume that the company decides to use the $2.5 billion to pay a dividend and the remaining $7.5 billion to pay down debt. What will happen to the equity beta? f) Assume that the company decides to use the $10 billion in cash to buy a social media company. What will happen to the equity beta? (Social media companies have an unlevered beta of 1.80) g) What if the cash is used plus debt of $5 billion to buy a social media company for $ 15 billion