Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharpe Ratio: 0.66 2 4. Assume that risk-free rate is 5% and your degree of risk-aversion is 6. Your utility function is Up = E(rp)

Sharpe Ratio: 0.66

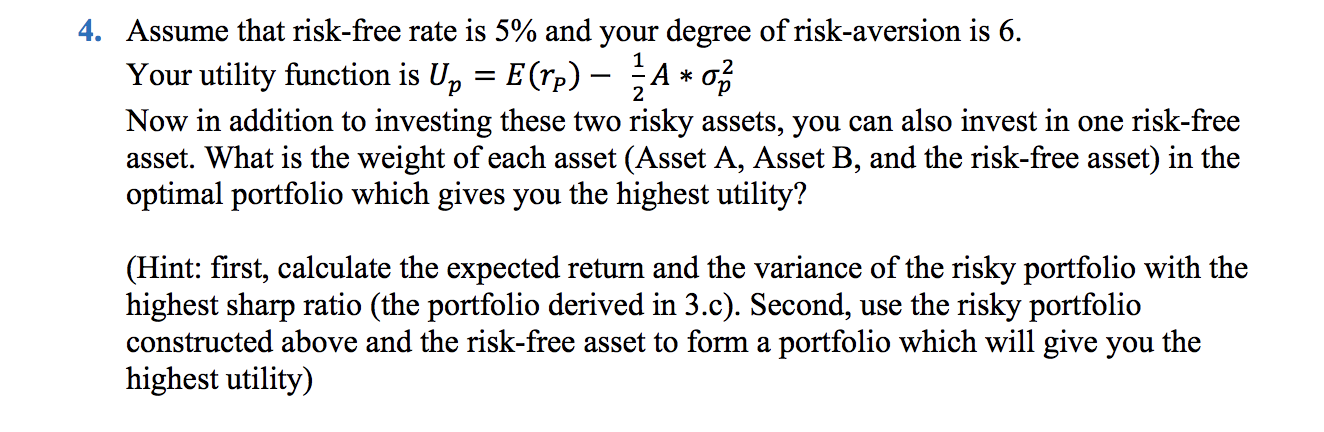

2 4. Assume that risk-free rate is 5% and your degree of risk-aversion is 6. Your utility function is Up = E(rp) A * o Now in addition to investing these two risky assets, you can also invest in one risk-free asset. What is the weight of each asset (Asset A, Asset B, and the risk-free asset) in the optimal portfolio which gives you the highest utility? (Hint: first, calculate the expected return and the variance of the risky portfolio with the highest sharp ratio (the portfolio derived in 3.c). Second, use the risky portfolio constructed above and the risk-free asset to form a portfolio which will give you the highest utility) 2 4. Assume that risk-free rate is 5% and your degree of risk-aversion is 6. Your utility function is Up = E(rp) A * o Now in addition to investing these two risky assets, you can also invest in one risk-free asset. What is the weight of each asset (Asset A, Asset B, and the risk-free asset) in the optimal portfolio which gives you the highest utility? (Hint: first, calculate the expected return and the variance of the risky portfolio with the highest sharp ratio (the portfolio derived in 3.c). Second, use the risky portfolio constructed above and the risk-free asset to form a portfolio which will give you the highest utility)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started