Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2 Effects of External transactions- 12 points The accounts for DX Company are listed below, identified by number. Following the list of accounts is

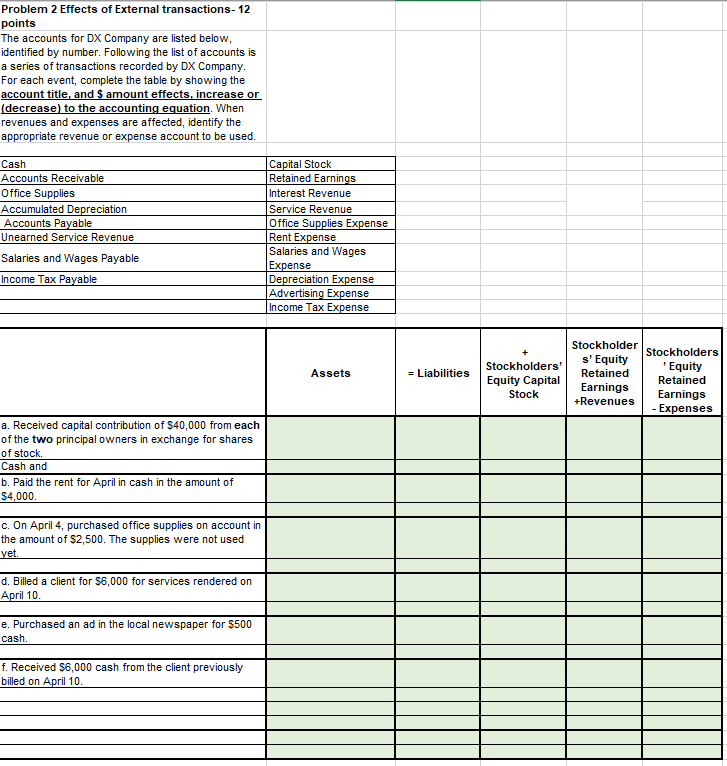

Problem 2 Effects of External transactions- 12 points The accounts for DX Company are listed below, identified by number. Following the list of accounts is a series of transactions recorded by DX Company. For each event, complete the table by showing the account title, and \$ amount effects, increase or (decrease) to the accounting equation. When revenues and expenses are affected, identify the appropriate revenue or expense account to be used. \begin{tabular}{|l|l|} \hline Cash & Capital Stock \\ \hline Accounts Receivable & Retained Earnings \\ \hline Office Supplies & Interest Revenue \\ \hline Accumulated Depreciation & Service Revenue \\ \hline Accounts Payable & Office Supplies Expense \\ \hline Unearned Service Revenue & Rent Expense \\ \hline Salaries and Wages Payable & SalariesandWagesExpense \\ \hline Income Tax Payable & Depreciation Expense \\ \hline & Advertising Expense \\ \hline & Income Tax Expense \\ \hline \end{tabular} a. Received capital contribution of $40,000 from each of the two principal owners in exchange for shares of stock. Cash and b. Paid the rent for April in cash in the amount of $4,000. c. On April 4, purchased office supplies on account in the amount of $2,500. The supplies were not used yet. d. Billed a client for $6,000 for services rendered on April 10. e. Purchased an ad in the local newspaper for $500 cash. f. Received $6,000 cash from the client previously billed on April 10

Problem 2 Effects of External transactions- 12 points The accounts for DX Company are listed below, identified by number. Following the list of accounts is a series of transactions recorded by DX Company. For each event, complete the table by showing the account title, and \$ amount effects, increase or (decrease) to the accounting equation. When revenues and expenses are affected, identify the appropriate revenue or expense account to be used. \begin{tabular}{|l|l|} \hline Cash & Capital Stock \\ \hline Accounts Receivable & Retained Earnings \\ \hline Office Supplies & Interest Revenue \\ \hline Accumulated Depreciation & Service Revenue \\ \hline Accounts Payable & Office Supplies Expense \\ \hline Unearned Service Revenue & Rent Expense \\ \hline Salaries and Wages Payable & SalariesandWagesExpense \\ \hline Income Tax Payable & Depreciation Expense \\ \hline & Advertising Expense \\ \hline & Income Tax Expense \\ \hline \end{tabular} a. Received capital contribution of $40,000 from each of the two principal owners in exchange for shares of stock. Cash and b. Paid the rent for April in cash in the amount of $4,000. c. On April 4, purchased office supplies on account in the amount of $2,500. The supplies were not used yet. d. Billed a client for $6,000 for services rendered on April 10. e. Purchased an ad in the local newspaper for $500 cash. f. Received $6,000 cash from the client previously billed on April 10 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started