Problem #2 Facts: (Question 6 - Question 9) Gummy Bear Company maintains a perpetual inventory system and provides the following purchases and sales data for

Problem #2 Facts: (Question 6 - Question 9)

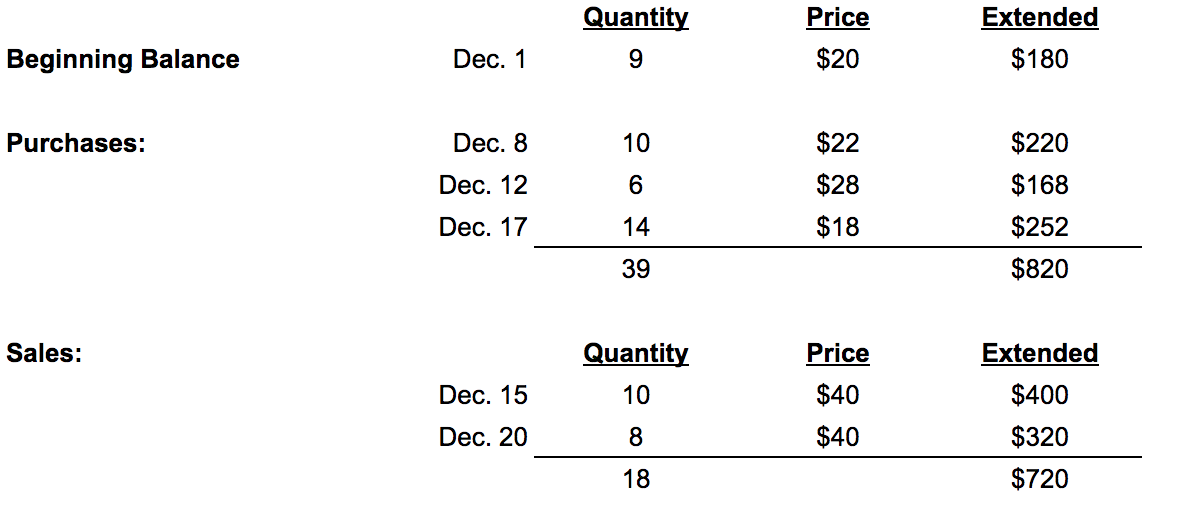

Gummy Bear Company maintains a perpetual inventory system and provides the following purchases and sales data for the month of December 2019. Assume the title transfers on the date of sale and all sales are on account. (Question 6 - Question 9 are independent of each other)

Question 6: 6a:Record sale entries for Gummy Bear using First-In-First-Out. 6b:What is the Gross Profit as of 12/31/2019? 6c: What is Gummy Bears total ending inventory at 12/31/2019? [Show all work: (1) Include all calculations to support every number and (2) include a Merchandise Inventory T-Account]

Date: MM/DD/YY

Dr. Account...XX

Cr. Account...XX

Question 7: 7a:Record sale entries for Gummy Bear using Weighted Average. 7b: What is the companys Gross Profit as of 12/31/2019? 7c: What is Gummy Bears total ending inventory at 12/31/2019? [Show all work: (1) Include all calculations to support every number and (2) include a Merchandise Inventory T-Account] (Round to 2 decimals throughout your calculations and the final answer).

Date: MM/DD/YY

Dr. Account...XX

Cr. Account...XX

Question 8: 8a:Record sale entries for Gummy Bear using Last-In-First-Out. 8b:What is the Gross Profit as of 12/31/2019? 6c: What is Gummy Bears total ending inventory at 12/31/2019? [Show all work: (1) Include all calculations to support every number and (2) include a Merchandise Inventory T-Account]

Date: MM/DD/YY

Dr. Account...XX

Cr. Account...XX

For questions 9 only, assume:

- Assume Gummy Bear uses the Specific Identification Method

- The inventory sold on Dec. 15th was from the Dec. 8th inventory and the inventory sold on Dec. 20th was from the Dec. 17th inventory.

- For the sale on 12/15/19, a sales discount of 2% was taken by the buyer.

- For the sale on 12/20/19, the buyer returned 3 units to Gummy Bear Company.

Question 9: Using good form, prepare the top portion of Gummy Bears multiple step income statement, ending with Gross Profit. [Show all work: Include all calculations to support every number included in multiple step income statement]

Quantity Price $20 Extended $180 Beginning Balance Dec. 1 Purchases: Dec. 8 Dec. 12 Dec. 17 $22 $28 $220 $168 $252 $820 $18 Sales: Price Extended Quantity 10 8 Dec. 15 Dec. 20 $40 $40 $400 $320 $720 18Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started