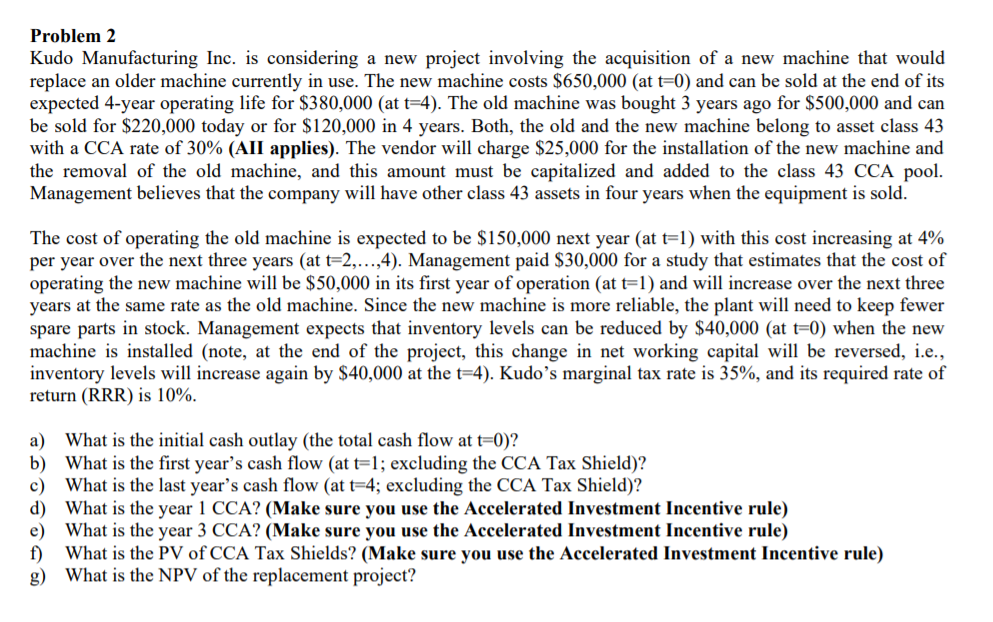

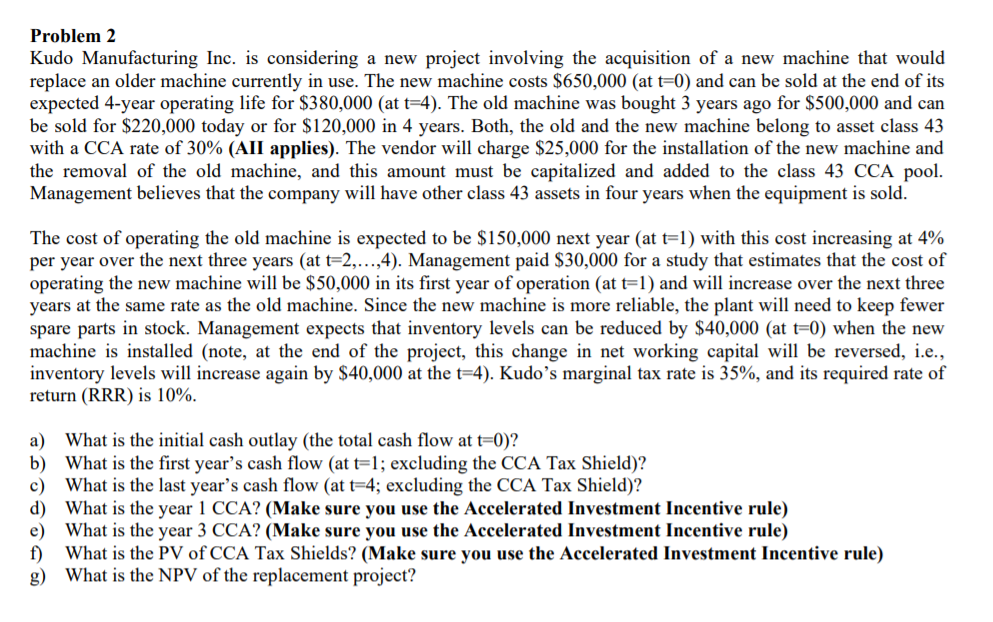

Problem 2 Kudo Manufacturing Inc. is considering a new project involving the acquisition of a new machine that would replace an older machine currently in use. The new machine costs $650,000 (at t=0) and can be sold at the end of its expected 4-year operating life for $380,000 (at t=4). The old machine was bought 3 years ago for $500,000 and can be sold for $220,000 today or for $120,000 in 4 years. Both, the old and the new machine belong to asset class 43 with a CCA rate of 30% (AII applies). The vendor will charge $25,000 for the installation of the new machine and the removal of the old machine, and this amount must be capitalized and added to the class 43 CCA pool. Management believes that the company will have other class 43 assets in four years when the equipment is sold. The cost of operating the old machine is expected to be $150,000 next year (at t=1) with this cost increasing at 4% per year over the next three years (at t=2,...,4). Management paid $30,000 for a study that estimates that the cost of operating the new machine will be $50,000 in its first year of operation (at t=1) and will increase over the next three years at the same rate as the old machine. Since the new machine is more reliable, the plant will need to keep fewer spare parts in stock. Management expects that inventory levels can be reduced by $40,000 (at t=0) when the new machine is installed (note, at the end of the project, this change in net working capital will be reversed, i.e., inventory levels will increase again by $40,000 at the t=4). Kudo's marginal tax rate is 35%, and its required rate of return (RRR) is 10%. a) What is the initial cash outlay (the total cash flow at t=0)? b) What is the first year's cash flow (at t=1; excluding the CCA Shield)? c) What is the last year's cash flow (at t=4; excluding the CCA Tax Shield)? d) What is the year 1 CCA? (Make sure you use the Accelerated Investment Incentive rule) e) What is the year 3 CCA? (Make sure you use the Accelerated Investment Incentive rule) f) What is the PV of CCA Tax Shields? (Make sure you use the Accelerated Investment Incentive rule) g) What is the NPV of the replacement project? Problem 2 Kudo Manufacturing Inc. is considering a new project involving the acquisition of a new machine that would replace an older machine currently in use. The new machine costs $650,000 (at t=0) and can be sold at the end of its expected 4-year operating life for $380,000 (at t=4). The old machine was bought 3 years ago for $500,000 and can be sold for $220,000 today or for $120,000 in 4 years. Both, the old and the new machine belong to asset class 43 with a CCA rate of 30% (AII applies). The vendor will charge $25,000 for the installation of the new machine and the removal of the old machine, and this amount must be capitalized and added to the class 43 CCA pool. Management believes that the company will have other class 43 assets in four years when the equipment is sold. The cost of operating the old machine is expected to be $150,000 next year (at t=1) with this cost increasing at 4% per year over the next three years (at t=2,...,4). Management paid $30,000 for a study that estimates that the cost of operating the new machine will be $50,000 in its first year of operation (at t=1) and will increase over the next three years at the same rate as the old machine. Since the new machine is more reliable, the plant will need to keep fewer spare parts in stock. Management expects that inventory levels can be reduced by $40,000 (at t=0) when the new machine is installed (note, at the end of the project, this change in net working capital will be reversed, i.e., inventory levels will increase again by $40,000 at the t=4). Kudo's marginal tax rate is 35%, and its required rate of return (RRR) is 10%. a) What is the initial cash outlay (the total cash flow at t=0)? b) What is the first year's cash flow (at t=1; excluding the CCA Shield)? c) What is the last year's cash flow (at t=4; excluding the CCA Tax Shield)? d) What is the year 1 CCA? (Make sure you use the Accelerated Investment Incentive rule) e) What is the year 3 CCA? (Make sure you use the Accelerated Investment Incentive rule) f) What is the PV of CCA Tax Shields? (Make sure you use the Accelerated Investment Incentive rule) g) What is the NPV of the replacement project