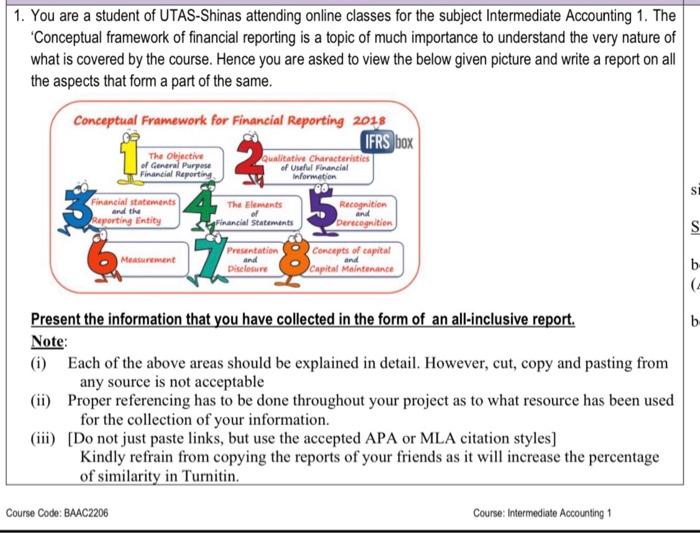

1. You are a student of UTAS-Shinas attending online classes for the subject Intermediate Accounting 1. The Conceptual framework of financial reporting is a topic of much importance to understand the very nature of what is covered by the course. Hence you are asked to view the below given picture and write a report on all the aspects that form a part of the same. Conceptual Framework for Financial Reporting 2018 IFRS box The objective of General Purpose Financial Reporting Qualitative Characteristics of Useful Financial Information SE Financial statements and the Reporting entity The Elements of Financial Statements Recognition and Derecognition vol Measurement Presentation and Disclosure Concepts of capital Capital Maintenance b ( b Present the information that you have collected in the form of an all-inclusive report. Note: (i) Each of the above areas should be explained in detail. However, cut, copy and pasting from any source is not acceptable (ii) Proper referencing has to be done throughout your project as to what resource has been used for the collection of your information. (iii) [Do not just paste links, but use the accepted APA or MLA citation styles] Kindly refrain from copying the reports of your friends as it will increase the percentage of similarity in Turnitin. Course Code: BAAC2206 Course: Intermediate Accounting 2. The Souvenir Company purchased, on 1 January 2015, a machine producing embossed souvenir badges. The machine cost 16,000 and was estimated to have a five-year life with a residual value of 1,000. The company plans on using one out of the two most important methods of deprecation which are straight line & Written down value methods. The CEO wants to decide on which method based on a few calculations that he asks you to perform which are given below. Prepare the required calculations to help the CEO arrive at a final decision. Required (a) Prepare a table of depreciation and net book values over the five-years using straight-line depreciation (b) Prepare a table of depreciation and net book value over the five years using reducing-balance depreciation. (c) Using the straight-line method of depreciation, show the effect of selling the asset at the end of Year 5 for a price of 2,500 (d) Using the straight-line method of depreciation, demonstrate the effect on disposing the asset at the end of Year 5 for zero 3. Mr. Ahmed sold to Mr. Ayman OMR 60,000 worth of goods on the 12th of March 2012 by accepting 130 days,8% interest bearing note. Both Mr. Ahmed & Mr. Ayman need to your help in understanding how and in what way the notes receivable and the payables should be treated. Provide them with the required help by showing how the transactions would be treated in the following situations. (i) When the notes are accepted. On the maturity date, the note is honored (iii) Suppose Mr. Ahmed prepared final accounts on the 15th of May 2012 (iv) Following the above situation the bill is met on maturity. (v) The note was dishonored on the maturity date by Mr. Ayman