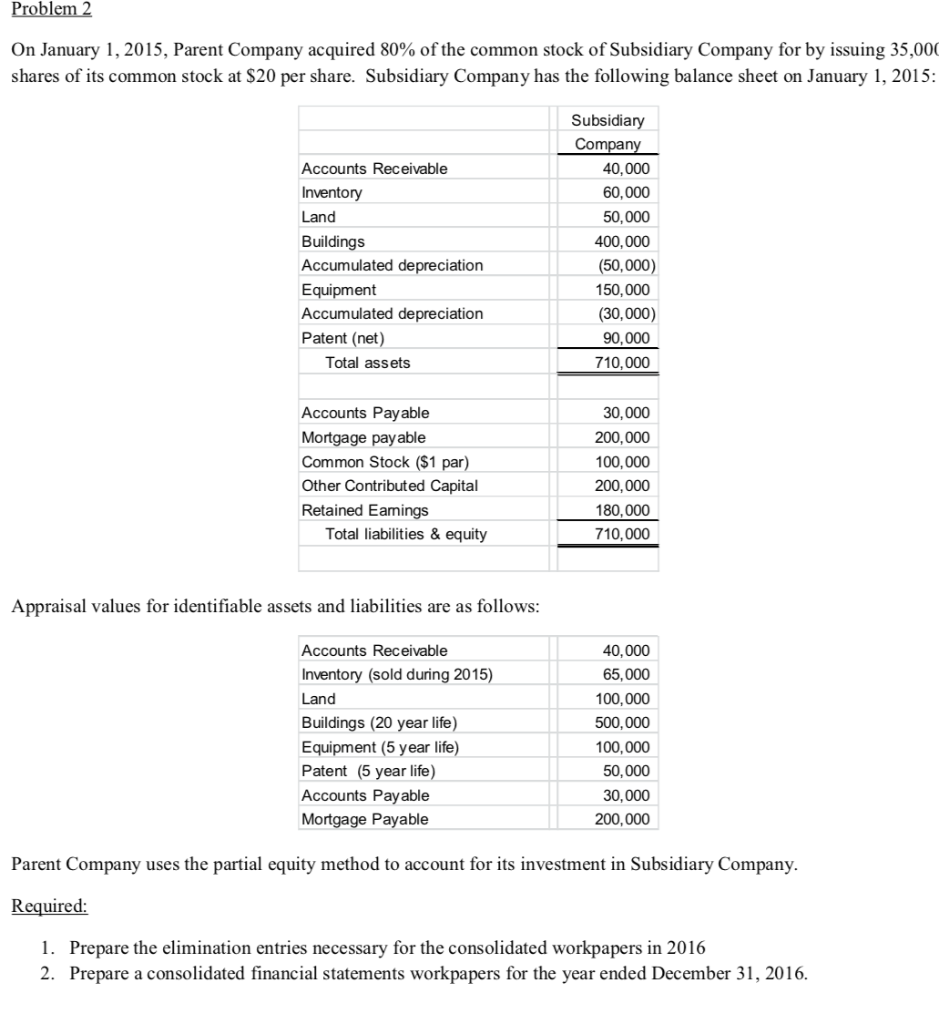

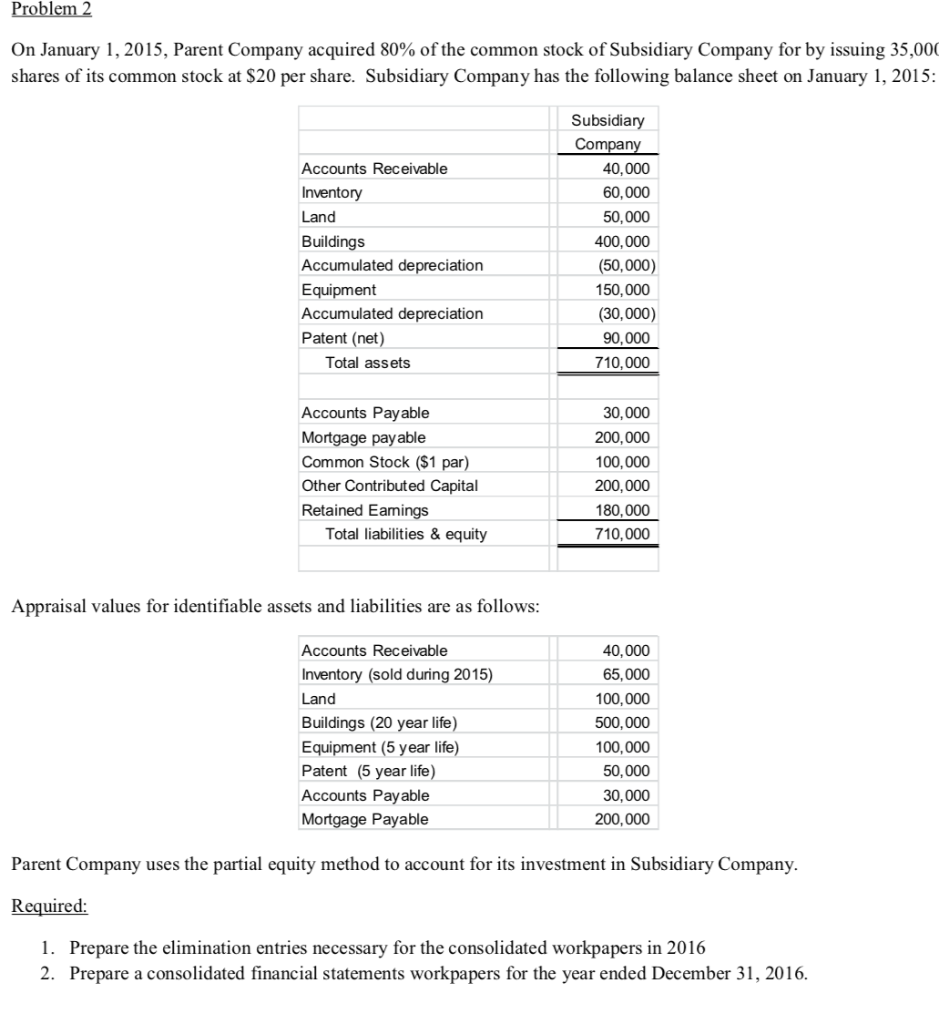

Problem 2 On January 1, 2015, Parent Company acquired 80% of the common stock of Subsidiary Company for by issuing 35,000 shares of its common stock at S20 per share. Subsidiary Company has the following balance sheet on January 1, 2015 Subsidiary Company Accounts Receivable Inventory Land Buildings Accumulated depreciation Equipment Accumulated depreciation Patent (net 40,000 60,000 50,000 400,000 50,000 150,000 (30,000) 90,000 710,000 Total assets Accounts Payable Mortgage pay able Common Stock ($1 par) Other Contributed Capital Retained Eamings 30,000 200,000 100,000 200,000 180,000 710,000 Total liabilities & equity Appraisal values for identifiable assets and liabilities are as follows Accounts Receivable Inventory (sold during 2015) Land Buildings (20 year life) Equipment (5 year life) Patent (5 year life) Accounts Payable Mortgage Payable 40,000 65,000 100,000 500,000 100,000 50,000 30,000 200,000 Parent Company uses the partial equity method to account for its investment in Subsidiary Company Required: 1. Prepare the elimination entries necessary for the consolidated workpapers in 2016 Prepare a consolidated financial statements workpapers for the year ended December 31, 2016 2. Problem 2 On January 1, 2015, Parent Company acquired 80% of the common stock of Subsidiary Company for by issuing 35,000 shares of its common stock at S20 per share. Subsidiary Company has the following balance sheet on January 1, 2015 Subsidiary Company Accounts Receivable Inventory Land Buildings Accumulated depreciation Equipment Accumulated depreciation Patent (net 40,000 60,000 50,000 400,000 50,000 150,000 (30,000) 90,000 710,000 Total assets Accounts Payable Mortgage pay able Common Stock ($1 par) Other Contributed Capital Retained Eamings 30,000 200,000 100,000 200,000 180,000 710,000 Total liabilities & equity Appraisal values for identifiable assets and liabilities are as follows Accounts Receivable Inventory (sold during 2015) Land Buildings (20 year life) Equipment (5 year life) Patent (5 year life) Accounts Payable Mortgage Payable 40,000 65,000 100,000 500,000 100,000 50,000 30,000 200,000 Parent Company uses the partial equity method to account for its investment in Subsidiary Company Required: 1. Prepare the elimination entries necessary for the consolidated workpapers in 2016 Prepare a consolidated financial statements workpapers for the year ended December 31, 2016 2