Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2 Saltine Chemical Inc. plan to build a chemical plant in Nassau, Bahamas, for the production of Iodized Salt and other industrial based

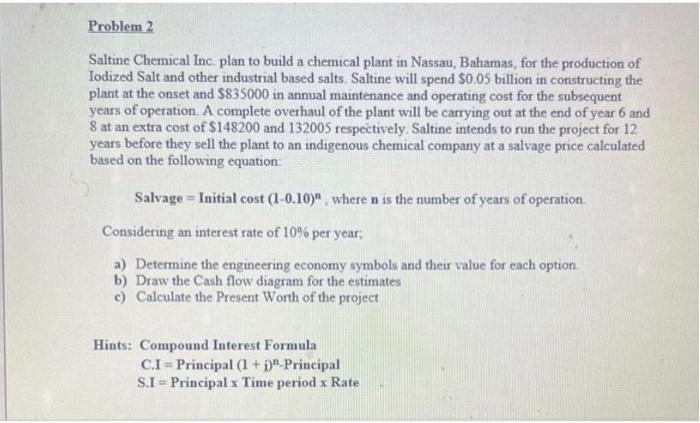

Problem 2 Saltine Chemical Inc. plan to build a chemical plant in Nassau, Bahamas, for the production of Iodized Salt and other industrial based salts. Saltine will spend $0.05 billion in constructing the plant at the onset and $835000 in annual maintenance and operating cost for the subsequent years of operation. A complete overhaul of the plant will be carrying out at the end of year 6 and 8 at an extra cost of $148200 and 132005 respectively. Saltine intends to run the project for 12 years before they sell the plant to an indigenous chemical company at a salvage price calculated based on the following equation: Salvage Initial cost (1-0.10)", where n is the number of years of operation. Considering an interest rate of 10% per year; a) Determine the engineering economy symbols and their value for each option b) Draw the Cash flow diagram for the estimates c) Calculate the Present Worth of the project TE Hints: Compound Interest Formula C.I= Principal (1+i)n-Principal S.I= Principal x Time period x Rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Engineering economy symbols and their values for each option Initial cost P 005 billion Annual maintenance and operating cost A 0835 million Overhau...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started