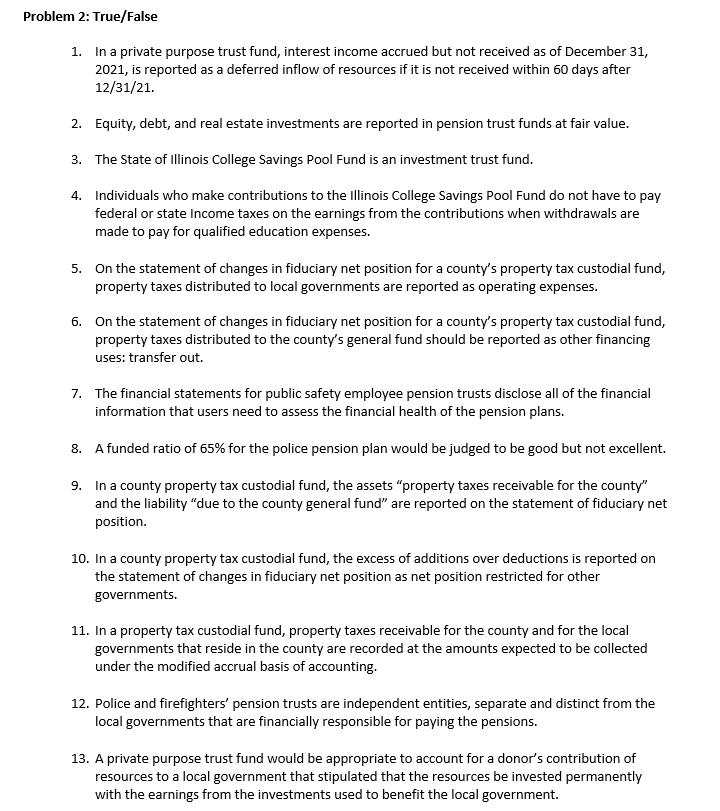

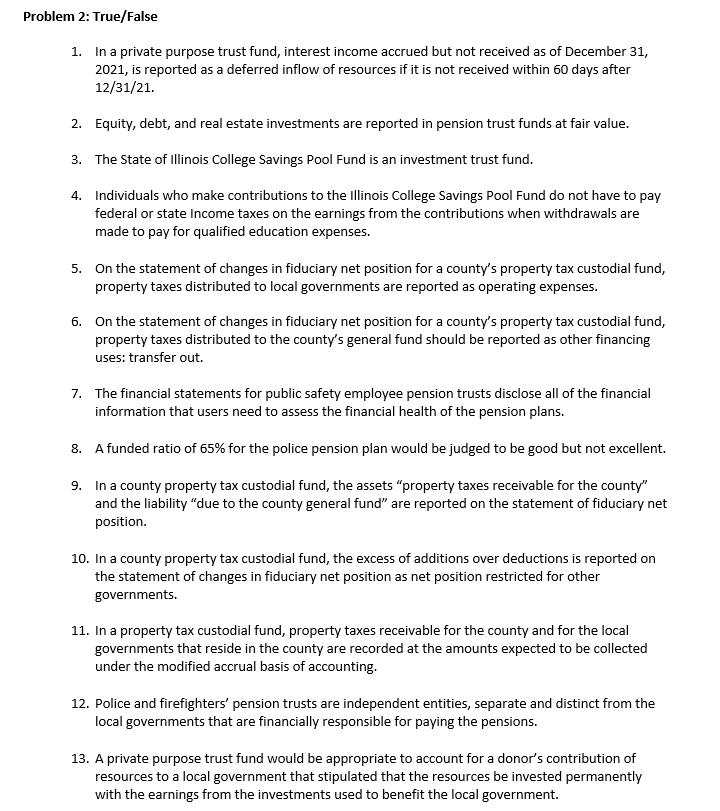

Problem 2: True/False 1. In a private purpose trust fund, interest income accrued but not received as of December 31, 2021, is reported as a deferred inflow of resources if it is not received within 60 days after 12/31/21. 2. Equity, debt, and real estate investments are reported in pension trust funds at fair value. 3. The State of Illinois College Savings Pool Fund is an investment trust fund. 4. Individuals who make contributions to the illinois College Savings Pool Fund do not have to pay federal or state Income taxes on the earnings from the contributions when withdrawals are made to pay for qualified education expenses. 5. On the statement of changes in fiduciary net position for a county's property tax custodial fund, property taxes distributed to local governments are reported as operating expenses. 6. On the statement of changes in fiduciary net position for a county's property tax custodial fund, property taxes distributed to the county's general fund should be reported as other financing uses: transfer out. 7. The financial statements for public safety employee pension trusts disclose all of the financial information that users need to assess the financial health of the pension plans. 8. A funded ratio of 65% for the police pension plan would be judged to be good but not excellent. 9. In a county property tax custodial fund, the assets property taxes receivable for the county" and the liability "due to the county general fund" are reported on the statement of fiduciary net position. 10. In a county property tax custodial fund, the excess of additions over deductions is reported on the statement of changes in fiduciary net position as net position restricted for other governments. 11. In a property tax custodial fund, property taxes receivable for the county and for the local governments that reside in the county are recorded at the amounts expected to be collected under the modified accrual basis of accounting. 12. Police and firefighters' pension trusts are independent entities, separate and distinct from the local governments that are financially responsible for paying the pensions. 13. A private purpose trust fund would be appropriate to account for a donor's contribution of resources to a local government that stipulated that the resources be invested permanently with the earnings from the investments used to benefit the local government