Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 21-16 Statement of cash flows; indirect method [LO21-4, 21-8] The comparative balance sheets for 2016 and 2015 and the statement of income for 2016

Problem 21-16 Statement of cash flows; indirect method [LO21-4, 21-8]

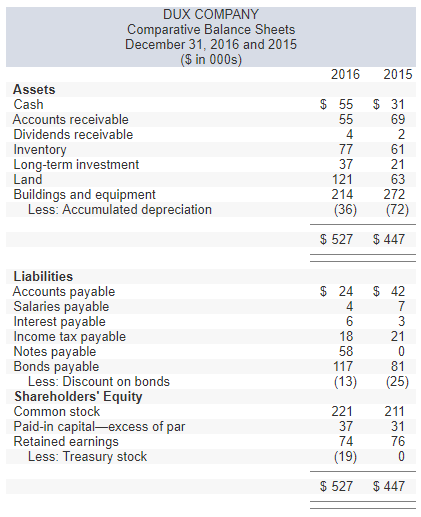

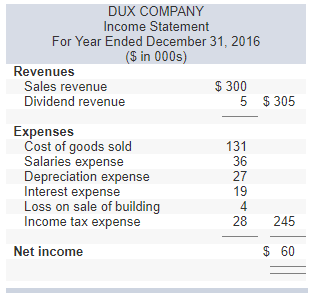

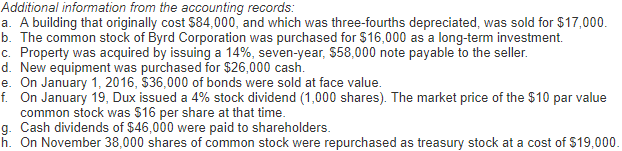

The comparative balance sheets for 2016 and 2015 and the statement of income for 2016 are given below for Dux Company. Additional information from Duxs accounting records is provided also.

REQUIRED:

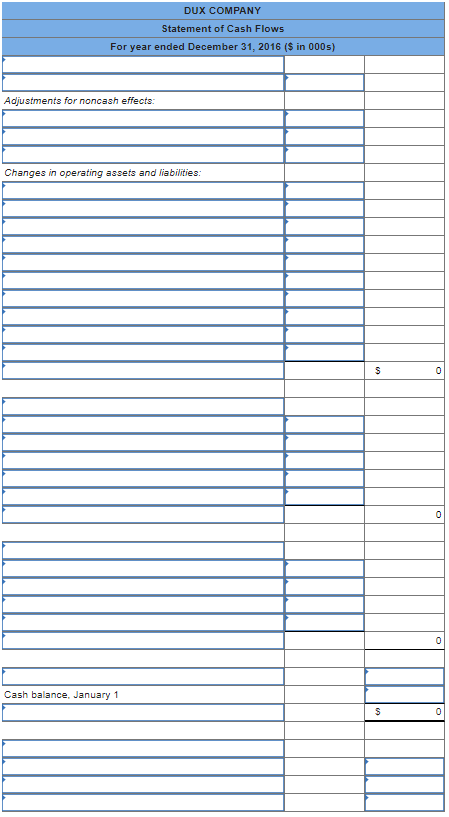

Prepare the statement of cash flows for Dux Company using the INDIRECT method. (Do not round intermediate calculations. Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands. (i.e., 10,000 should be entered as 10).))

DUX COMPANY Comparative Balance Sheets December 31, 2016 and 2015 (S in 000s) 2016 2015 Assets Cash Accounts receivable Dividends receivable Inventory Long-term investment Land Buildings and equipment $ 55 $ 31 69 4 61 21 63 214 272 37 121 Less: Accumulated depreciation (36) (72) $ 527 447 Liabilities Accounts payable Salaries payable Interest payable Income tax payable Notes payable Bonds payable $ 24 $ 42 4 6 18 58 21 81 (13) (25) Less: Discount on bonds Shareholders' Equity Common stock Paid-in capital-excess of par Retained earnings 221 211 31 76 37 74 Less: Treasury stoclk $ 527 447 DUX COMPANY Income Statement For Year Ended December 31, 2016 (S in 000s) Revenues Sales revenue Dividend revenue $ 300 5 $ 305 Expenses Cost of goods sold Salaries expense Depreciation expense Interest expense Loss on sale of building Income tax expense 131 36 27 19 4 28 245 Net income $ 60 Additional information from the accounting records: a. A building that originally cost $84,000, and which was three-fourths depreciated, was sold for $17,000 b. The common stock of Byrd Corporation was purchased for $16,000 as a long-term investment. c. Property was acquired by issuing a 14%, seven-year, $58,000 note payable to the seller d. New equipment was purchased for $26,000 cash e. On January 1, 2016, $36,000 of bonds were sold at face value. f On January 19, Dux issued a 4% stock dividend (1,000 shares). The market price of the $10 par value common stock was S16 per share at that time a ovmbes9.o0s hares lf omnostoc werchaed as treasury stock at a cost of 519,000 h. On November 38,000 shares of common stock were repurchased as treasury stock at a cost of $19,000 DUX COMPANY Statement of Cash Flows For year ended December 31, 2016 ($ in 000s) Adjustments for noncash effects: Changes in operating assets and liabilities Cash balance, January 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started