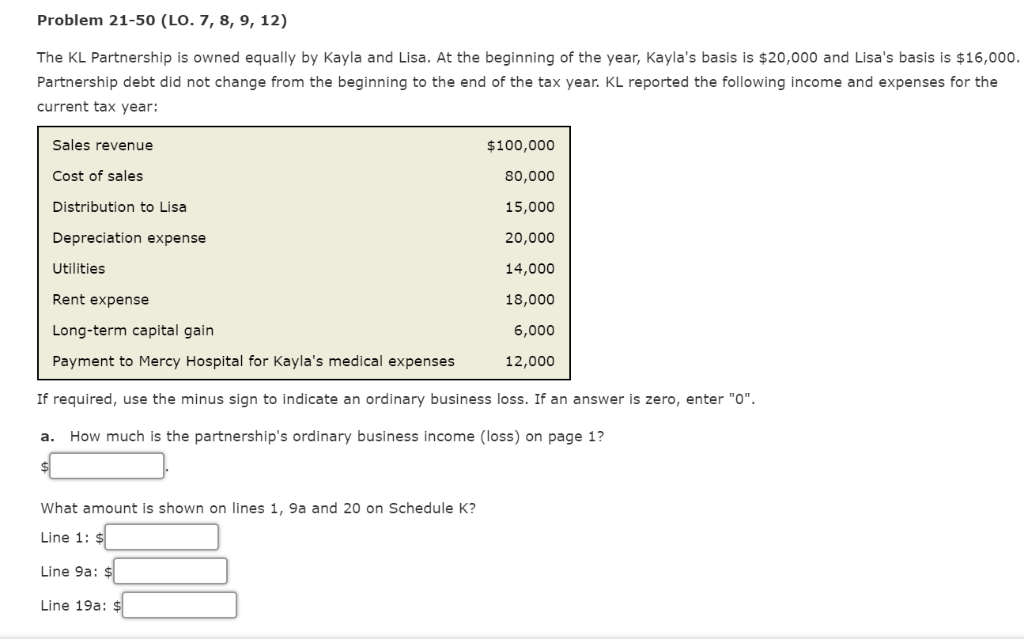

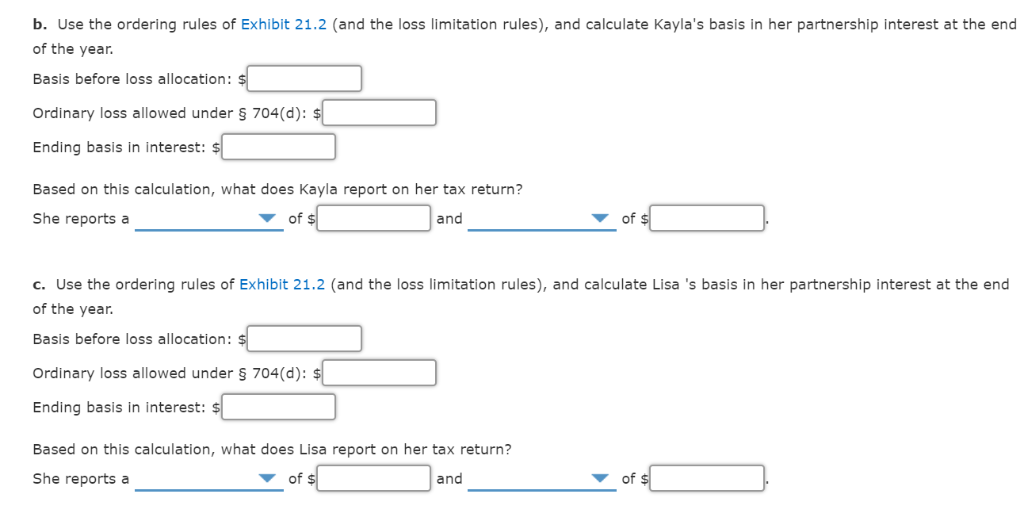

Problem 21-50 (LO. 7, 8, 9, 12) The KL Partnership is owned equally by Kayla and Lisa. At the beginning of the year, Kayla's basis is $20,000 and Lisa's basis is $16,000 Partnership debt did not change from the beginning to the end of the tax year. KL reported the following income and expenses for the current tax year: Sales revenue Cost of sales Distribution to Lisa Depreciation expense Utilities Rent expense Long-term capital gain Payment to Mercy Hospital for Kayla's medical expenses $100,000 80,000 15,000 20,000 14,000 18,000 6,000 12,000 If required, use the minus sign to indicate an ordinary business loss. If an answer is zero, enter "O". a. How much is the partnership's ordinary business income (loss) on page 1? What amount is shown on lines 1, 9a and 20 on Schedule K? Line 1: Line 9a: Line 19a: b. Use the ordering rules of Exhibit 21.2 (and the loss limitation rules), and calculate Kayla's basis in her partnership interest at the end of the year. Basis before loss allocation: Ordinary loss allowed under g 704(d): Ending basis in interest: Based on this calculation, what does Kayla report on her tax return? of s She reports a and of c. Use the ordering rules of Exhibit 21.2 (and the loss limitation rules), and calculate Lisa 's basis in her partnership interest at the end of the year. Basis before loss allocation: Ordinary loss allowed under 704(d): Ending basis in interest: $ Based on this calculation, what does Lisa report on her tax return? She reports a of and of Problem 21-50 (LO. 7, 8, 9, 12) The KL Partnership is owned equally by Kayla and Lisa. At the beginning of the year, Kayla's basis is $20,000 and Lisa's basis is $16,000 Partnership debt did not change from the beginning to the end of the tax year. KL reported the following income and expenses for the current tax year: Sales revenue Cost of sales Distribution to Lisa Depreciation expense Utilities Rent expense Long-term capital gain Payment to Mercy Hospital for Kayla's medical expenses $100,000 80,000 15,000 20,000 14,000 18,000 6,000 12,000 If required, use the minus sign to indicate an ordinary business loss. If an answer is zero, enter "O". a. How much is the partnership's ordinary business income (loss) on page 1? What amount is shown on lines 1, 9a and 20 on Schedule K? Line 1: Line 9a: Line 19a: b. Use the ordering rules of Exhibit 21.2 (and the loss limitation rules), and calculate Kayla's basis in her partnership interest at the end of the year. Basis before loss allocation: Ordinary loss allowed under g 704(d): Ending basis in interest: Based on this calculation, what does Kayla report on her tax return? of s She reports a and of c. Use the ordering rules of Exhibit 21.2 (and the loss limitation rules), and calculate Lisa 's basis in her partnership interest at the end of the year. Basis before loss allocation: Ordinary loss allowed under 704(d): Ending basis in interest: $ Based on this calculation, what does Lisa report on her tax return? She reports a of and of