Answered step by step

Verified Expert Solution

Question

1 Approved Answer

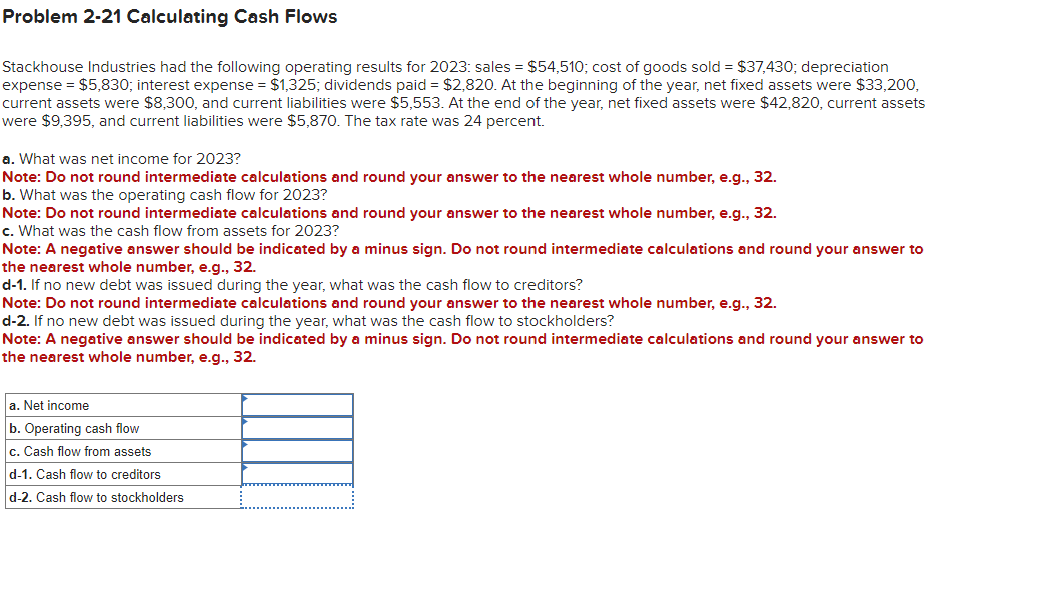

Problem 2-21 Calculating Cash Flows Stackhouse Industries had the following operating results for 2023: sales = $54,510; cost of goods sold = $37,430; depreciation

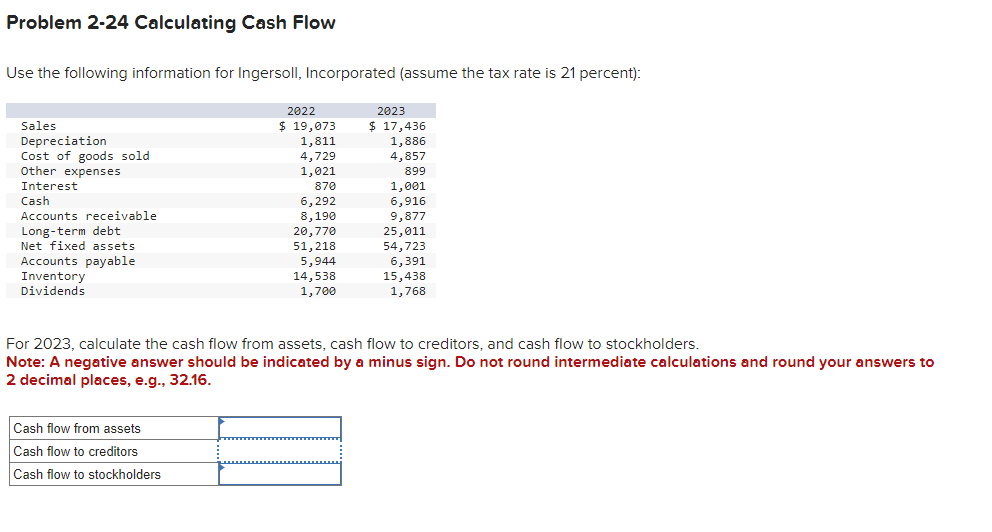

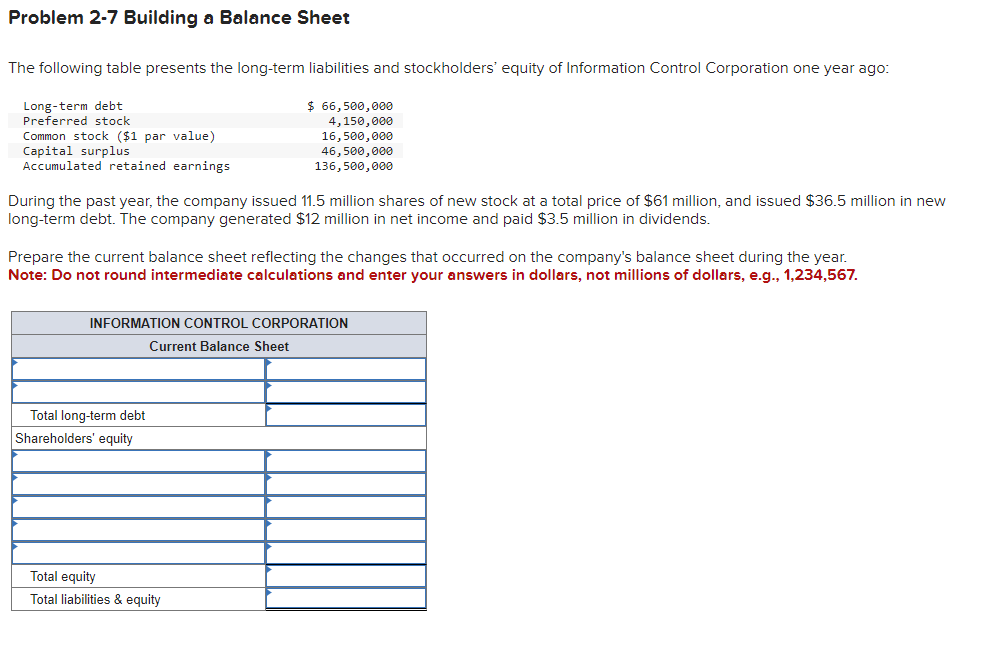

Problem 2-21 Calculating Cash Flows Stackhouse Industries had the following operating results for 2023: sales = $54,510; cost of goods sold = $37,430; depreciation expense = $5,830; interest expense = $1,325; dividends paid = $2,820. At the beginning of the year, net fixed assets were $33,200, current assets were $8,300, and current liabilities were $5,553. At the end of the year, net fixed assets were $42,820, current assets were $9,395, and current liabilities were $5,870. The tax rate was 24 percent. a. What was net income for 2023? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. b. What was the operating cash flow for 2023? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. c. What was the cash flow from assets for 2023? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. d-1. If no new debt was issued during the year, what was the cash flow to creditors? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. d-2. If no new debt was issued during the year, what was the cash flow to stockholders? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. a. Net income b. Operating cash flow c. Cash flow from assets d-1. Cash flow to creditors d-2. Cash flow to stockholders Problem 2-7 Building a Balance Sheet The following table presents the long-term liabilities and stockholders' equity of Information Control Corporation one year ago: Long-term debt Preferred stock Common stock ($1 par value) Capital surplus Accumulated retained earnings $ 66,500,000 4,150,000 16,500,000 46,500,000 136,500,000 During the past year, the company issued 11.5 million shares of new stock at a total price of $61 million, and issued $36.5 million in new long-term debt. The company generated $12 million in net income and paid $3.5 million in dividends. Prepare the current balance sheet reflecting the changes that occurred on the company's balance sheet during the year. Note: Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567. INFORMATION CONTROL CORPORATION Current Balance Sheet Total long-term debt Shareholders' equity Total equity Total liabilities & equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started