Answered step by step

Verified Expert Solution

Question

1 Approved Answer

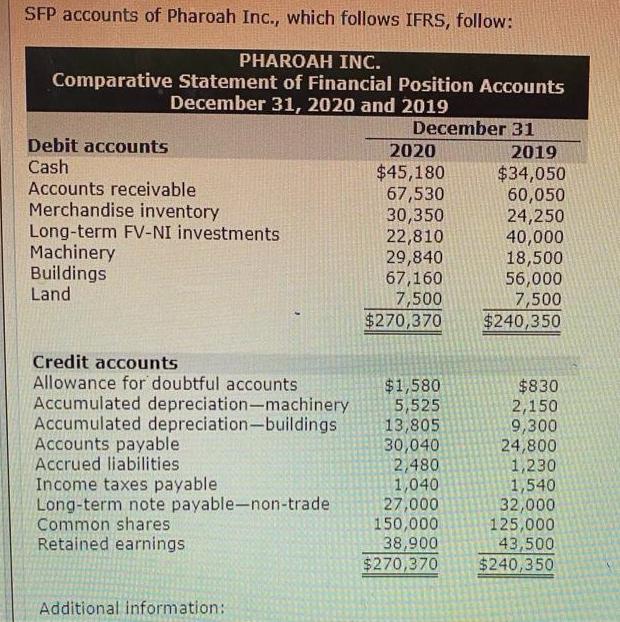

SFP accounts of Pharoah Inc., which follows IFRS, follow: PHAROAH INC. Comparative Statement of Financial Position Accounts December 31, 2020 and 2019 December 31

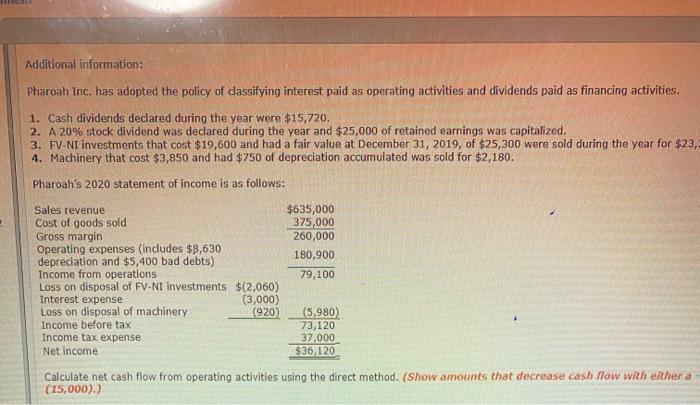

SFP accounts of Pharoah Inc., which follows IFRS, follow: PHAROAH INC. Comparative Statement of Financial Position Accounts December 31, 2020 and 2019 December 31 Debit accounts Cash Accounts receivable Merchandise inventory Long-term FV-NI investments Machinery Buildings Land 2020 $45,180 67,530 30,350 22,810 29,840 67,160 7,500 $270,370 2019 $34,050 60,050 24,250 40,000 18,500 56,000 7,500 $240,350 Credit accounts Allowance for doubtful accounts Accumulated depreciation-machinery Accumulated depreciation-buildings Accounts payable Accrued liabilities Income taxes payable Long-term note payable-non-trade Common shares Retained earnings $1,580 5,525 13,805 30,040 2,480 1,040 27,000 150,000 38,900 $270,370 $830 2,150 9,300 24,800 1,230 1,540 32,000 125,000 43,500 $240,350 Additional information: Additional information: Pharoah Inc. has adopted the policy of dassifying interest paid as operating activities and dividends paid as financing activities. 1. Cash dividends declared during the year were $15,720. 2. A 20% stock dividend was dedlared during the year and $25,000 of retained earnings was capitalized. 3. FV-NI investments that cost $19,600 and had a fair value at December 31, 2019, of $25,300 were sold during the year for $23, 4. Machinery that cost $3,850 and had $750 of depreciation accumulated was sold for $2,180. Pharoah's 2020 statement of income is as follows: $635,000 375,000 260,000 Sales revenue Cost of goods sold Gross margin Operating expenses (includes $8,630 depreciation and $5,400 bad debts) Income from operations Loss on disposal of FV-NI investments $(2,060) Interest expense Loss on disposal of machinery Income before tax 180,900 79,100 (3,000) (920 (5,980) 73,120 37,000 $36,120 Income tax expense Net income Calculate net cash flow from operating activities using the direct method. (Show amounts that decrease cash flow with either a (15,000).)

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer Cash flows from operating activities using Direct Method Particulars Amount Cash Receiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started