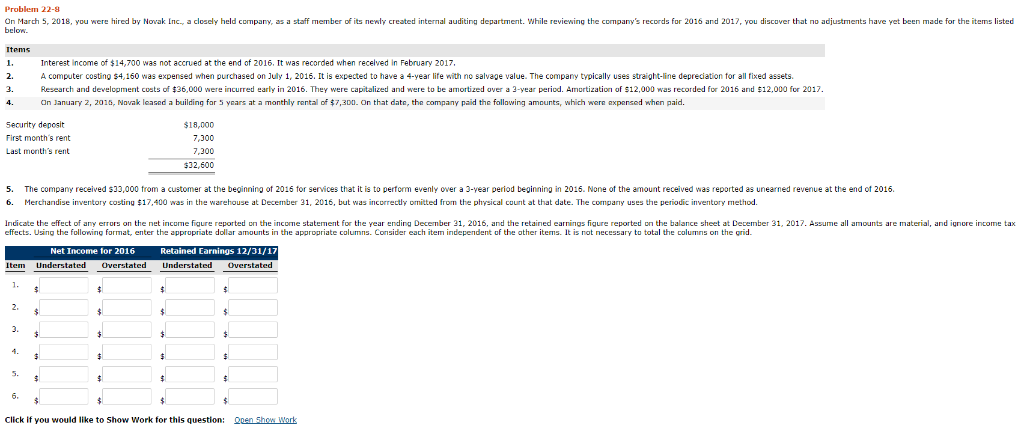

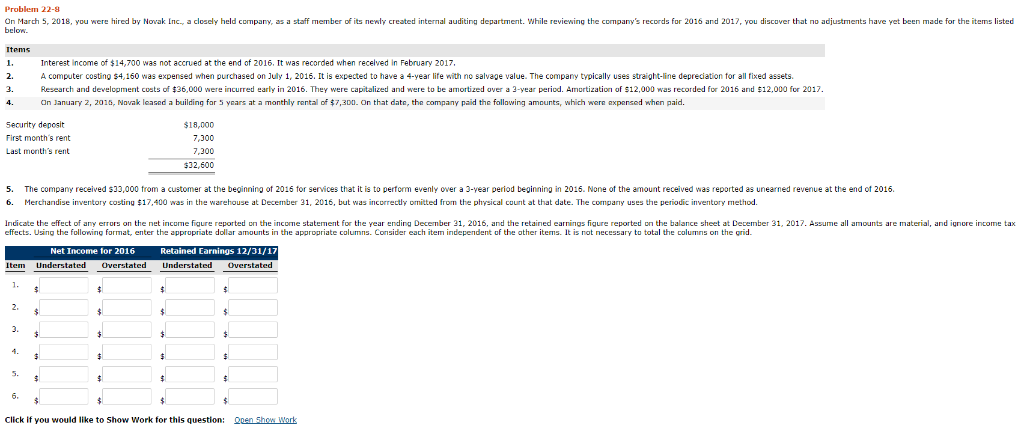

Problem 22-8 On March 5, 2018, you were hired by Novak Inc, a closcly held company, as a staff member of its newdy created internal auditing department. While reviewing the company's records for 2016 ad 2012, you discover that no adjustments have yet been made for the items listed below. Interest income of $14,700 was not accrued at the end of 2016, It was recorded when recelved in February 2017 A computer costing $4,160 was expensed when purchased on July 1, 2016. It is expected to have a 4-year life with no salvage value. The company typically uses straight-line depreciation for all fixed assets. Research and development costs of 36,000 were incurred early in 2016. They were capitalized and were to be amortized over a 3-year period. Amortization of $12,000 was recorded for 2016 and $12,000 for 2017. an January 2, 2015, Novak leased a building for 5 years at a monthly rental of 7,3DO On that date, the company paid the following amounts, which were mpensed when paid. Seourity deposit First month 's rent Last month's rent $18,000 7,300 7,300 $32,600 5. The company received 33,000 trom a customer at the beginning of 2016 for services that it is to perform evenly over a 3-year p None of the amount received was reported as unearned revenue at the end of 2016 6. Merchandise inventory costing $17,400 was in the warehouse at December 31, 2016, but was incorrectly omitted from the physical count at that date. The comparry uses the periodic inventory method period beginning in 2026 Indicate the effect of any errors on the net income figure reported on the income statement for the year ending December 31, 2016, and the retained earnings figure reported o heet at December 31, 2017. Assume all amounts are material, and ignore income tax effects. Using the following format, enter the appropriate dollar amounts in the appropriate columns. Consider each item independent of the ather iterns. It is not necessary to total the columns on the grid fissary to total the on the balance and gnore income ta Net Income tor 2016 Retained Earnings 12/31/17 Overstated Understated Overstated Click if you would like to Show Work for this question: en Show Work Problem 22-8 On March 5, 2018, you were hired by Novak Inc, a closcly held company, as a staff member of its newdy created internal auditing department. While reviewing the company's records for 2016 ad 2012, you discover that no adjustments have yet been made for the items listed below. Interest income of $14,700 was not accrued at the end of 2016, It was recorded when recelved in February 2017 A computer costing $4,160 was expensed when purchased on July 1, 2016. It is expected to have a 4-year life with no salvage value. The company typically uses straight-line depreciation for all fixed assets. Research and development costs of 36,000 were incurred early in 2016. They were capitalized and were to be amortized over a 3-year period. Amortization of $12,000 was recorded for 2016 and $12,000 for 2017. an January 2, 2015, Novak leased a building for 5 years at a monthly rental of 7,3DO On that date, the company paid the following amounts, which were mpensed when paid. Seourity deposit First month 's rent Last month's rent $18,000 7,300 7,300 $32,600 5. The company received 33,000 trom a customer at the beginning of 2016 for services that it is to perform evenly over a 3-year p None of the amount received was reported as unearned revenue at the end of 2016 6. Merchandise inventory costing $17,400 was in the warehouse at December 31, 2016, but was incorrectly omitted from the physical count at that date. The comparry uses the periodic inventory method period beginning in 2026 Indicate the effect of any errors on the net income figure reported on the income statement for the year ending December 31, 2016, and the retained earnings figure reported o heet at December 31, 2017. Assume all amounts are material, and ignore income tax effects. Using the following format, enter the appropriate dollar amounts in the appropriate columns. Consider each item independent of the ather iterns. It is not necessary to total the columns on the grid fissary to total the on the balance and gnore income ta Net Income tor 2016 Retained Earnings 12/31/17 Overstated Understated Overstated Click if you would like to Show Work for this question: en Show Work