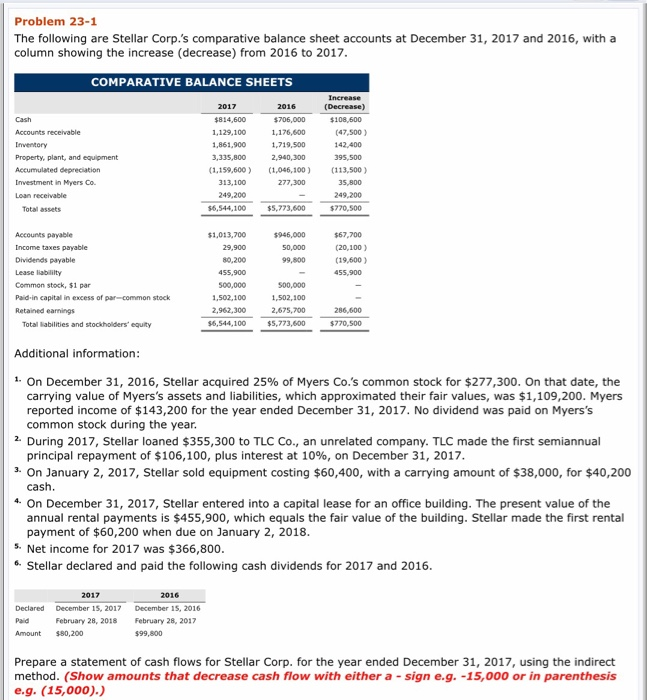

Problem 23-1 The following are Stellar Corp.'s comparative balance sheet accounts at December 31, 2017 and 2016, with column showing the increase (decrease) from 2016 to 2017 a COMPARATIVE BALANCE SHEETS Increase 2017 2016 (Decrease] Cash $814,600 $706,000 $108,600 1,129,100 1,176,600 (47,500) Accounts receivable Inventory 1,861,900 1,719,500 142,400- 3,335,800 Property, plant, and equipment 2,940,300 395,500 (1,046,100) (113,500 7 Accumulated depreciation (1,159,600) Investment in Myers Co. 313,100 277,300 35.800 249,200 249,200 Loan receivable $6,544,100 $5,773,600 $770,500 Total assets $1,013,700 Accounts payable s946,000 $67,700 (20,100 ) Income taxes payable 29,900 50,000 Dividends payable 80,200 99,800 (19.600 ) Lease liabililty 455,900 455,900 Common stock, $1 par 500,000 500,000 1,502,100 Paid-in capital in excess of par-common stock 1,502,100 2,962,300 2,675,700 286,600 Retained earnings $770,500 $6,544,100 $5,773,600 Total labilities and stockholders" equity Additional information: 1 On December 31, 2016, Stellar acquired 25% of Myers Co.'s common stock for $277,300. On that date, the carrying value of Myers's assets and liabilities, which approximated their fair values, was $1,109,200. Myers reported income of $143,200 for the year ended December 31, 2017. No dividend was paid on Myers's common stock during the year 2. During 2017, Stellar loaned $355,300 to TLC Co., an unrelated company. TLC made the first semiannual principal repayment of $106,100, plus interest at 10%, on December 31, 2017. 3. On January 2, 2017, Stellar sold equipment costing $60,400, with a carrying amount of $38,000, for $40,200 cash On December 31, 2017, Stellar entered into a capital lease for an office building. The present value of the annual rental payments is $455,900, which equals the fair value of the building. Stellar made the first rental payment of $60,200 when due on January 2, 2018. . Net income for 2017 was $366,800. Stellar declared and paid the followinng cash dividends for 2017 and 2016. 6 2017 2016 December 15, 2016 December 15, 2017 Declared Paid February 28, 2018 February 28, 2017 Amount $99,800 $80,200 Prepare a statement of cash flows for Stellar Corp. for the year ended December 31, 2017, using the indirect method. (Show amounts that decrease cash flow with either a sign e.g. -15,000 or in parenthesis e.g. (15,000).) STELLAR CORP. Statement of Cash Flows Adjustments to reconcile net income to