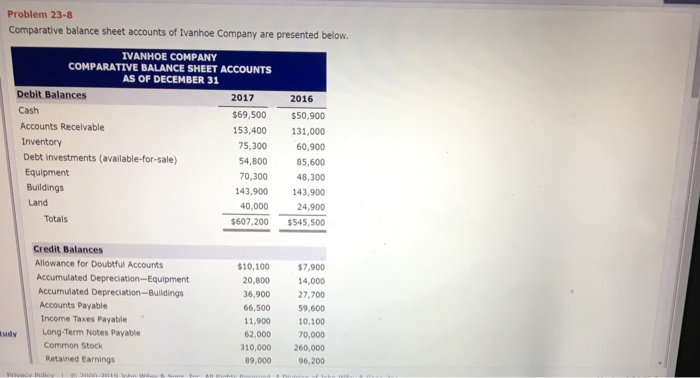

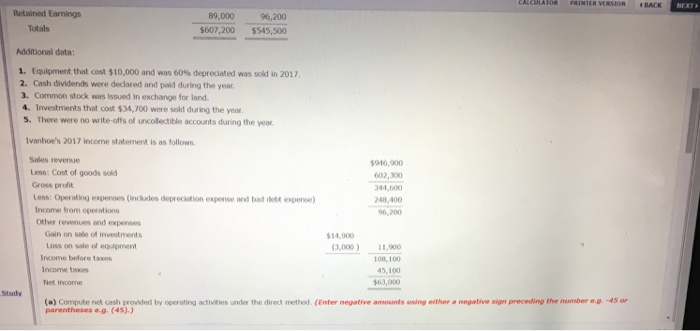

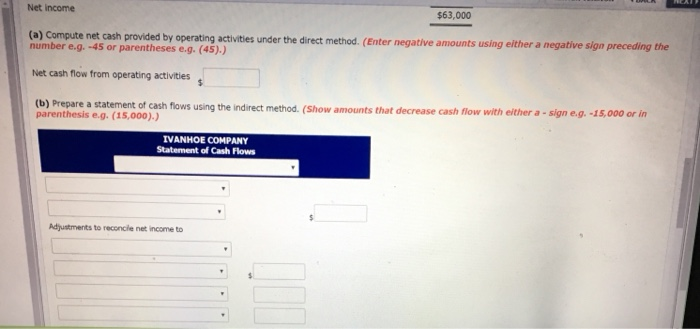

Problem 23-8 Comparative balance sheet accounts of Ivanhoe Company are presented below. IVANHOE COMPANY COMPARATIVE BALANCE SHEET ACCOUNTS AS OF DECEMBER 31 Debit Balances 2017 2016 69,500 $50,900 153,400 131,000 75,300 60,900 4,800 85,600 0,300 48,300 143,900 143,900 24,900 $607,200 $545,500 Accounts Receivable Debt investments (avaiable-for-sale) 40,000 Credit Balances Allowance for Doubtful Accounts Accumulated Depreciation-Equipment Accumulated Depreciation-Buildings Accounts Payable Income Taxes Payable $10,100 $7,900 20,800 14,000 36,900 27,700 59,600 11,900 10,100 62,000 0,000 10,000 260,000 89,00096,200 66,500 tudy Long-Term Notes Payable Common Stock Retained Earnings ULATOR PRINTER VIRSION BACK Retained Earnings 89,000 96,200 607,200 $545,500 Totals Additional data: 1. Equipment that cost $10,000 and was 60% depreciated was sold in 2017 2. Cash dividends were decdlared and paid during the yer 3. Common stock was Issued in exchange for land 4 Investments that cost $34,700 were sold during the year 5. There were no write-offs of uncollectible accounts during the year Ivanhoe's 2017 income statement is as follows. Sales revenue Less: Cost of goods sold Gross profit Less: OperatingexperesCinckales depreciation expense and bad debt espense) Income from operations Other revenues and expenses 916,900 602, xo 344,600 248,400 96,200 Gain on sale of investments Loss on sale of equipment $14,900 (3,000) 11,900 108,100 45,100 $63,000 Income before tax Income taxes Net incorme Study (a) Compute net cash grovided by operating activitios under the direct method. (Enter negative amounts using either a negative sign preceding the mmber parentheses e.g. (45)) Net income $63,000 (a) compute net cash provided by operating activities under the direct method. (Enter negative amounts using either a negative sign preceding the Enter negative amounts using either a m number e.g.-45 or parentheses e.g. (45).) Net cash flow from operating activities s using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) IVANHOE COMPANY Statement of Cash Flows Adjustments to reconcile net income to CALCULATOR PRINTER VERSION BACK NEXT s by BACK NEXT CALCULATOR PRIN TE R VERSION Problem 23-8 Comparative balance sheet accounts of Ivanhoe Company are presented below. IVANHOE COMPANY COMPARATIVE BALANCE SHEET ACCOUNTS AS OF DECEMBER 31 Debit Balances 2017 2016 69,500 $50,900 153,400 131,000 75,300 60,900 4,800 85,600 0,300 48,300 143,900 143,900 24,900 $607,200 $545,500 Accounts Receivable Debt investments (avaiable-for-sale) 40,000 Credit Balances Allowance for Doubtful Accounts Accumulated Depreciation-Equipment Accumulated Depreciation-Buildings Accounts Payable Income Taxes Payable $10,100 $7,900 20,800 14,000 36,900 27,700 59,600 11,900 10,100 62,000 0,000 10,000 260,000 89,00096,200 66,500 tudy Long-Term Notes Payable Common Stock Retained Earnings ULATOR PRINTER VIRSION BACK Retained Earnings 89,000 96,200 607,200 $545,500 Totals Additional data: 1. Equipment that cost $10,000 and was 60% depreciated was sold in 2017 2. Cash dividends were decdlared and paid during the yer 3. Common stock was Issued in exchange for land 4 Investments that cost $34,700 were sold during the year 5. There were no write-offs of uncollectible accounts during the year Ivanhoe's 2017 income statement is as follows. Sales revenue Less: Cost of goods sold Gross profit Less: OperatingexperesCinckales depreciation expense and bad debt espense) Income from operations Other revenues and expenses 916,900 602, xo 344,600 248,400 96,200 Gain on sale of investments Loss on sale of equipment $14,900 (3,000) 11,900 108,100 45,100 $63,000 Income before tax Income taxes Net incorme Study (a) Compute net cash grovided by operating activitios under the direct method. (Enter negative amounts using either a negative sign preceding the mmber parentheses e.g. (45)) Net income $63,000 (a) compute net cash provided by operating activities under the direct method. (Enter negative amounts using either a negative sign preceding the Enter negative amounts using either a m number e.g.-45 or parentheses e.g. (45).) Net cash flow from operating activities s using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) IVANHOE COMPANY Statement of Cash Flows Adjustments to reconcile net income to CALCULATOR PRINTER VERSION BACK NEXT s by BACK NEXT CALCULATOR PRIN TE R VERSION