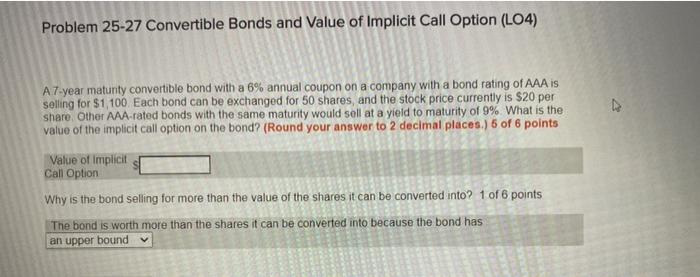

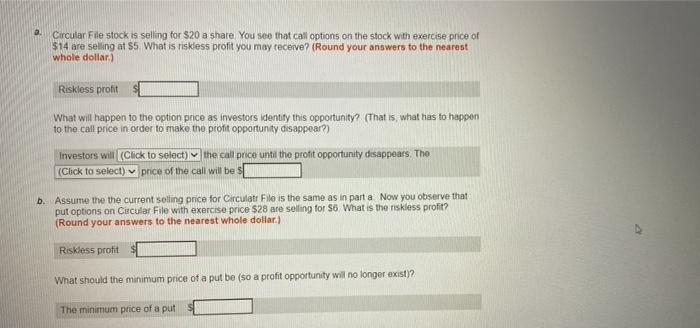

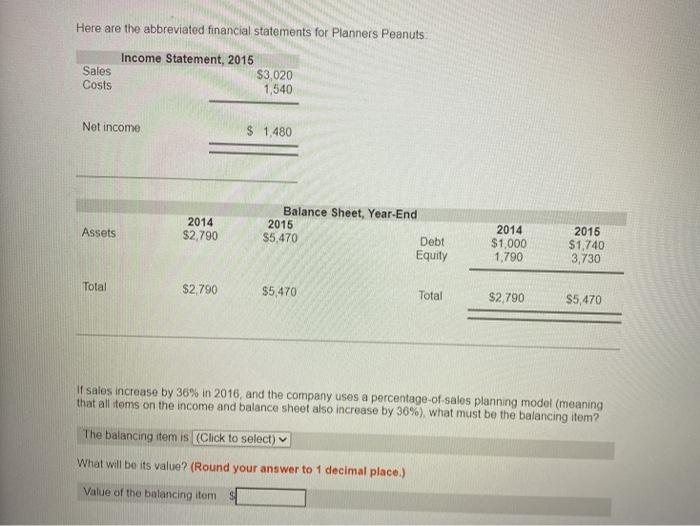

Problem 25-27 Convertible Bonds and Value of Implicit Call Option (L04) A7-year matunty convertible bond with a 6% annual coupon on a company with a bond rating of AAA is selling for $1,100 Each bond can be exchanged for 50 shares, and the stock price currently is $20 per share Other AAA-rated bonds with the same maturity would sell at a yield to maturity of 9% What is the value of the implicit call option on the bond? (Round your answer to 2 decimal places.) 5 of 6 points Value of implicit Call Option Why is the bond selling for more than the value of the shares it can be converted into? 1 of 6 points The bond is worth more than the shares it can be converted into because the bond has an upper bound 8. Circular File stock is selling for $20 a share you see that call options on the stock with exercise price of $14 are selling at 5 What is riskless profit you may receive? (Round your answers to the nearest whole dollar) Riskless proht What will happen to the option price as investors identify this opportunity? (That is what has to happen to the call price in order to make the profit opportunity disappear?) Investors will (Click to select the call price until the profit opportunity disappears. The (Click to select) price of the call will be $ [ b. Assume the the current selling price for Circulat File is the same as in part a Now you observe that put options on Circular File with exercise price $28 are selling for $6 What is the riskless profit? (Round your answers to the nearest whole dollar) Riskless profit What should the minimum price of a put be (so a profit opportunity will no longer exist)? The minimum price of a put Here are the abbreviated financial statements for Planners Peanuts Sales Costs Income Statement, 2015 $3,020 1,540 Net income $ 1,480 Assets 2014 $2,790 Balance Sheet, Year-End 2015 $5,470 Debt Equity 2014 $1,000 1,790 2016 $1,740 3,730 Total $2,790 $5,470 Total $2,790 S5,470 if sales increase by 36% in 2016, and the company uses a percentage-of-sales planning model (meaning that all items on the income and balance sheet also increase by 36%), what must be the balancing item? The balancing item is (Click to select) What will be its value? (Round your answer to 1 decimal place.) Value of the balancing item