Answered step by step

Verified Expert Solution

Question

1 Approved Answer

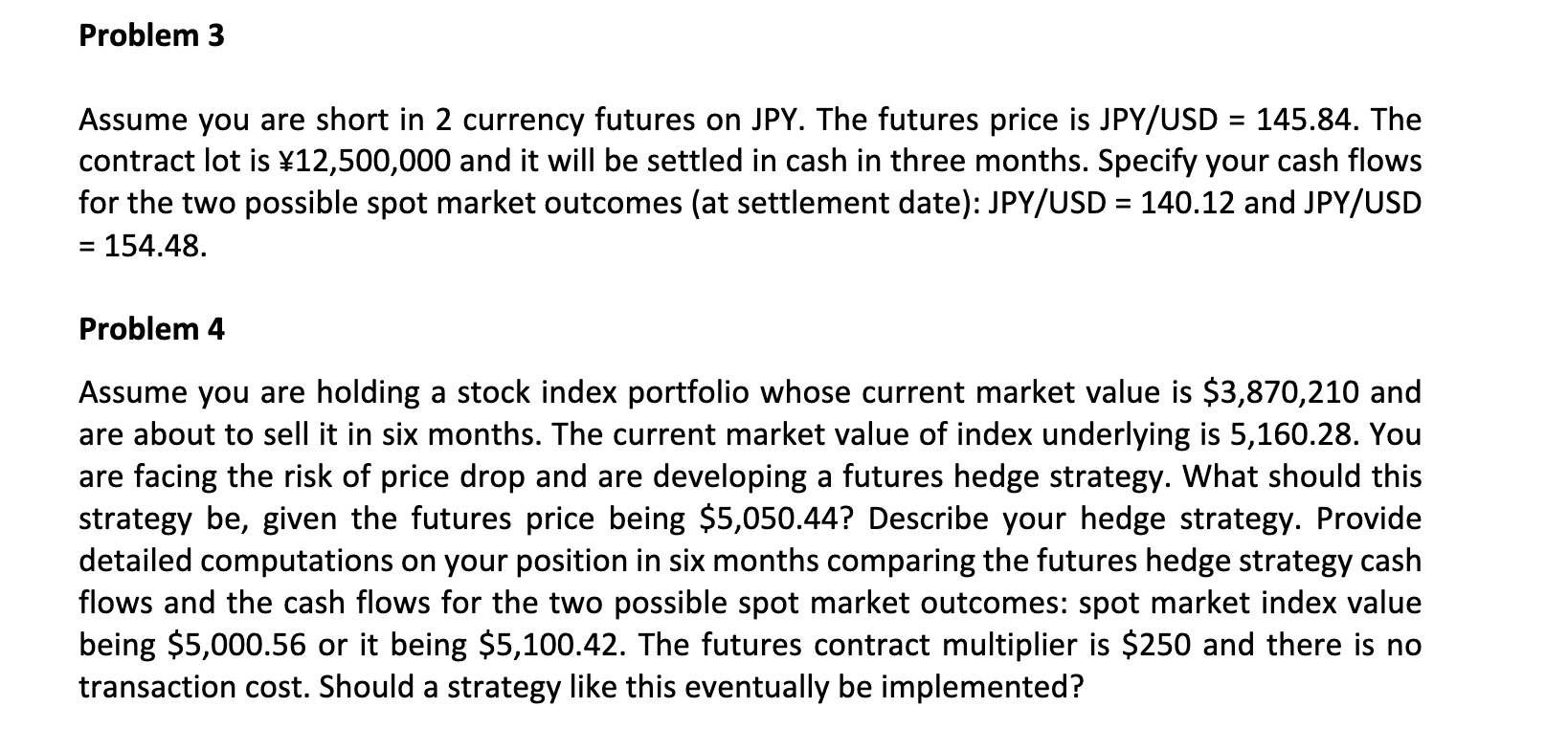

Problem 3 Assume you are short in 2 currency futures on JPY . The futures price is JPY / USD = 1 4 5 .

Problem

Assume you are short in currency futures on JPY The futures price is JPYUSD The

contract lot is and it will be settled in cash in three months. Specify your cash flows

for the two possible spot market outcomes at settlement date: JPYUSD and JPYUSD

Problem

Assume you are holding a stock index portfolio whose current market value is $ and

are about to sell it in six months. The current market value of index underlying is You

are facing the risk of price drop and are developing a futures hedge strategy. What should this

strategy be given the futures price being $ Describe your hedge strategy. Provide

detailed computations on your position in six months comparing the futures hedge strategy cash

flows and the cash flows for the two possible spot market outcomes: spot market index value

being $ or it being $ The futures contract multiplier is $ and there is no

transaction cost. Should a strategy like this eventually be implemented?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started