Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3: Open the File HW3Pb2.xlsx. In that file, you have information on the adjusted price of Priceline (PCLN) from Jan 02 2014 to

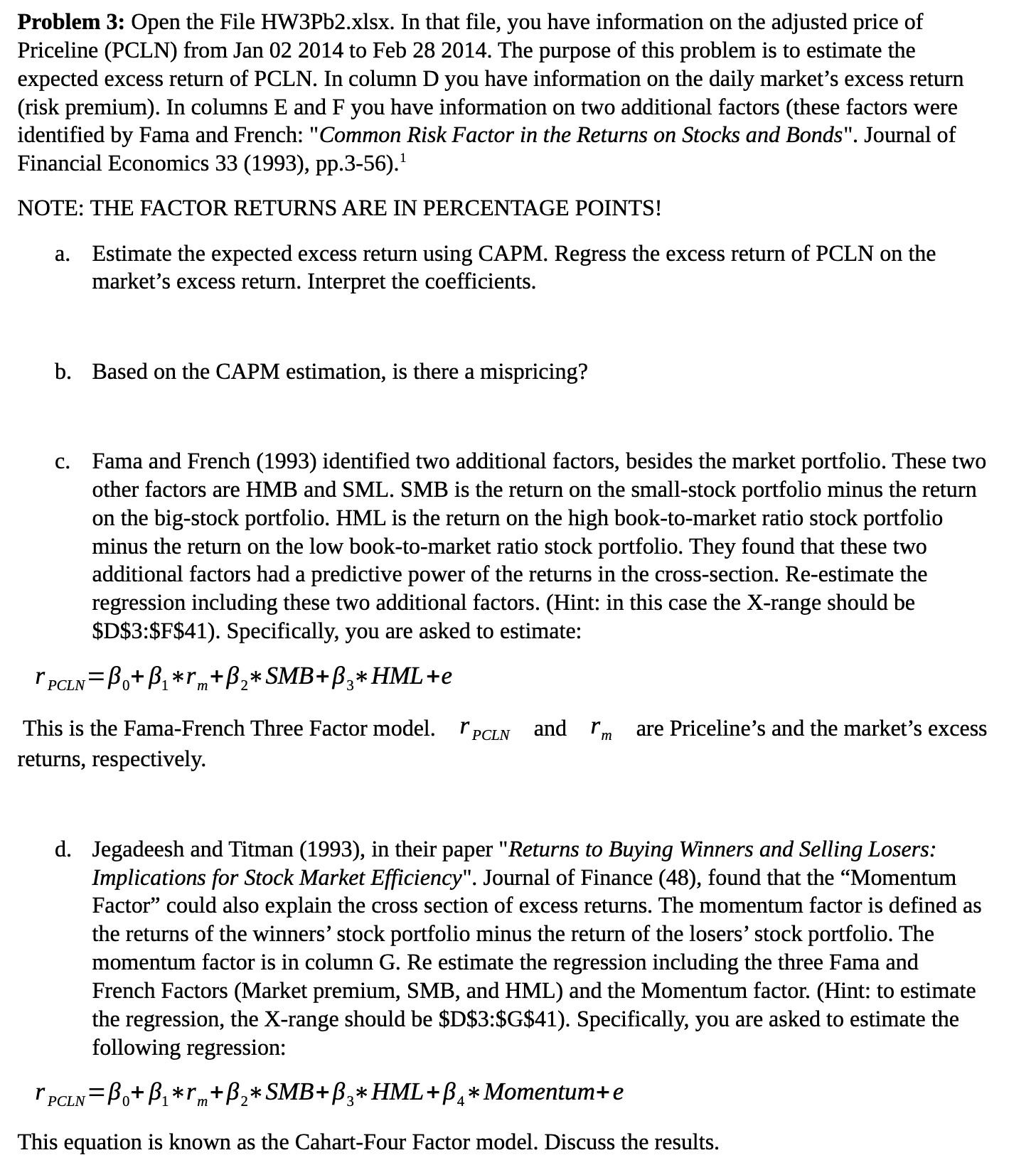

Problem 3: Open the File HW3Pb2.xlsx. In that file, you have information on the adjusted price of Priceline (PCLN) from Jan 02 2014 to Feb 28 2014. The purpose of this problem is to estimate the expected excess return of PCLN. In column D you have information on the daily market's excess return (risk premium). In columns E and F you have information on two additional factors (these factors were identified by Fama and French: "Common Risk Factor in the Returns on Stocks and Bonds". Journal of Financial Economics 33 (1993), pp.3-56). NOTE: THE FACTOR RETURNS ARE IN PERCENTAGE POINTS! a. Estimate the expected excess return using CAPM. Regress the excess return of PCLN on the market's excess return. Interpret the coefficients. b. Based on the CAPM estimation, is there a mispricing? C. Fama and French (1993) identified two additional factors, besides the market portfolio. These two other factors are HMB and SML. SMB is the return on the small-stock portfolio minus the return on the big-stock portfolio. HML is the return on the high book-to-market ratio stock portfolio minus the return on the low book-to-market ratio stock portfolio. They found that these two additional factors had a predictive power of the returns in the cross-section. Re-estimate the regression including these two additional factors. (Hint: in this case the X-range should be $D$3:$F$41). Specifically, you are asked to estimate: TPCLN-Bo+B *r+B*SMB+B HML +e This is the Fama-French Three Factor model. returns, respectively. PCLN and m are Priceline's and the market's excess d. Jegadeesh and Titman (1993), in their paper "Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency". Journal of Finance (48), found that the "Momentum Factor" could also explain the cross section of excess returns. The momentum factor is defined as the returns of the winners' stock portfolio minus the return of the losers' stock portfolio. The momentum factor is in column G. Re estimate the regression including the three Fama and French Factors (Market premium, SMB, and HML) and the Momentum factor. (Hint: to estimate the regression, the X-range should be $D$3:$G$41). Specifically, you are asked to estimate the following regression: PCLN=BO+B*rm+* SMB+3* HML + * Momentum+e 4 This equation is known as the Cahart-Four Factor model. Discuss the results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Estimate the expected excess return using CAPM To estimate the expected excess return using the Capital Asset Pricing Model CAPM you need to regress ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started