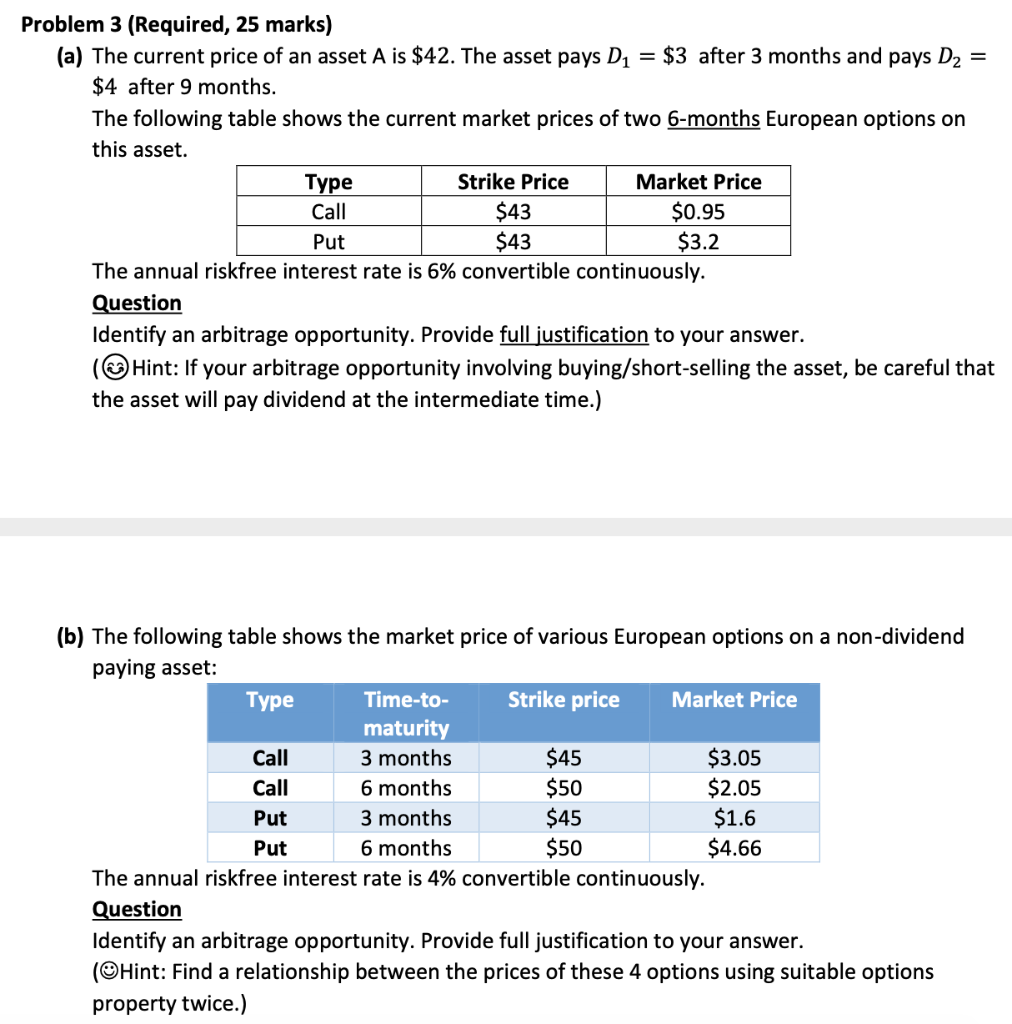

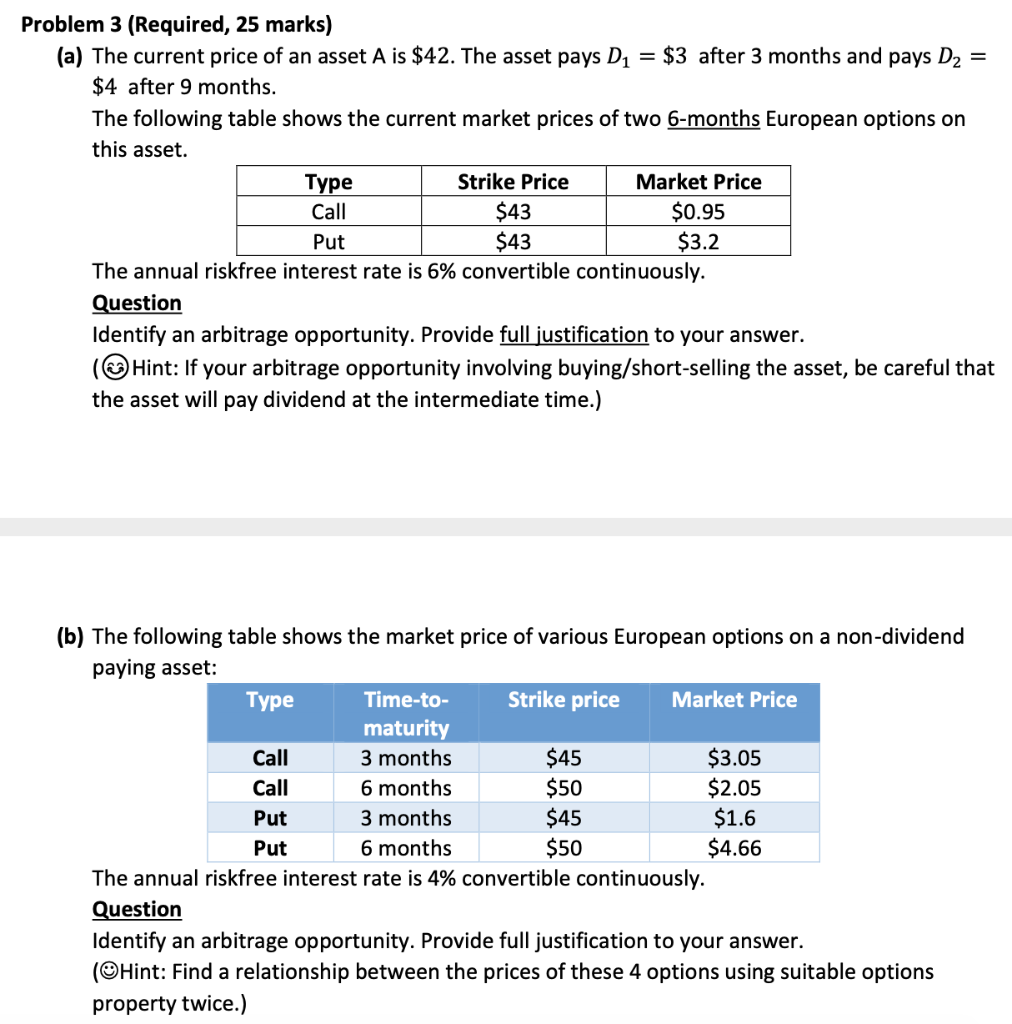

Problem 3 (Required, 25 marks) (a) The current price of an asset A is $42. The asset pays D1 = $3 after 3 months and pays D2 = $4 after 9 months. The following table shows the current market prices of two 6-months European options on this asset. Type Strike Price Market Price Call $43 $0.95 Put $43 $3.2 The annual riskfree interest rate is 6% convertible continuously. Question Identify an arbitrage opportunity. Provide full justification to your answer. (Hint: If your arbitrage opportunity involving buying/short-selling the asset, be careful that the asset will pay dividend at the intermediate time.) (b) The following table shows the market price of various European options on a non-dividend paying asset: Type Time-to- Strike price Market Price maturity Call 3 months $45 $3.05 Call 6 months $50 $2.05 Put 3 months $45 $1.6 Put 6 months $50 $4.66 The annual riskfree interest rate is 4% convertible continuously. Question Identify an arbitrage opportunity. Provide full justification to your answer. (Hint: Find a relationship between the prices of these 4 options using suitable options property twice.) Problem 3 (Required, 25 marks) (a) The current price of an asset A is $42. The asset pays D1 = $3 after 3 months and pays D2 = $4 after 9 months. The following table shows the current market prices of two 6-months European options on this asset. Type Strike Price Market Price Call $43 $0.95 Put $43 $3.2 The annual riskfree interest rate is 6% convertible continuously. Question Identify an arbitrage opportunity. Provide full justification to your answer. (Hint: If your arbitrage opportunity involving buying/short-selling the asset, be careful that the asset will pay dividend at the intermediate time.) (b) The following table shows the market price of various European options on a non-dividend paying asset: Type Time-to- Strike price Market Price maturity Call 3 months $45 $3.05 Call 6 months $50 $2.05 Put 3 months $45 $1.6 Put 6 months $50 $4.66 The annual riskfree interest rate is 4% convertible continuously. Question Identify an arbitrage opportunity. Provide full justification to your answer. (Hint: Find a relationship between the prices of these 4 options using suitable options property twice.)