Answered step by step

Verified Expert Solution

Question

1 Approved Answer

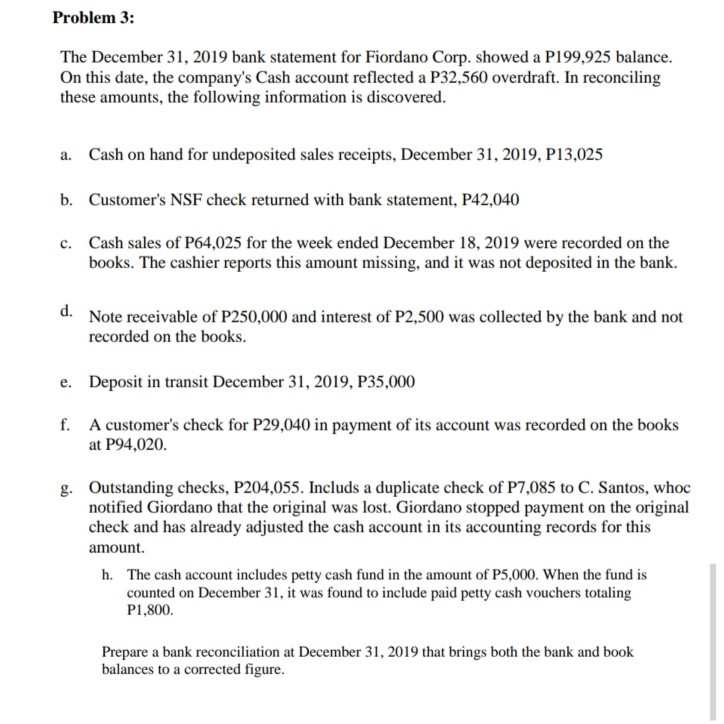

Problem 3: The December 31, 2019 bank statement for Fiordano Corp. showed a P199,925 balance. On this date, the company's Cash account reflected a P32,560

Problem 3: The December 31, 2019 bank statement for Fiordano Corp. showed a P199,925 balance. On this date, the company's Cash account reflected a P32,560 overdraft. In reconciling these amounts, the following information is discovered. a. Cash on hand for undeposited sales receipts, December 31, 2019, P13,025 b. Customer's NSF check returned with bank statement, P42,040 c. Cash sales of P64,025 for the week ended December 18, 2019 were recorded on the books. The cashier reports this amount missing, and it was not deposited in the bank. d. Note receivable of P250,000 and interest of P2,500 was collected by the bank and not recorded on the books. e. Deposit in transit December 31, 2019, P35,000 f. A customer's check for P29,040 in payment of its account was recorded on the books at P94,020. g. Outstanding checks, P204,055. Includs a duplicate check of P7,085 to C. Santos, whoc notified Giordano that the original was lost. Giordano stopped payment on the original check and has already adjusted the cash account in its accounting records for this amount. h. The cash account includes petty cash fund in the amount of P5,000. When the fund is counted on December 31, it was found to include paid petty cash vouchers totaling P1,800. Prepare a bank reconciliation at December 31, 2019 that brings both the bank and book balances to a corrected figure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started