Answered step by step

Verified Expert Solution

Question

1 Approved Answer

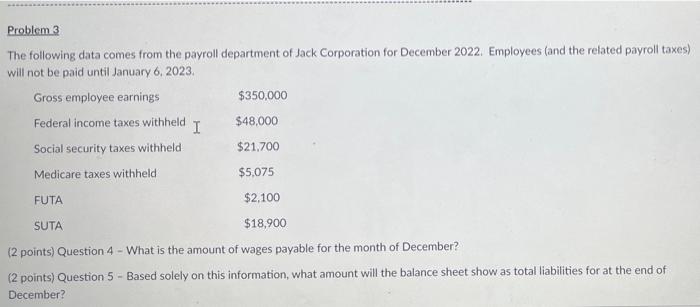

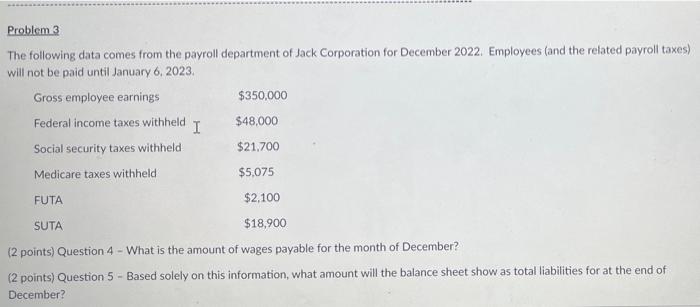

Problem 3 The following data comes from the payroll department of Jack Corporation for December 2022. Employees (and the related payroll taxes) will not be

Problem 3 The following data comes from the payroll department of Jack Corporation for December 2022. Employees (and the related payroll taxes) will not be paid until January 6, 2023. Gross employee earnings $350,000 Federal income taxes withheld $48,000 I Social security taxes withheld $21,700 Medicare taxes withheld $5,075 FUTA $2,100 SUTA $18,900 (2points) Question 4 What is the amount of wages payable for the month of December? (2 points) Question 5 - Based solely on this information, what amount will the balance sheet show as total liabilities for at the end of December?

Problem 3 The following data comes from the payroll department of Jack Corporation for December 2022. Employees (and the related payroll taxes) will not be paid until January 6, 2023 Gross employee earnings $350,000 Federal income taxes withheld I $48,000 Social security taxes withheld $21,700 Medicare taxes withheld $5,075 FUTA $2,100 SUTA $18,900 (2 points) Question 4 - What is the amount of wages payable for the month of December? (2 points) Question 5 - Based solely on this information, what amount will the balance sheet show as total liabilities for at the end of December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started