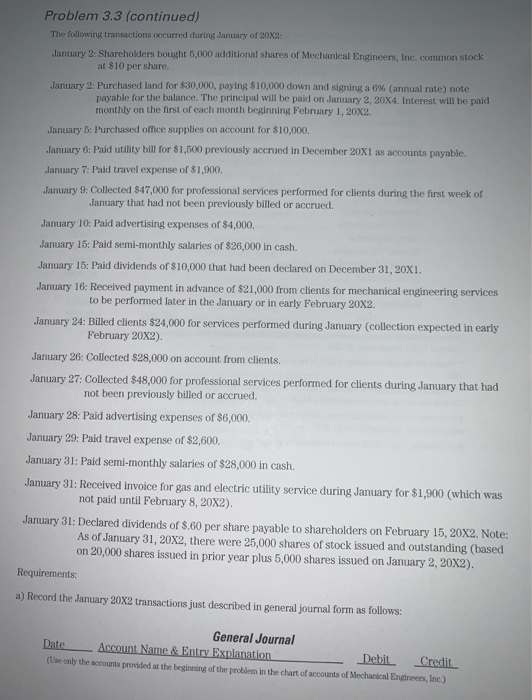

Problem 3.3 (continued) The following transactions occurred during January of 20X2: January 2 Shareholders bought 1,000 additional shares of Mechanical Engineers, Inc. common stock at $10 per share. January 2: Purchased land for $30,000, paying $10,000 down and signing a 6% (annual rate) note payable for the balance. The principal will be paid on January 2, 20X4. Interest will be paid monthly on the first of each month beginning February 1, 20X2. January 5: Purchased office supplies on account for $10,000. January 6: Paid utility bill for $1,000 previously accrued in December 20X1 as accounts payable. January 7: Paid travel expense of $1,900. January 9: Collected $47,000 for professional services performed for clients during the first week of January that had not been previously billed or accrued. January 10: Paid advertising expenses of $4,000. January 16: Paid semi-monthly salaries of $26,000 in cash. January 15: Paid dividends of $10,000 that had been declared on December 31, 20X1. January 16: Received payment in advance of $21,000 from clients for mechanical engineering services to be performed later in the January or in early February 20X2 January 24: Billed clients $24,000 for services performed during January (collection expected in early February 20X2) January 26: Collected $28,000 on account from clients. January 27: Collected $48,000 for professional services performed for clients during January that had not been previously billed or accrued. January 28: Paid advertising expenses of $6,000 January 29: Paid travel expense of $2,600. January 31: Paid semi-monthly salaries of $28,000 in cash. January 31: Received invoice for gas and electric utility service during January for $1,900 (which was not paid until February 8, 20X2). January 31: Declared dividends of $.60 per share payable to shareholders on February 15, 20X2. Note: As of January 31, 20X2, there were 25,000 shares of stock issued and outstanding (based on 20,000 shares issued in prior year plus 5,000 shares issued on January 2, 20X2). Requirements: a) Record the January 20X2 transactions just described in general journal form as follows: General Journal Date Account Name & Entry Explanation Debit Credit (Use only the accounts provided at the beginning of the problem in the chart of accounts of Mechanical Engineers, Inc.)