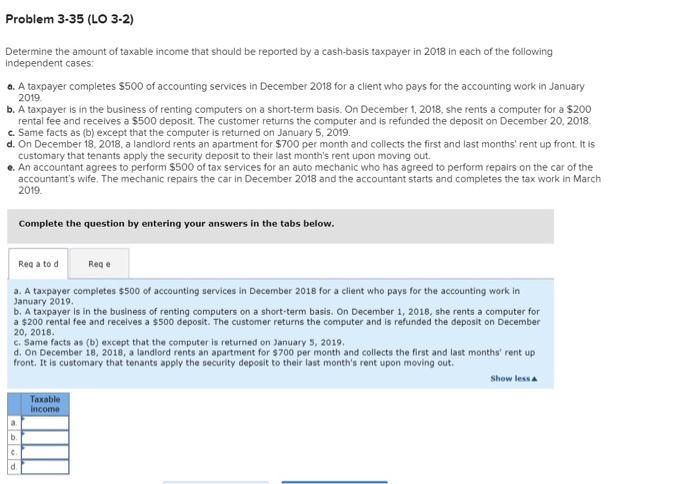

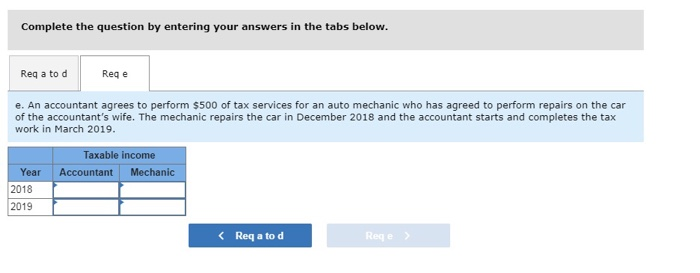

Problem 3-35 (LO 3-2) Determine the amount of taxable income that should be reported by a cash-basis taxpayer in 2018 in each of the following a. A taxpayer completes $500 of accounting services in December 2018 for a client who pays for the accounting work in January 2019. b. A taxpayer is in the business of renting computers on a short-term basis. On December 1, 2018, she rents a computer for a $200 rental fee and receives a $500 deposit. The customer returns the computer and is refunded the deposit on December 20, 2018 c. Same facts as (b) except that the computer is returned on January 5, 2019. d. On December 18, 2018, a landlord rents an apartment for $700 per month and collects the first and last months' rent up front It is customary that tenants apply the security deposit to their last month's rent upon moving out e. An accountant agrees to perform $500 of tax services for an auto mechanic who has agreed to perform repairs on the car of the accountant's wife. The mechanic repairs the car in December 2018 and the accountant starts and completes the tax work in March 2019. Complete the question by entering your answers in the tabs below Req a to d Req e a. A taxpayer completes $500 of accounting services in December 2018 for a client who pays for the accounting work in anuary 2019. b. A taxpayer is in the business of renting computers on a short-term basis. On December 1, 2018, she rents a computer for a $200 rental fee and receives a $500 deposit. The customer returns the computer and is refunded the deposit on December 20, 2018 c. Same facts as (b) except that the computer is returned on January 5, 2019 d. On December 18, 2018, a landlord rents an apartment for $700 per month and collects the first and last months' rent up front. It is customary that tenants apply the security deposit to their last month's rent upon moving out Show less Complete the question by entering your answers in the tabs below. Req a to dReq e e. An accountant agrees to perform $500 of tax services for an auto mechanic who has agreed to perform repairs on the car of the accountant's wife. The mechanic repairs the car in December 2018 and the accountant starts and completes the tax work in March 2019. Taxable income Year Accountant Mechanic 2018 2019 Req a to d eg e