Answered step by step

Verified Expert Solution

Question

1 Approved Answer

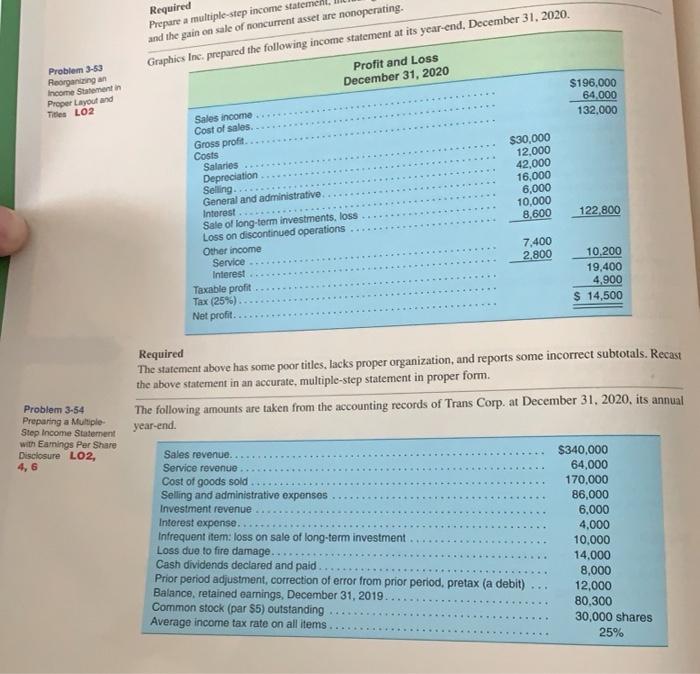

Problem 3-53 Required Prepare a multiple-step income statemel and the gain on sale of noncurrent asset are nonoperating. Graphics Inc. prepared the following income statement

Problem 3-53

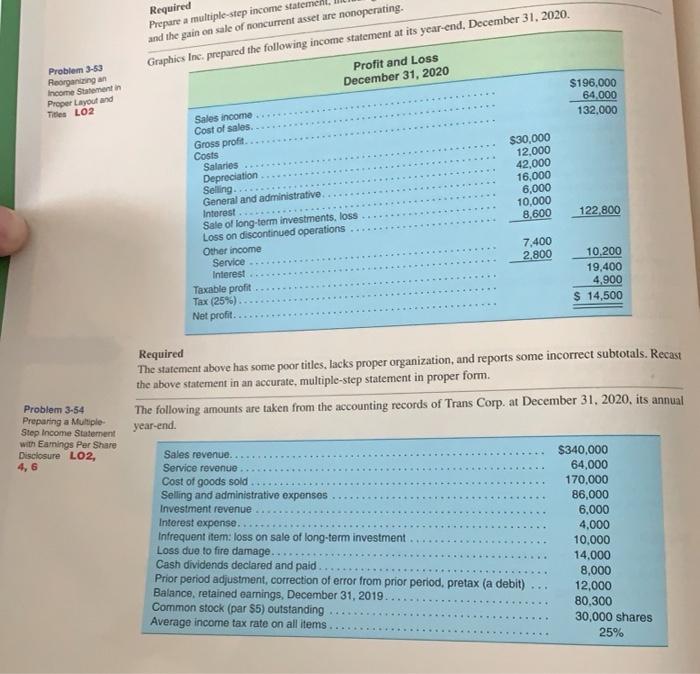

Required Prepare a multiple-step income statemel and the gain on sale of noncurrent asset are nonoperating. Graphics Inc. prepared the following income statement at its year-end, December 31, 2020 Profit and Loss December 31, 2020 Problem -63 Reorganizing an Income Statement Proper Layout and Title LO2 $196,000 64,000 132.000 Sales income Cost of sales. Gross profit Costs Salaries Depreciation Selling General and administrative Interest Sale of long-term investments, loss Loss on discontinued operations Other income Service Interest Taxable profit Tax (25%) Net profit. $30,000 12.000 42,000 16,000 6,000 10,000 8,600 122,800 7,400 2.800 10,200 19,400 4,900 $ 14,500 Required The statement above has some poor titles, lacks proper organization, and reports some incorrect subtotals. Recast the above statement in an accurate, multiple-step statement in proper form. The following amounts are taken from the accounting records of Trans Corp. at December 31, 2020. its annual year-end. Problem 3-54 Preparing a Multiple Step Income Statement with Earnings Per Share Disclosure LO2, 4,6 Sales revenue.. Service revenue Cost of goods sold Selling and administrative expenses Investment revenue Interest expense. Infrequent item: loss on sale of long-term investment Loss due to fire damage. Cash dividends declared and paid Prior period adjustment, correction of error from prior period, pretax (a debit) Balance, retained earnings, December 31, 2019 Common stock (par $5) outstanding Average income tax rate on all items $340,000 64,000 170.000 86,000 6,000 4,000 10,000 14.000 8,000 12,000 80.300 30,000 shares 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started