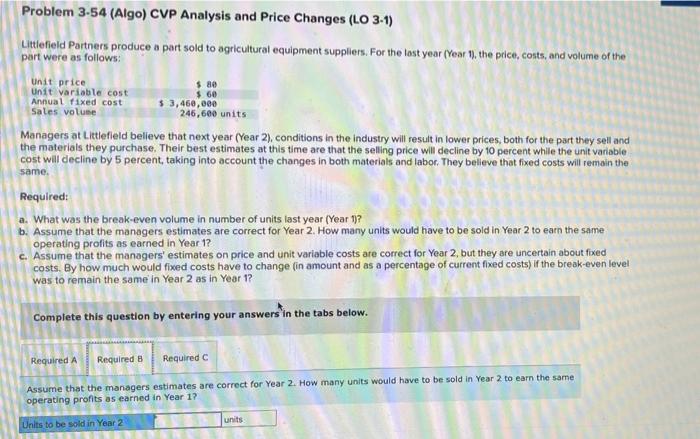

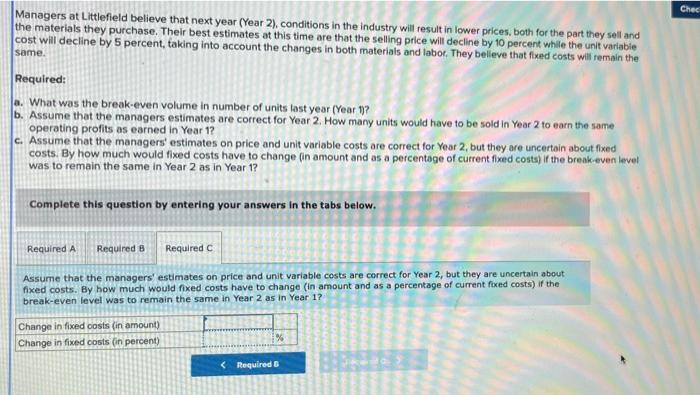

Problem 3.54 (Algo) CVP Analysis and Price Changes (LO 3-1) Littlefieid Partners produce a part sold to agricultural equipment suppliers. For the last year (Year 1), the price, costs, and volume of the part were as follows: Managers at Littlefield believe that next year (Year 2), conditions in the industry will result in lower prices, both for the part they sell and the materials they purchase. Their best estimates at this time are that the selling price will decline by 10 percent while the unit variable cost will decline by 5 percent, taking into account the changes in both materials and labor. They belleve that fixed costs will remain the same. Required: a. What was the break-even volume in number of units last year (Year 11)? b. Assume that the managers estimates are correct for Year 2 . How many units would have to be sold in Year 2 to earn the same operating profits as earned in Year 1 ? c. Assume that the managers' estimates on price and unit variable costs are correct for Year 2, but they are uncertain about fixed costs. By how much would fixed costs have to change (in amount and as a percentage of current fixed costs) if the break-even level was to remain the same in Year 2 as in Year 1 ? Complete this question by entering your answers in the tabs below. Assume that the managers estimates are correct for Year 2. How many units would have to be sold in Year 2 to earn the same operating profits as earned in Year 1 ? Managers at Littlefield believe that next year (Year 2), conditions in the industry will result in lower prices, both for the part they sell and the materials they purchase. Their best estimates at this time are that the selling price will decline by 10 percent while the unit variabie cost will decline by 5 percent, taking into account the changes in both materials and labor. They believe that fixed costs will remain the same. Required: a. What was the break-even volume in number of units last year (Year 11 ? b. Assume that the managers estimates are correct for Year 2 . How many units would have to be sold in Year 2 to earn the same operating profits as earned in Year 1 ? c. Assume that the managers' estimates on price and unit variable costs are correct for Year 2 , but they are uncertain about flxed costs. By how much would fixed costs have to change (in amount and as a percentage of current fixed costs) if the break-even level. was to remain the same in Year 2 as in Year 1 ? Complete this question by entering your answers in the tabs below. Assume that the managers' estimates on price and unit variable costs are correct for Year 2, but they are uncertain about fixed costs. By how much would fixed costs have to change (in amount and as a percentage of current fixed costs) if the break-even level was to remain the same in Year 2 as in Year 1