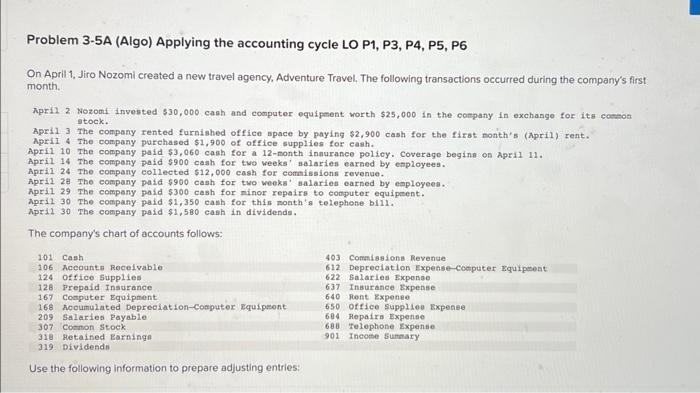

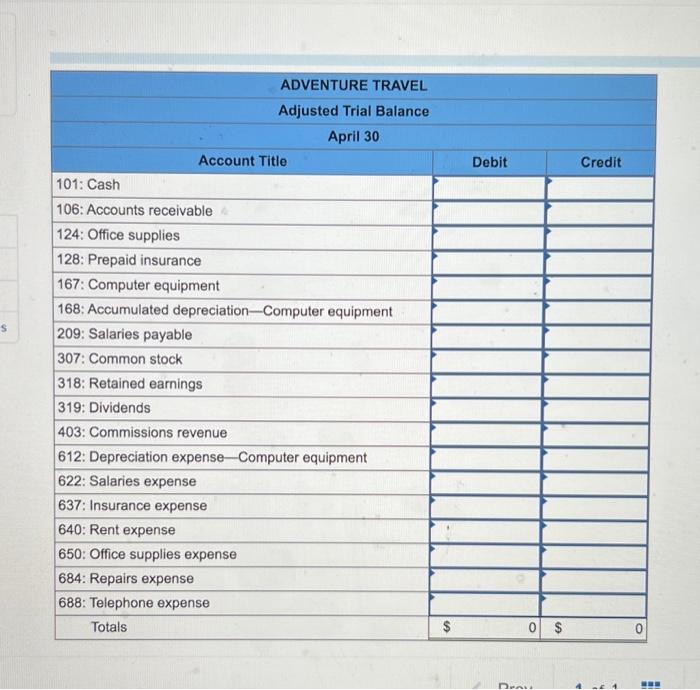

Problem 3-5A (Algo) Applying the accounting cycle LO P1, P3, P4, P5, P6 On April 1. Jiro Nozomi created a new travel agency. Adventure Travel. The following transactions occurred during the company's first . month. Npril 2 Nozomi invested $30,000 cash and computer equipment worth $25,000 in the company in exchange for its coenton stock. April - 3 The company rented furnished office space by paying $2,900 cash for the firat nonth's (April) rent. Apri1.4 the company parchased $1,900 of office supplies for cash. Apri1 10 The company paid $3,060 caah for a 12-month innurance poliey. Coverage beginn on April 11. April 14 The compeny paid $900 cash for two weeks' nalaries earned by enployees. Rpril. 24 The company collected $12,000 cash for comaissions revenue. Apri1 28 The company paid $900 cash for two weeks' lalaries earned by enployees. Apri1 29 The company paid $300 cash for minor repairs to conputer equiponent. April 30 The company paid $1,350 eash for thin month's telephone bill. hpril 30 The company paid $1,580 cash in dividenda. The company's chart of accounts follows: Use the following information to prepare adjusting entries: ADVENTURE TRAVEL Adjusted Trial Balance April 30 \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ Account Title } \\ \hline 101: Cash \\ \hline 106: Accounts receivable & Credit \\ \hline 124: Office supplies & & \\ \hline 128: Prepaid insurance & & \\ \hline 167: Computer equipment & & \\ \hline 168: Accumulated depreciation-Computer equipment & & \\ \hline 209: Salaries payable & & \\ \hline 307: Common stock & & \\ \hline 318: Retained earnings & & \\ \hline 319: Dividends & & \\ \hline 403: Commissions revenue & & \\ \hline 612: Depreciation expense-Computer equipment & & \\ \hline 622: Salaries expense & & \\ \hline 637: Insurance expense & & \\ \hline 640: Rent expense & & \\ \hline 650: Office supplies expense & & \\ \hline 684: Repairs expense & & \\ \hline 688: Telephone expense & & \\ \hline Totals & & \\ \hline \end{tabular}