Answered step by step

Verified Expert Solution

Question

1 Approved Answer

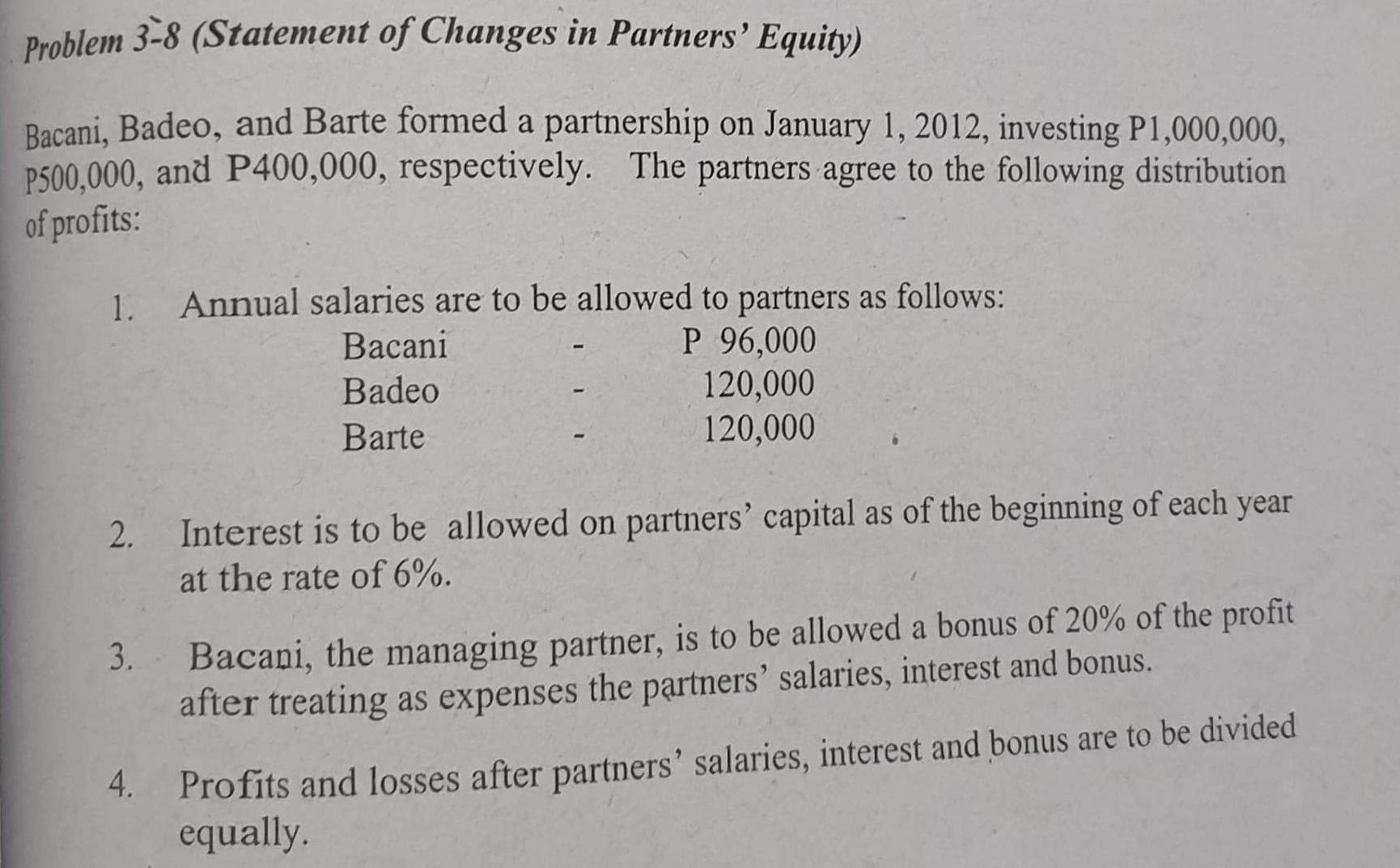

Problem 3-8 (Statement of Changes in Partners' Equity) Bacani, Badeo, and Barte formed a partnership on January 1, 2012, investing P1,000,000, P500,000, and P400,000, respectively.

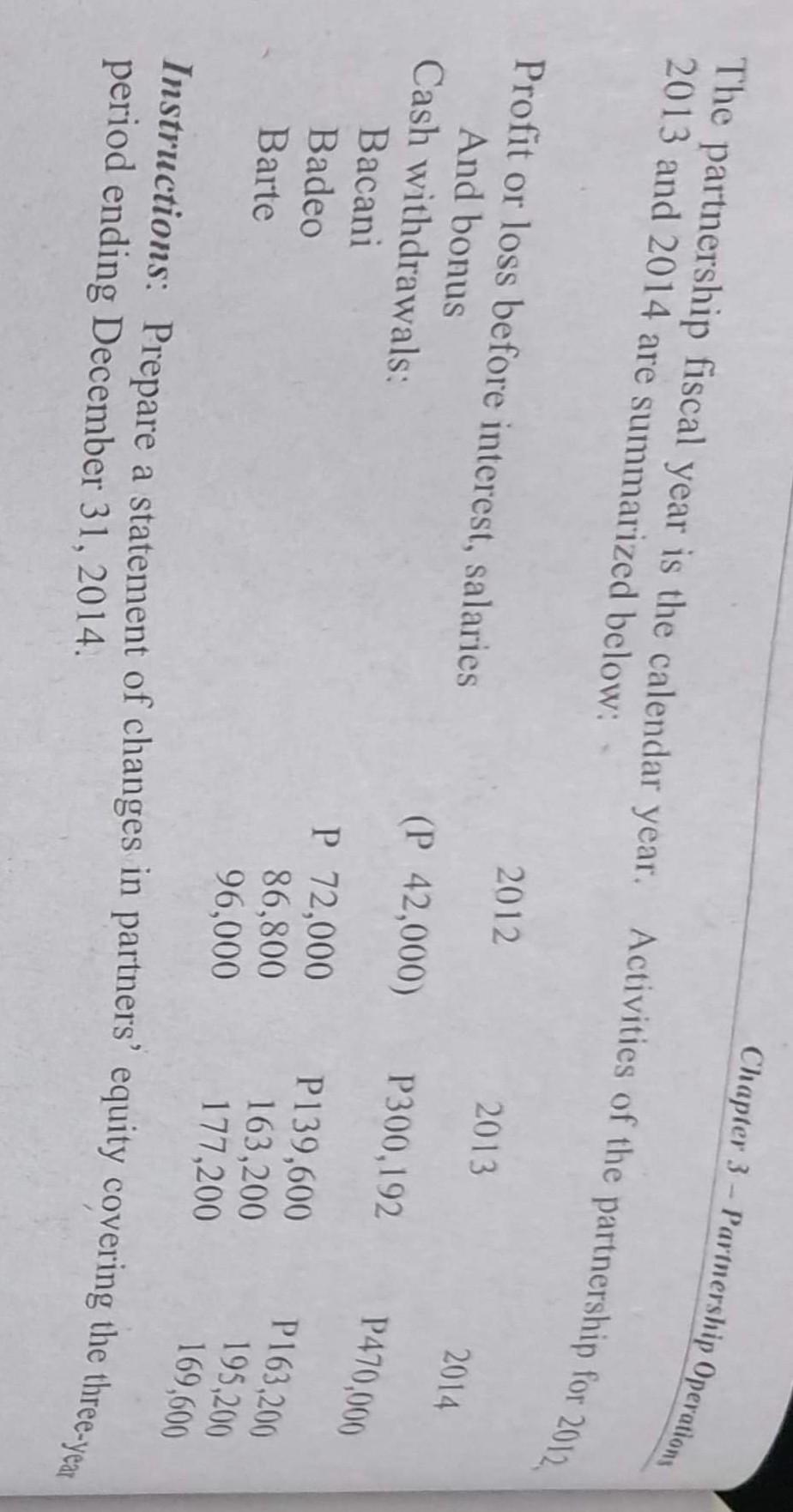

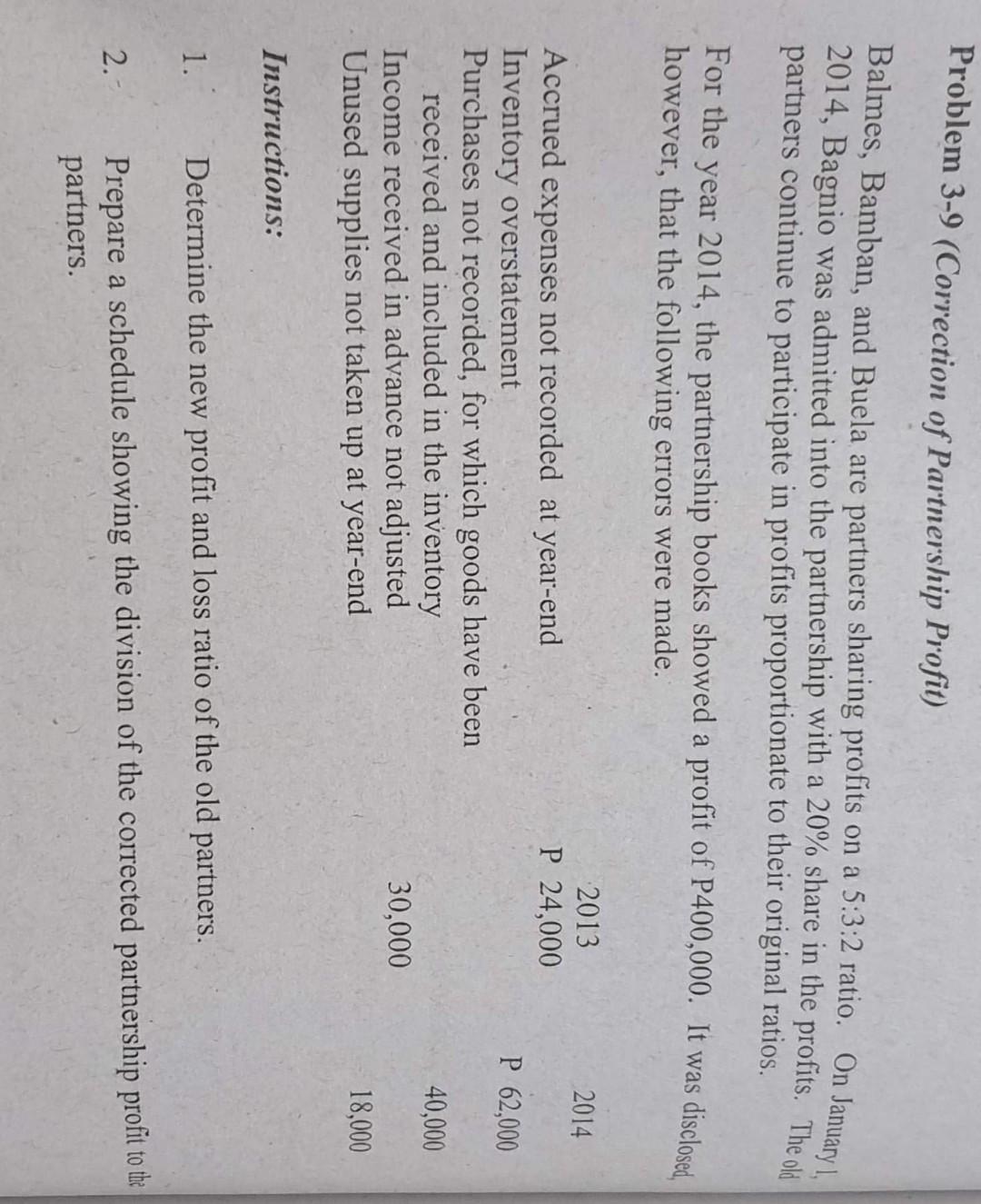

Problem 3-8 (Statement of Changes in Partners' Equity) Bacani, Badeo, and Barte formed a partnership on January 1, 2012, investing P1,000,000, P500,000, and P400,000, respectively. The partners agree to the following distribution of profits: 1. Annual salaries are to be allowed to partners as follows: Bacani P 96,000 Badeo 120,000 Barte 120,000 2. Interest is to be allowed on partners' capital as of the beginning of each year at the rate of 6%. 3. Bacani, the managing partner, is to be allowed a bonus of 20% of the profit after treating as expenses the partners' salaries, interest and bonus. 4. Profits and losses after partners' salaries, interest and bonus are to be divided equally 2013 and 2014 are summarized below: 2012 2013 2014 Profit or loss before interest, salaries And bonus Cash withdrawals: Bacani Badeo Barte (P 42,000) P300,192 P470,000 P 72,000 86,800 96,000 P139,600 163,200 177,200 P163,200 195,200 169,600 period ending December 31, 2014. The partnership fiscal year is the calendar year. Activities of the partnership for 2012 Chapter 3 - Partnership Operations Instructions: Prepare a statement of changes in partners' equity covering the three-year Problem 3-9 (Correction of Partnership Profit) Balmes, Bamban, and Buela are partners sharing profits on a 5:3:2 ratio. On January 1, 2014, Bagnio was admitted into the partnership with a 20% share in the profits. The old partners continue to participate in profits proportionate to their original ratios. For the year 2014, the partnership books showed a profit of P400,000. It was disclosed, however, that the following errors were made. 2014 2013 P 24,000 P 62,000 Accrued expenses not recorded at year-end Inventory overstatement Purchases not recorded, for which goods have been received and included in the inventory Income received in advance not adjusted Unused supplies not taken up at year-end 40,000 30,000 18,000 Instructions: 1. Determine the new profit and loss ratio of the old partners. 2. Prepare a schedule showing the division of the corrected partnership profit to the partners. Problem 3-8 (Statement of Changes in Partners' Equity) Bacani, Badeo, and Barte formed a partnership on January 1, 2012, investing P1,000,000, P500,000, and P400,000, respectively. The partners agree to the following distribution of profits: 1. Annual salaries are to be allowed to partners as follows: Bacani P 96,000 Badeo 120,000 Barte 120,000 2. Interest is to be allowed on partners' capital as of the beginning of each year at the rate of 6%. 3. Bacani, the managing partner, is to be allowed a bonus of 20% of the profit after treating as expenses the partners' salaries, interest and bonus. 4. Profits and losses after partners' salaries, interest and bonus are to be divided equally 2013 and 2014 are summarized below: 2012 2013 2014 Profit or loss before interest, salaries And bonus Cash withdrawals: Bacani Badeo Barte (P 42,000) P300,192 P470,000 P 72,000 86,800 96,000 P139,600 163,200 177,200 P163,200 195,200 169,600 period ending December 31, 2014. The partnership fiscal year is the calendar year. Activities of the partnership for 2012 Chapter 3 - Partnership Operations Instructions: Prepare a statement of changes in partners' equity covering the three-year Problem 3-9 (Correction of Partnership Profit) Balmes, Bamban, and Buela are partners sharing profits on a 5:3:2 ratio. On January 1, 2014, Bagnio was admitted into the partnership with a 20% share in the profits. The old partners continue to participate in profits proportionate to their original ratios. For the year 2014, the partnership books showed a profit of P400,000. It was disclosed, however, that the following errors were made. 2014 2013 P 24,000 P 62,000 Accrued expenses not recorded at year-end Inventory overstatement Purchases not recorded, for which goods have been received and included in the inventory Income received in advance not adjusted Unused supplies not taken up at year-end 40,000 30,000 18,000 Instructions: 1. Determine the new profit and loss ratio of the old partners. 2. Prepare a schedule showing the division of the corrected partnership profit to the partners

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started