Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxation Question on Trusts Juliet Aspen created a trust on 1 March 2019 in favour of her three grandchildren Kenny, John, and Zweli (aged 21,

Taxation Question on Trusts

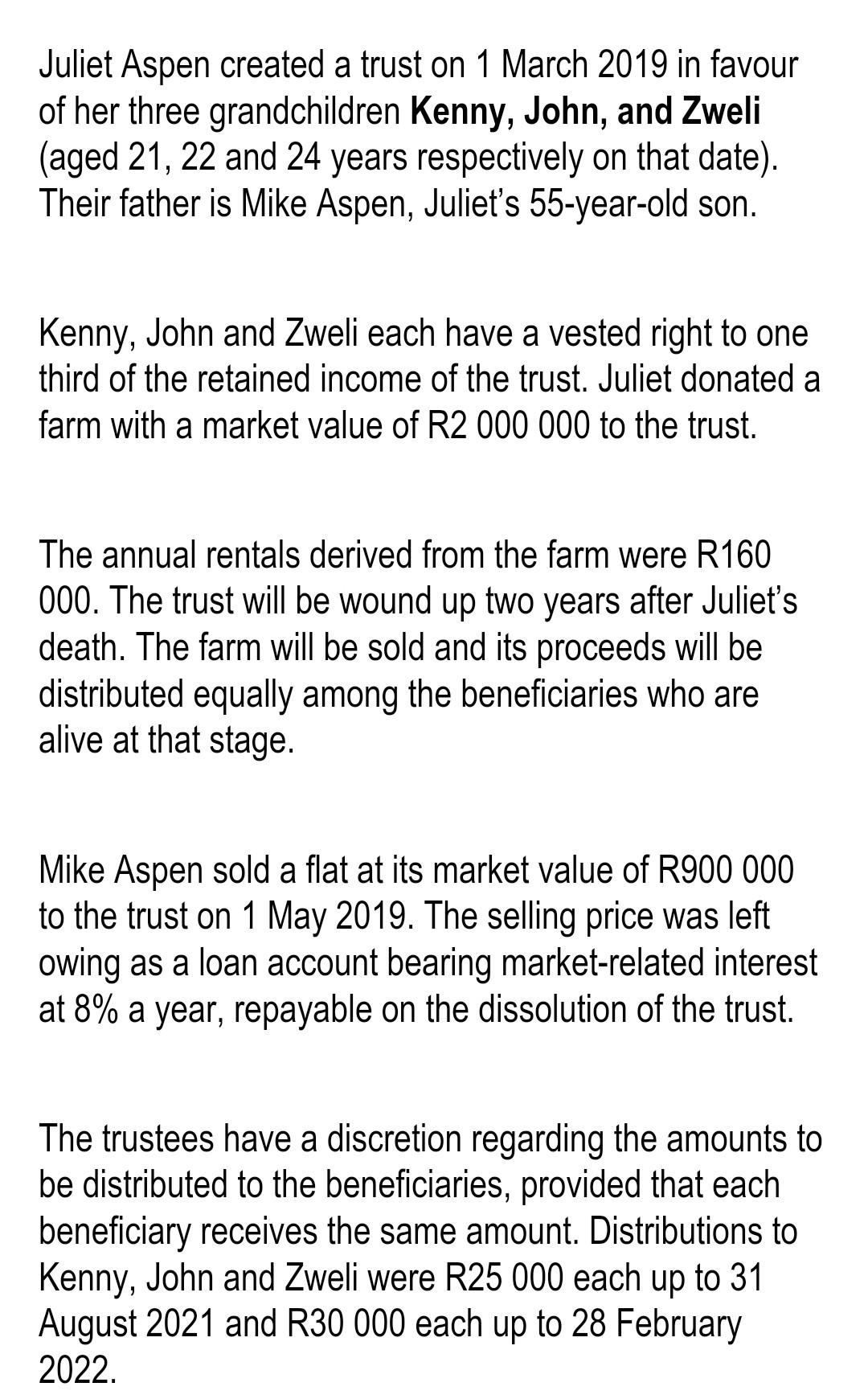

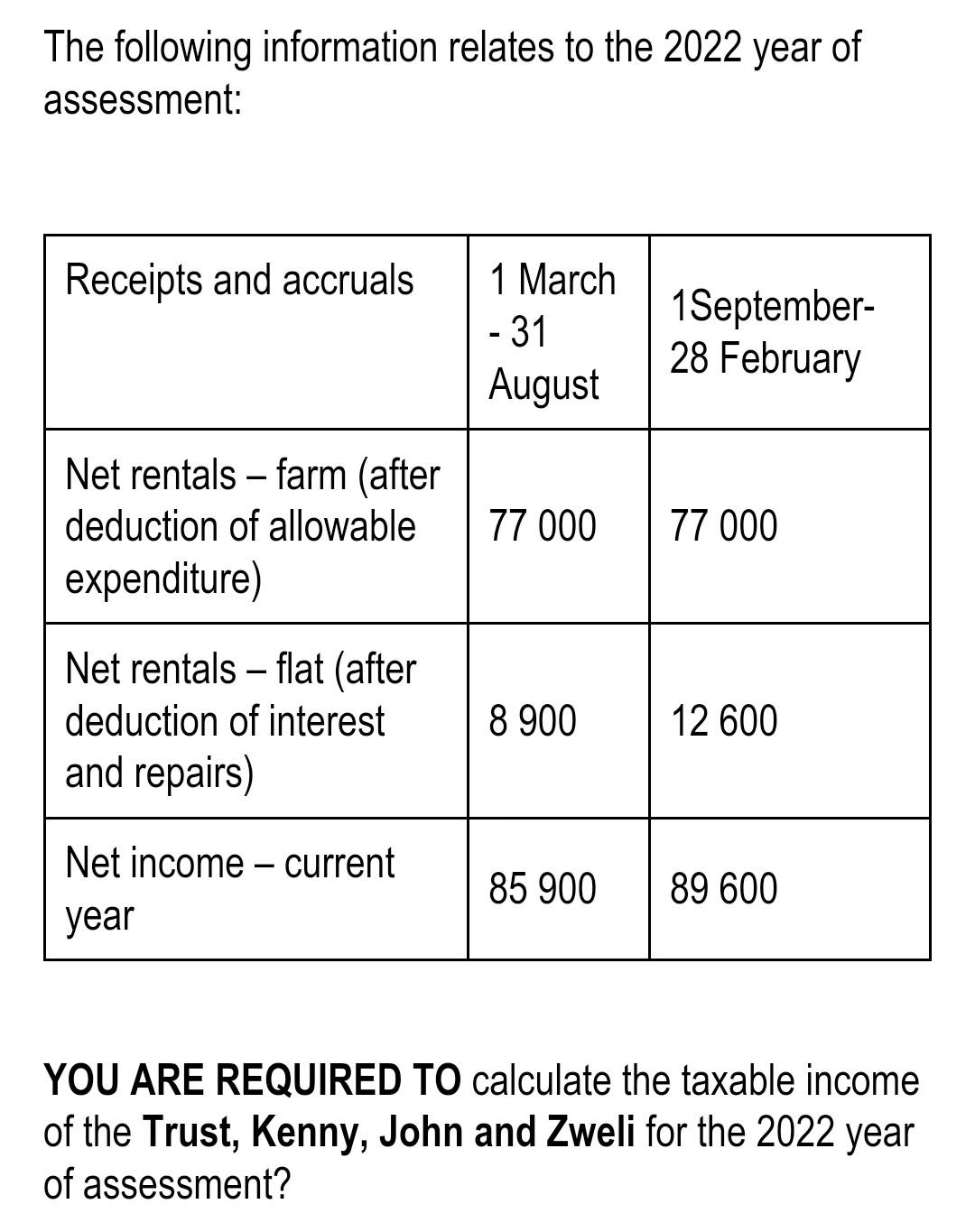

Juliet Aspen created a trust on 1 March 2019 in favour of her three grandchildren Kenny, John, and Zweli (aged 21, 22 and 24 years respectively on that date). Their father is Mike Aspen, Juliet's 55-year-old son. Kenny, John and Zweli each have a vested right to one third of the retained income of the trust. Juliet donated a farm with a market value of R2 000000 to the trust. The annual rentals derived from the farm were R 160 000 . The trust will be wound up two years after Juliet's death. The farm will be sold and its proceeds will be distributed equally among the beneficiaries who are alive at that stage. Mike Aspen sold a flat at its market value of R900 000 to the trust on 1 May 2019. The selling price was left owing as a loan account bearing market-related interest at 8% a year, repayable on the dissolution of the trust. The trustees have a discretion regarding the amounts to be distributed to the beneficiaries, provided that each beneficiary receives the same amount. Distributions to Kenny, John and Zweli were R25 000 each up to 31 August 2021 and R30 000 each up to 28 February 2022. The following information relates to the 2022 year of assessment: YOU ARE REQUIRED TO calculate the taxable income of the Trust, Kenny, John and Zweli for the 2022 year of assessment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started