Answered step by step

Verified Expert Solution

Question

1 Approved Answer

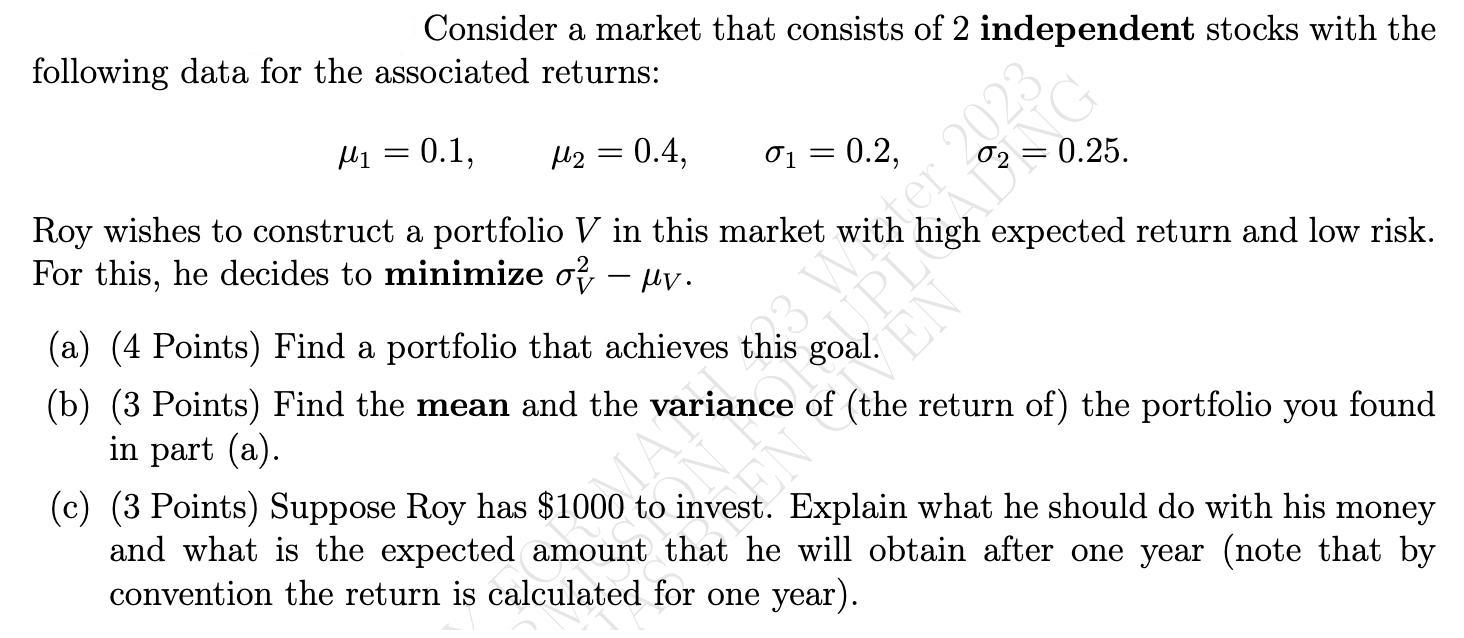

Consider a market that consists of 2 independent stocks with the following data for the associated returns: M = 0.1, M = 0.4, Roy

Consider a market that consists of 2 independent stocks with the following data for the associated returns: M = 0.1, M = 0.4, Roy wishes to construct a portfolio V in this market with high expected return and low risk. For this, he decides to minimize of - v. 01 0.2, = er 2023 0.25. (a) (4 Points) Find a portfolio that achieves this goal. (b) (3 Points) Find the mean and the variance of (the return of) the portfolio you found in part (a). (c) (3 Points) Suppose Roy has $1000 to invest. Explain what he should do with his money and what is the expected amount that he will obtain after one year (note that by convention the return is calculated for one year).

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To find a portfolio that achieves the goal of high expected return and low risk we can use the con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started