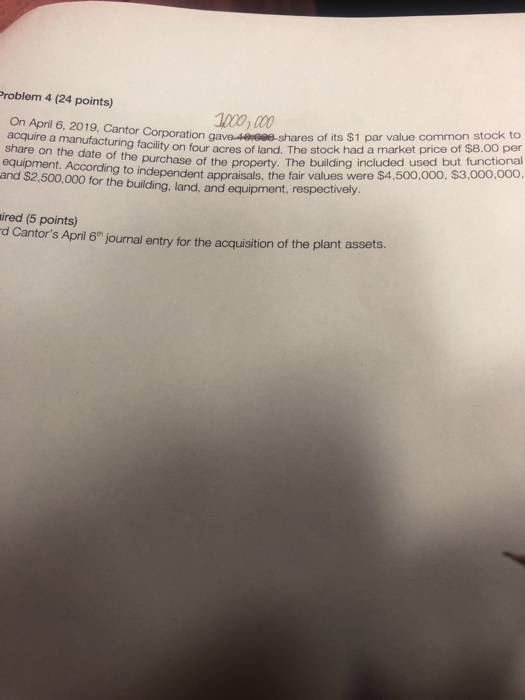

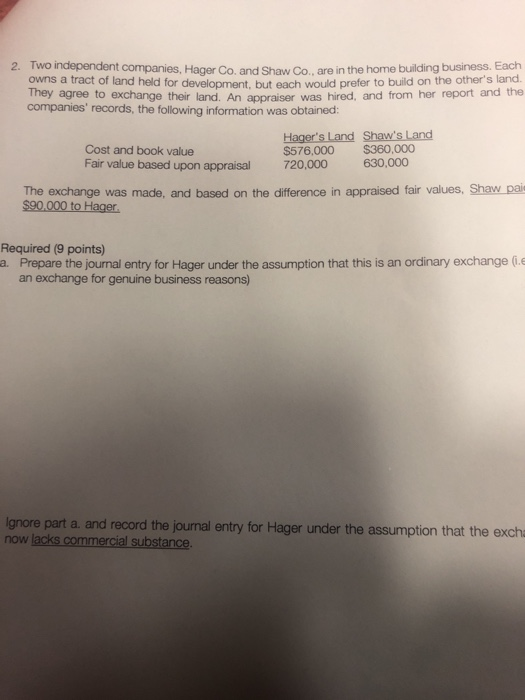

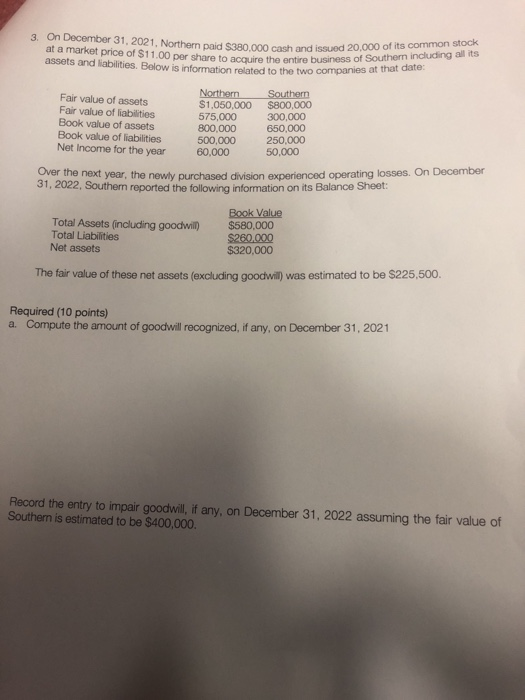

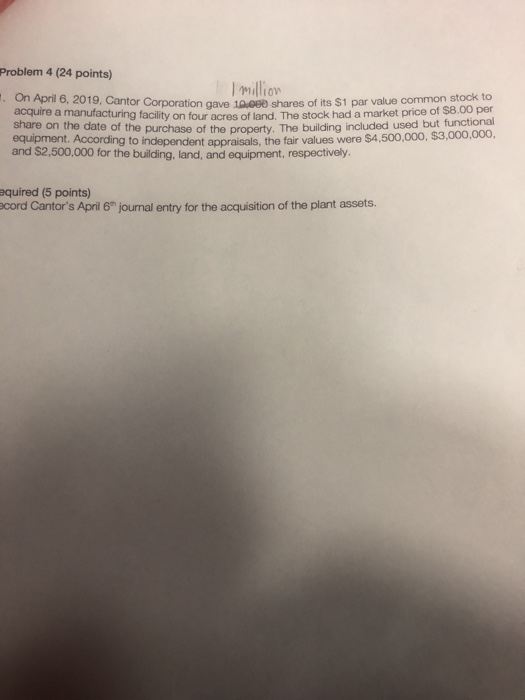

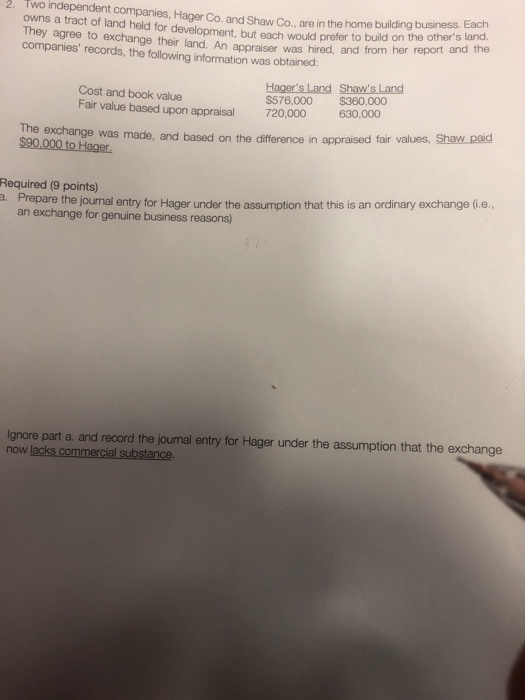

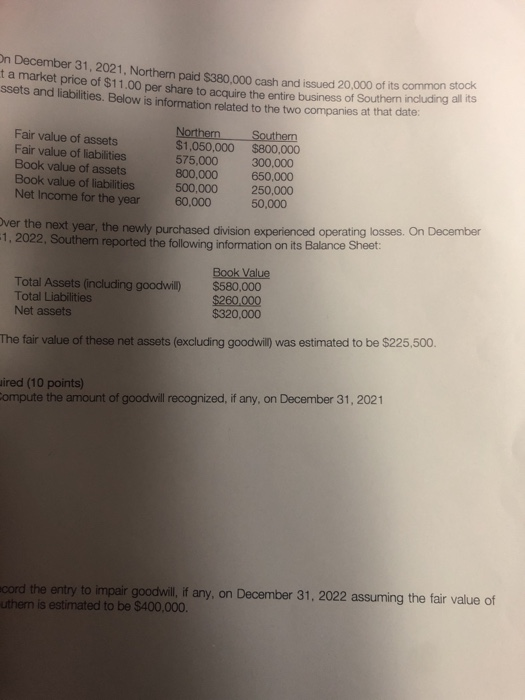

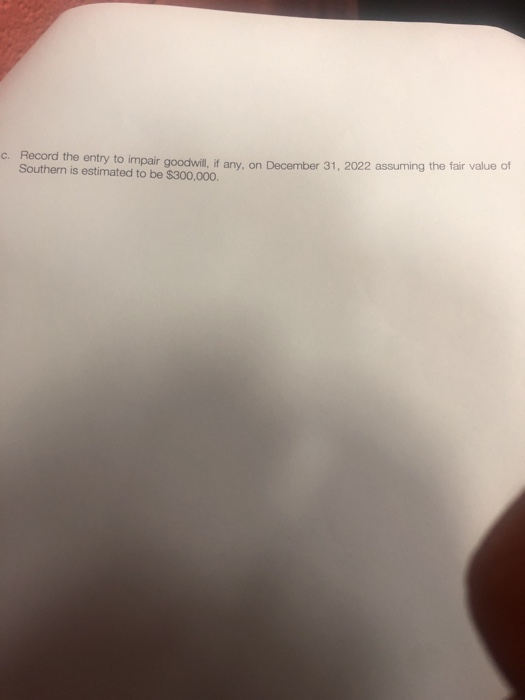

Problem 4 (24 points) On April 6, 2019, Cantor ga acquire a manufacturing facility on four acres of land share on the date of of the . The stock had a market price of $8.00 per tne purchase of the property. The building included used but functional independent appraisals, the fair values were $4,.500,000, $3,000,000, or Corporation gave-4ereee-shares of its $1 par value common stock to t. According to and $2,500,000 for the building, land, and equipment, respectively. ired (5 points) d Cantor's April 6h journal entry for the acquisition of the plant assets. 2. Two independent companies, Hager Co. and Shaw Co., are in the home building business. Each owns a tract of land held for development, but each would prefer to build on the other's land They agree to exchange their land. An appraiser was hired, and from her report and the companies' records, the following information was obtained $576,000 $360,000 720,000 Cost and book value Fair value based upon appraisal 630,000 The exchange was made, and based on the difference in appraised fair values, Shaw pai $90,000 to Hager. Required (9 points) a. Prepare the journal entry for Hager under the assumption that this is an ordinary exchange (. an exchange for genuine business reasons) Ignore part a. and record the journal entry for Hager under the assumption that the excha now lacks commercial substance 3. On December 31, 2021, Northern paid $380. 000 cash and issued 20,000 of its common stock of Southern including all its at a market price of $11.00 per share to acquire the entire business assets and liabilities. Below is information related to the two companies a that date Northerm Southern $1,050,000 $800,000 575,000 300,000 800,000 500,000 250,000 Fair value of assets Fair value of liabilities Book value of assets Book value of liabilities Net Income for the year 650,000 60,000 50,000 Over the next year, the newly purchased division experienced operating losses. On December 31, 2022, Southerm reported the following information on its Balance Sheet Total Assets (including goodwill) $580,000 Total Liabilities Net assets $320,000 The fair value of these net assets (excluding goodwill) was estimated to be $225.500. Required (10 points) a. Compute the amount of goodwill recognized, if any, on December 31, 2021 Record the entry to impair goodwill,if any, on December 31, 2022 assuming the fair value of Southern is estimated to be $400,000. o impair goodwill, if any, on December 31, 2022 assum ed to be $300,000 Problem 4 (24 points) miliow On Apri 6, 2019, Cantor Corporation gave 10.088 shares of its $1 par value common stock to acquire a manufacturing facility on four acres of land. The stock had a market price of 6.0u per share on the date of the property. The equipment. According to independent appraisals, the Ace purchase of the property. The building included used but functional fair values were $4,500,000, $3,000,000, and $2,500,000 for the building, land, and equipment, respectively equired (5 points) acord Cantor's April 6h journal entry for the acquisition of the plant assets. 2. Two independent companies, Hager Co. and Shaw Co., are in the home building business. Each opment, but each would prefer to build on the other's land. dld, An appraiser was hired, and from her report and the owns a tract of land held for devel They agree to exchange their land. companies' records, the following information was h was obtained Cost and book value Fair value based upon appraisal $576,000 $360,000 720,000 630.000 paid The exchange was made, and based on the difference in appraised fair values, Shaw $90,000 to Hager. Required (9 points) a. Prepare the journal entry for Hager under the assumption that this is an ordinary exchange (.e. an exchange for genuine business reasons) Ignore part a. and record the journal entry for Hager under the assumption that the exchange now lacks commercial substance n December 31, 2021, Northern paid $380.000 cash and issued 20,000 of its t a market price of $11.00 per share to acquire the entire business of ssets and liabilities. Below is information related to the two companies at issued 20,000 including all its that date: Northerm Southem $1,050,000 $800,000 575,000 300,000 800,000 650,000 500,000 250,000 Fair value of assets Fair value of liabilities Book value of assets Book value of liabilities Net Income for the year60,000 50,000 On December ver the next year, the newly purchased division experienced operating losses. 1,2022, Southern reported the following information on its Balance Sheet Total Assets (including goodwill) $580,000 Total Liabilities Net assets $260.000 $320,000 The fair value of these net assets (excluding goodwill) was estimated to be $225,500. ired (10 points) ompute the amount of goodwill recognized, if any, on December 31, 2021 cord the entry to impair goodwill,if any, on December 31, 2022 assuming the fair value of uthern is estimated to be $400,000. c. Record the entry to impai ir goodwill, if any, on December 31, 2022 assuming the fair value of Southern is estimated to be $300,000 Problem 4 (24 points) On April 6, 2019, Cantor ga acquire a manufacturing facility on four acres of land share on the date of of the . The stock had a market price of $8.00 per tne purchase of the property. The building included used but functional independent appraisals, the fair values were $4,.500,000, $3,000,000, or Corporation gave-4ereee-shares of its $1 par value common stock to t. According to and $2,500,000 for the building, land, and equipment, respectively. ired (5 points) d Cantor's April 6h journal entry for the acquisition of the plant assets. 2. Two independent companies, Hager Co. and Shaw Co., are in the home building business. Each owns a tract of land held for development, but each would prefer to build on the other's land They agree to exchange their land. An appraiser was hired, and from her report and the companies' records, the following information was obtained $576,000 $360,000 720,000 Cost and book value Fair value based upon appraisal 630,000 The exchange was made, and based on the difference in appraised fair values, Shaw pai $90,000 to Hager. Required (9 points) a. Prepare the journal entry for Hager under the assumption that this is an ordinary exchange (. an exchange for genuine business reasons) Ignore part a. and record the journal entry for Hager under the assumption that the excha now lacks commercial substance 3. On December 31, 2021, Northern paid $380. 000 cash and issued 20,000 of its common stock of Southern including all its at a market price of $11.00 per share to acquire the entire business assets and liabilities. Below is information related to the two companies a that date Northerm Southern $1,050,000 $800,000 575,000 300,000 800,000 500,000 250,000 Fair value of assets Fair value of liabilities Book value of assets Book value of liabilities Net Income for the year 650,000 60,000 50,000 Over the next year, the newly purchased division experienced operating losses. On December 31, 2022, Southerm reported the following information on its Balance Sheet Total Assets (including goodwill) $580,000 Total Liabilities Net assets $320,000 The fair value of these net assets (excluding goodwill) was estimated to be $225.500. Required (10 points) a. Compute the amount of goodwill recognized, if any, on December 31, 2021 Record the entry to impair goodwill,if any, on December 31, 2022 assuming the fair value of Southern is estimated to be $400,000. o impair goodwill, if any, on December 31, 2022 assum ed to be $300,000 Problem 4 (24 points) miliow On Apri 6, 2019, Cantor Corporation gave 10.088 shares of its $1 par value common stock to acquire a manufacturing facility on four acres of land. The stock had a market price of 6.0u per share on the date of the property. The equipment. According to independent appraisals, the Ace purchase of the property. The building included used but functional fair values were $4,500,000, $3,000,000, and $2,500,000 for the building, land, and equipment, respectively equired (5 points) acord Cantor's April 6h journal entry for the acquisition of the plant assets. 2. Two independent companies, Hager Co. and Shaw Co., are in the home building business. Each opment, but each would prefer to build on the other's land. dld, An appraiser was hired, and from her report and the owns a tract of land held for devel They agree to exchange their land. companies' records, the following information was h was obtained Cost and book value Fair value based upon appraisal $576,000 $360,000 720,000 630.000 paid The exchange was made, and based on the difference in appraised fair values, Shaw $90,000 to Hager. Required (9 points) a. Prepare the journal entry for Hager under the assumption that this is an ordinary exchange (.e. an exchange for genuine business reasons) Ignore part a. and record the journal entry for Hager under the assumption that the exchange now lacks commercial substance n December 31, 2021, Northern paid $380.000 cash and issued 20,000 of its t a market price of $11.00 per share to acquire the entire business of ssets and liabilities. Below is information related to the two companies at issued 20,000 including all its that date: Northerm Southem $1,050,000 $800,000 575,000 300,000 800,000 650,000 500,000 250,000 Fair value of assets Fair value of liabilities Book value of assets Book value of liabilities Net Income for the year60,000 50,000 On December ver the next year, the newly purchased division experienced operating losses. 1,2022, Southern reported the following information on its Balance Sheet Total Assets (including goodwill) $580,000 Total Liabilities Net assets $260.000 $320,000 The fair value of these net assets (excluding goodwill) was estimated to be $225,500. ired (10 points) ompute the amount of goodwill recognized, if any, on December 31, 2021 cord the entry to impair goodwill,if any, on December 31, 2022 assuming the fair value of uthern is estimated to be $400,000. c. Record the entry to impai ir goodwill, if any, on December 31, 2022 assuming the fair value of Southern is estimated to be $300,000