Answered step by step

Verified Expert Solution

Question

1 Approved Answer

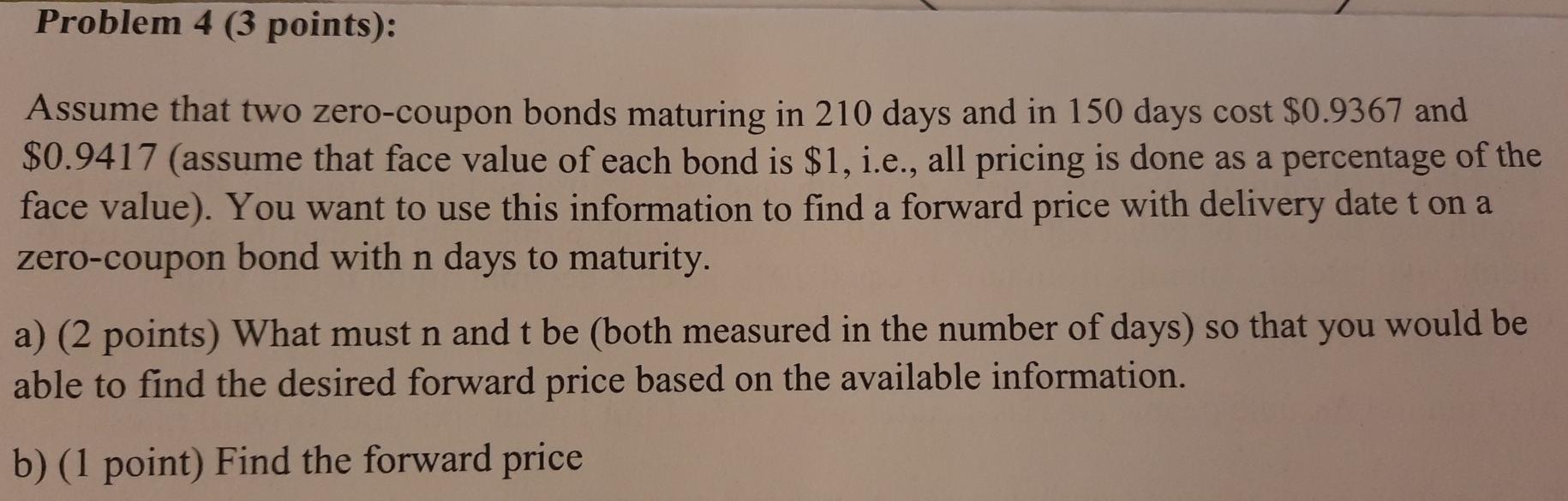

Problem 4 (3 points): Assume that two zero-coupon bonds maturing in 210 days and in 150 days cost $0.9367 and $0.9417 (assume that face value

Problem 4 (3 points): Assume that two zero-coupon bonds maturing in 210 days and in 150 days cost $0.9367 and $0.9417 (assume that face value of each bond is $1, i.e., all pricing is done as a percentage of the face value). You want to use this information to find a forward price with delivery date t on a zero-coupon bond with n days to maturity. a) (2 points) What must n and t be (both measured in the number of days) so that you would be able to find the desired forward price based on the available information. b) (1 point) Find the forward price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started