Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4 (5 pts) Scenario: The following model was built by a banking firm to predict whether a customer is risky to receive a loan

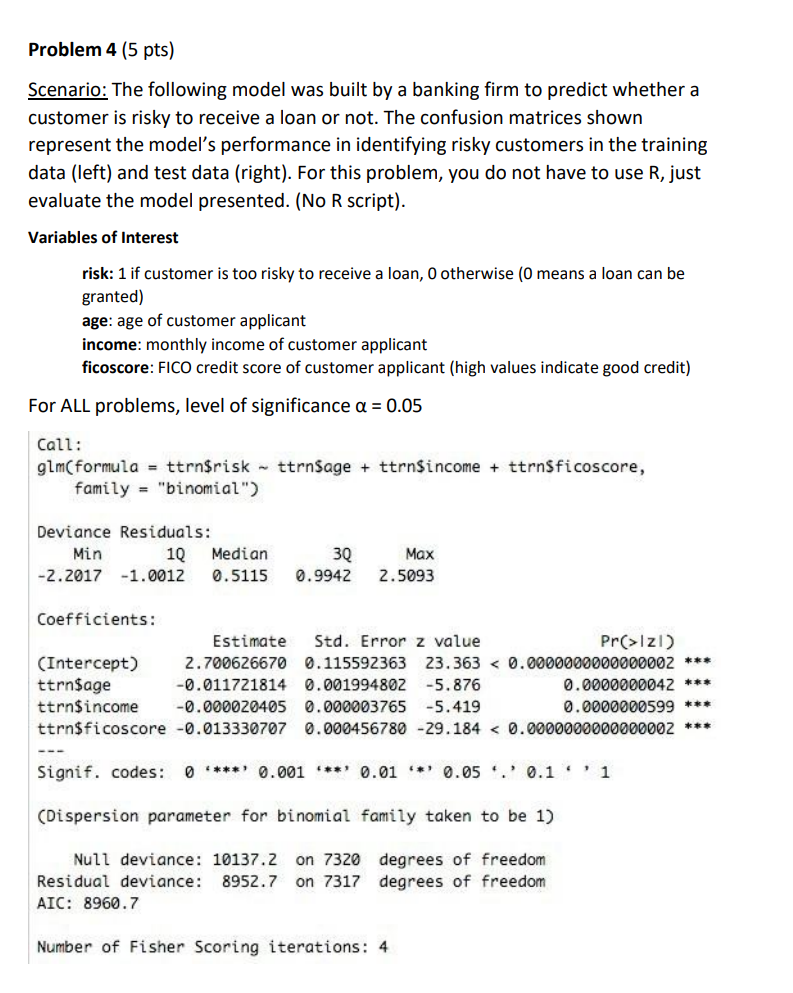

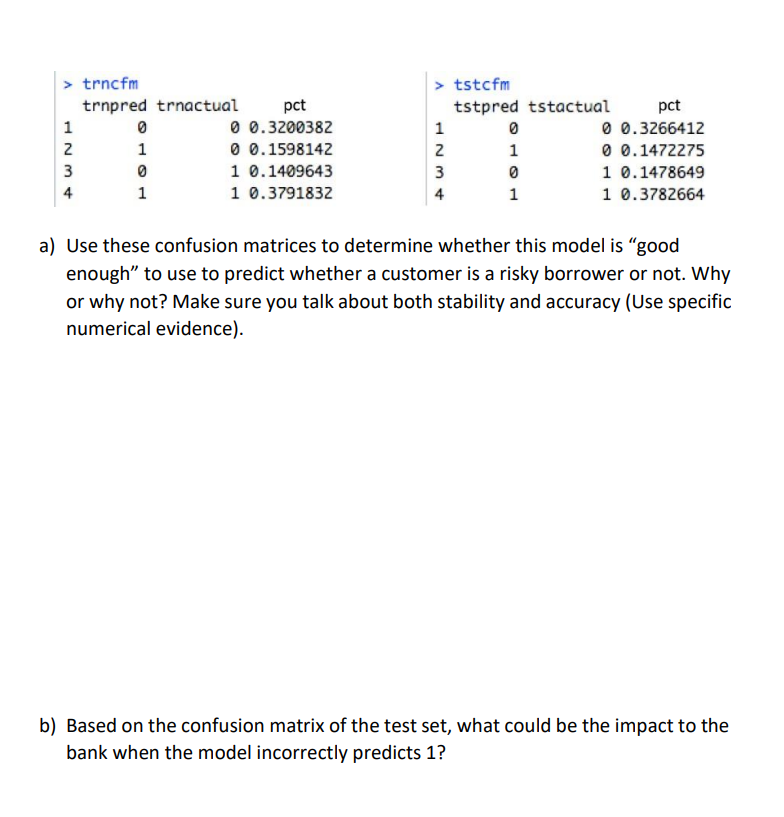

Problem 4 (5 pts) Scenario: The following model was built by a banking firm to predict whether a customer is risky to receive a loan or not. The confusion matrices shown represent the model's performance in identifying risky customers in the training data (left) and test data (right). For this problem, you do not have to use R, just evaluate the model presented. (No R script). Variables of Interest risk: 1 if customer is too risky to receive a loan, 0 otherwise ( 0 means a loan can be granted) age: age of customer applicant income: monthly income of customer applicant ficoscore: FICO credit score of customer applicant (high values indicate good credit) For ALL problems, level of significance =0.05 Call: glm(formula = ttrn\$risk ttrn\$age + ttrn\$income + ttrn\$ficoscore, family = "binomial") Deviance Residuals: Coefficients: \begin{tabular}{lrrrr} & Estimate & Std. Error z value & Pr(>z) \\ (Intercept) & 2.700626670 & 0.115592363 & 23.363

Problem 4 (5 pts) Scenario: The following model was built by a banking firm to predict whether a customer is risky to receive a loan or not. The confusion matrices shown represent the model's performance in identifying risky customers in the training data (left) and test data (right). For this problem, you do not have to use R, just evaluate the model presented. (No R script). Variables of Interest risk: 1 if customer is too risky to receive a loan, 0 otherwise ( 0 means a loan can be granted) age: age of customer applicant income: monthly income of customer applicant ficoscore: FICO credit score of customer applicant (high values indicate good credit) For ALL problems, level of significance =0.05 Call: glm(formula = ttrn\$risk ttrn\$age + ttrn\$income + ttrn\$ficoscore, family = "binomial") Deviance Residuals: Coefficients: \begin{tabular}{lrrrr} & Estimate & Std. Error z value & Pr(>z) \\ (Intercept) & 2.700626670 & 0.115592363 & 23.363 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started