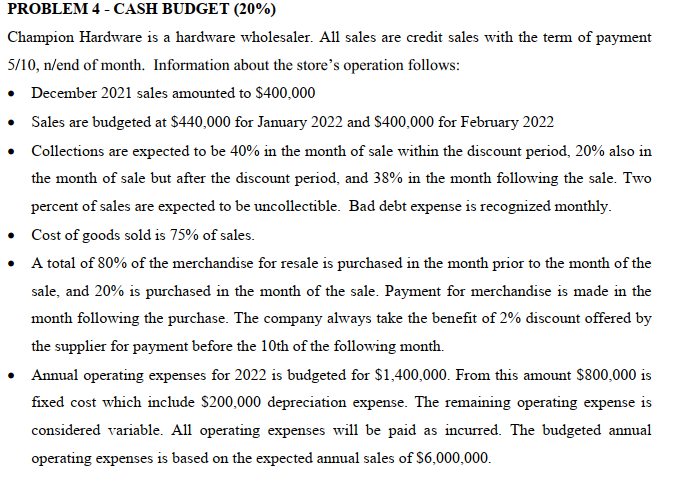

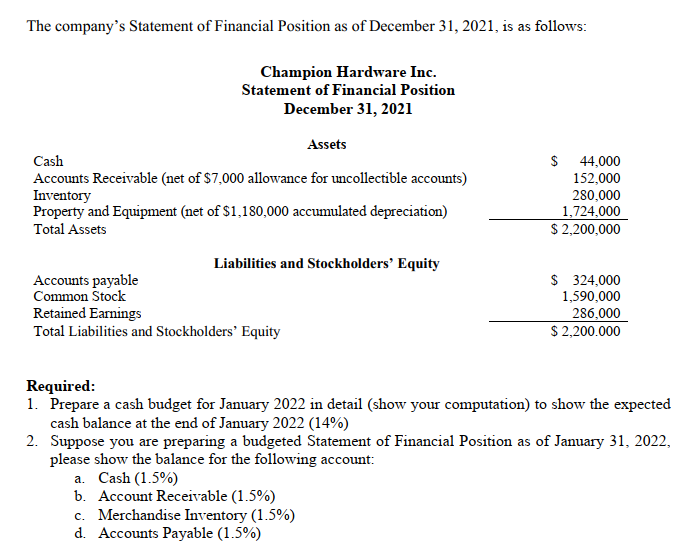

PROBLEM 4 - CASH BUDGET (20%) Champion Hardware is a hardware wholesaler. All sales are credit sales with the term of payment 5/10, n/end of month. Information about the store's operation follows: December 2021 sales amounted to $400,000 Sales are budgeted at $440,000 for January 2022 and $400,000 for February 2022 Collections are expected to be 40% in the month of sale within the discount period, 20% also in the month of sale but after the discount period, and 38% in the month following the sale. Two percent of sales are expected to be uncollectible. Bad debt expense is recognized monthly. Cost of goods sold is 75% of sales. A total of 80% of the merchandise for resale is purchased in the month prior to the month of the sale, and 20% is purchased in the month of the sale. Payment for merchandise is made in the month following the purchase. The company always take the benefit of 2% discount offered by the supplier for payment before the 10th of the following month. Annual operating expenses for 2022 is budgeted for $1,400,000. From this amount $800,000 is fixed cost which include $200,000 depreciation expense. The remaining operating expense is considered variable. All operating expenses will be paid as incurred. The budgeted annual operating expenses is based on the expected annual sales of $6,000,000. The company's Statement of Financial Position as of December 31, 2021, is as follows: Champion Hardware Inc. Statement of Financial Position December 31, 2021 Assets Cash Accounts Receivable (net of $7,000 allowance for uncollectible accounts) Inventory Property and Equipment (net of $1,180,000 accumulated depreciation) Total Assets $ 44,000 152,000 280,000 1,724,000 $ 2,200,000 Liabilities and Stockholders' Equity Accounts payable Common Stock Retained Earnings Total Liabilities and Stockholders' Equity $ 324,000 1,590,000 286,000 $ 2,200.000 Required: 1. Prepare a cash budget for January 2022 in detail (show your computation) to show the expected cash balance at the end of January 2022 (14%) 2. Suppose you are preparing a budgeted Statement of Financial Position as of January 31, 2022, please show the balance for the following account: a. Cash (1.5%) b. Account Receivable (1.5%) c. Merchandise Inventory (1.5%) d. Accounts Payable (1.5%)