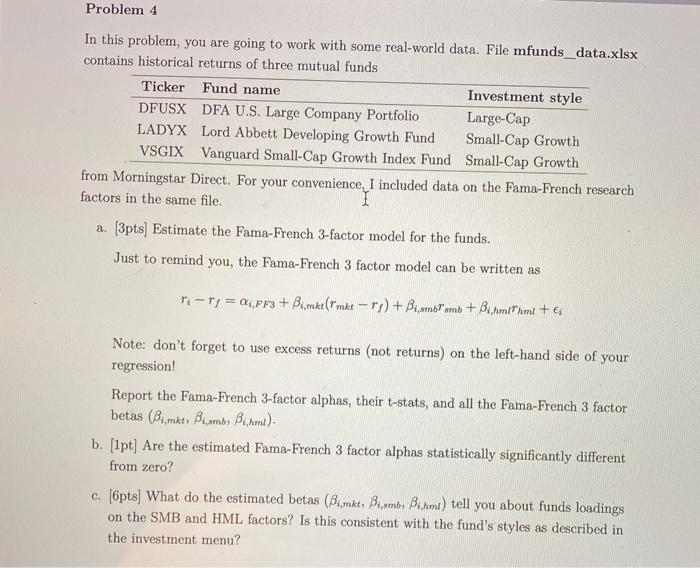

Problem 4 In this problem, you are going to work with some real-world data. File mfunds_data.xlsx contains historical returns of three mutual funds Ticker Fund name Investment style DFUSX DFA U.S. Large Company Portfolio Large-Cap LADYX Lord Abbett Developing Growth Fund Small-Cap Growth VSGIX Vanguard Small-Cap Growth Index Fund Small-Cap Growth from Morningstar Direct. For your convenience. I included data on the Fama-French research factors in the same file. a. [3pts] Estimate the Fama-French 3-factor model for the funds. Just to remind you, the Fama-French 3 factor model can be written as ri-ry=01,FF3 + Bi mkt (rmkt - ry) + Bimbamo + Buhmhmt te Note: don't forget to use excess returns (not returns) on the left-hand side of your regression! Report the Fama-French 3-factor alphas, their t-stats, and all the Fama-French 3 factor betas (Bi mikt, Bemba Bu,hml). b. [1pt) Are the estimated Fama-French 3 factor alphas statistically significantly different from zero? c. [6pts) What do the estimated betas (Bimkt, Bambi Binm) tell you about funds loadings on the SMB and HML factors? Is this consistent with the fund's styles as described in the investment menu? Problem 4 In this problem, you are going to work with some real-world data. File mfunds_data.xlsx contains historical returns of three mutual funds Ticker Fund name Investment style DFUSX DFA U.S. Large Company Portfolio Large-Cap LADYX Lord Abbett Developing Growth Fund Small-Cap Growth VSGIX Vanguard Small-Cap Growth Index Fund Small-Cap Growth from Morningstar Direct. For your convenience. I included data on the Fama-French research factors in the same file. a. [3pts] Estimate the Fama-French 3-factor model for the funds. Just to remind you, the Fama-French 3 factor model can be written as ri-ry=01,FF3 + Bi mkt (rmkt - ry) + Bimbamo + Buhmhmt te Note: don't forget to use excess returns (not returns) on the left-hand side of your regression! Report the Fama-French 3-factor alphas, their t-stats, and all the Fama-French 3 factor betas (Bi mikt, Bemba Bu,hml). b. [1pt) Are the estimated Fama-French 3 factor alphas statistically significantly different from zero? c. [6pts) What do the estimated betas (Bimkt, Bambi Binm) tell you about funds loadings on the SMB and HML factors? Is this consistent with the fund's styles as described in the investment menu