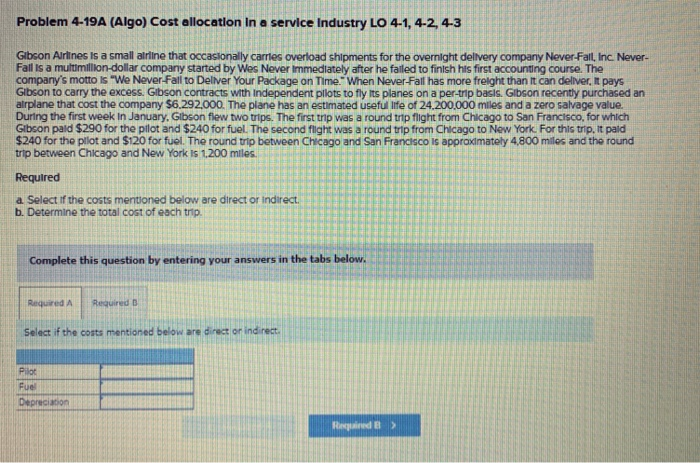

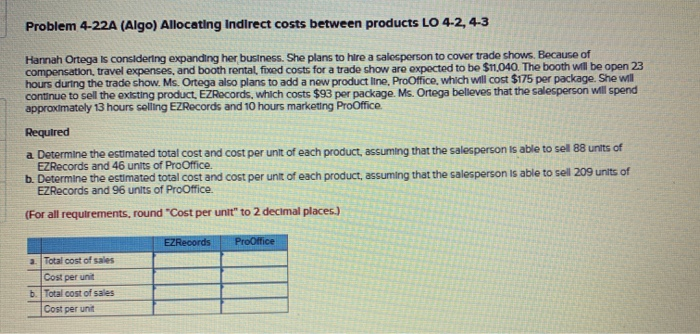

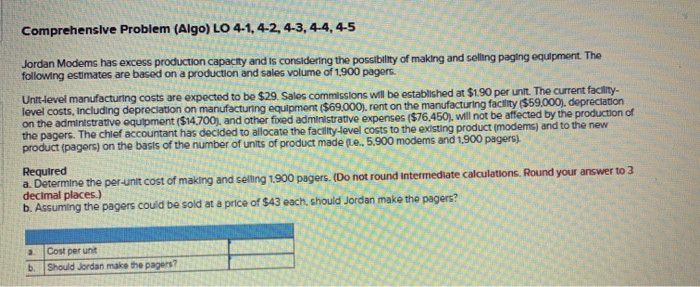

Problem 4-19A (Algo) Cost allocation in a service Industry LO 4-1, 4-2, 4-3 Gibson Alrlines Is a small alrline that oCcasionally carrles overload shipments for the overnlght delivery company Never-Fall, Inc. Never. Fall Is a multimillion-dollar company started by Wes Never Immediately after he failed to finlsh his first accounting course. The company's motto is "We Never-Fall to Deliver Your Package on Time. When Never-Fall has more freight than it can dellver, It pays Gibson to carry the excess. Gibson contracts with Independent plots to fly Its planes on a per-trip basls. Gibson recently purchased an alrplane that cost the company $6.292,000. The plane has an estimated useful life of 24.200,000 miles and a zero salvage value. During the first week In January, Gibson flew two trips. The first trip was a round trip flight from Chicago to San Francisco, for which Gibson pald $290 for the pilot and $240 for fuel. The second flight was a round trip from Chicago to New York. For this trip, it paid $240 for the pllot and $120 for fuel. The round trip between Chicago and San Francisco is appraximately 4,800 miles and the round trip between Chicago and New York is 1,200 miles Required a Select if the costs mentioned below are direct or indirect. b. Determine the total cost of each trip. Complete this question by entering your answers in the tabs below. Required B Required A Select if the costs mentioned below are direct or indirect. Pilot Fuel Depreciation Reqained Problem 4-22A (Algo) Allocating Indirect costs between products LO 4-2, 4-3 Hannah Ortega is considertng expanding her business. She plans to hire a salesperson to cover trade shows. Because of compensation, travel expenses, and booth rental, fixed costs for a trade show are expected to be $11,040. The booth will be open 23 hours during the trade show. Ms. Ortega also plans to add a new product line, ProOffice, which will cost $175 per package. She will continue to sell the existing product, EZRecords, which costs $93 per package. Ms. Ortega belleves that the salesperson will spend approximatoly 13 hours selling EZRecords and 10 hours marketing ProOffice Required a Determine the estimated total cost and cost per unt of each product, assuming that the sales person is able to sell 88 unts of EZRecords and 46 unts of ProOffice. b. Determine the estimated total cost and cost per unit of each product, assuming that the salesperson is able to sell 209 units of EZRecords and 96 units of ProOffice (For all requirements, round "Cost per unit" to 2 decimal places) ProOffice EZRecords Total cost of sales a Cost per unit b. Total cost of sales Cost per unit Comprehenslve Problem (Algo) LO 4-1,4-2, 4-3, 4-4, 4-5 Jordan Modems has excess production capacty and Is considertng the possibility of making and selling paging equipment. The following estimates are based on a production and sales volume of 1,900 pagers Unit-level manufacturing costs are expected to be $29. Sales commissions will be established at $1.90 per unit. The current facility- level costs, Including depreciation on manufacturing equipment ($69000), rent on the manufacturing factity ($59.000), depreciation on the administrative equipment ($14,700), and other fixed administrative expenses ($76,450), wll not be affected by the production of the pagers. The chief accountant has declded to allocate the facility-level costs to the existing product (modems) and to the new product (pagors) on the basis of the number of units of product made (L., 5.900 modems and 1,900 pagers) Required a. Determine the per-unit cost of making and selling 1.900 pagers. (Do not round intermediate calculations. Round your answer to 3 decimal places) b. Assuming the pagers could be sold at a price of $43 each, should Jordan make the pagers? Cost per unit a. b. Should Jordan make the pagers