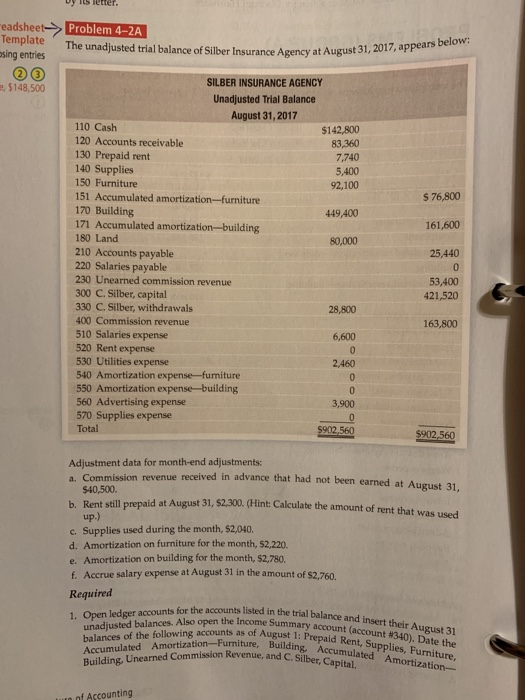

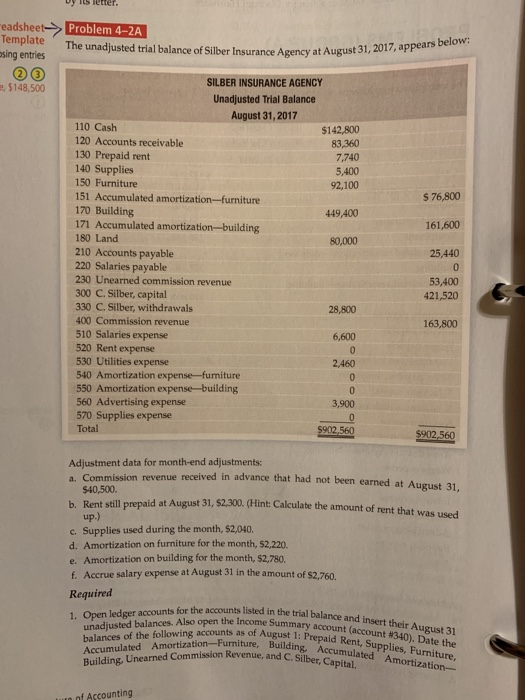

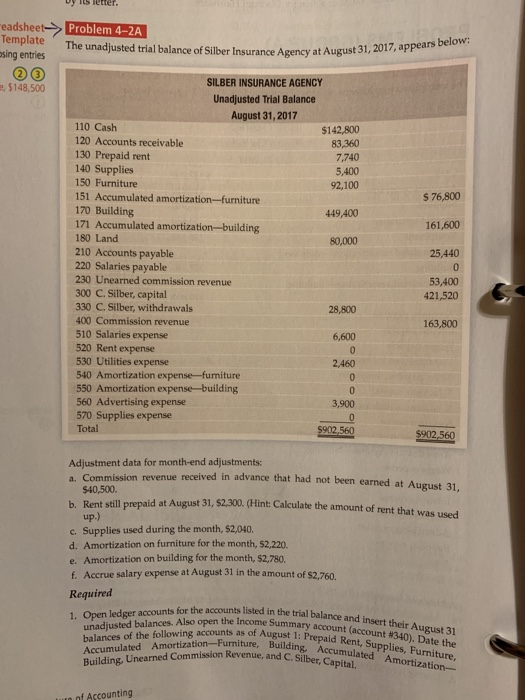

Problem 4-2A

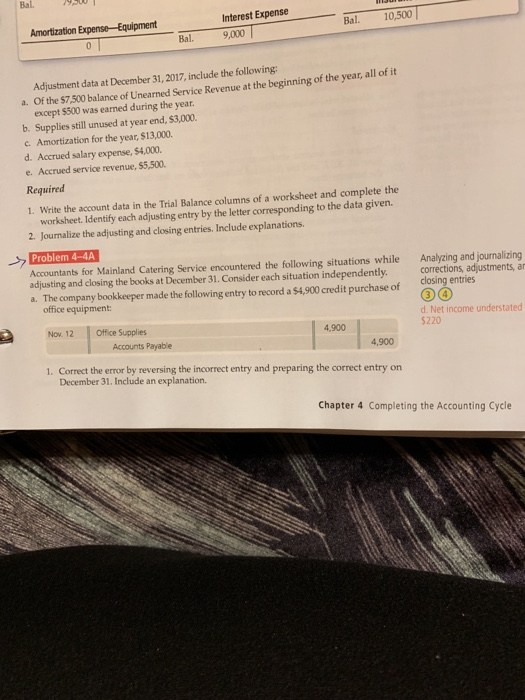

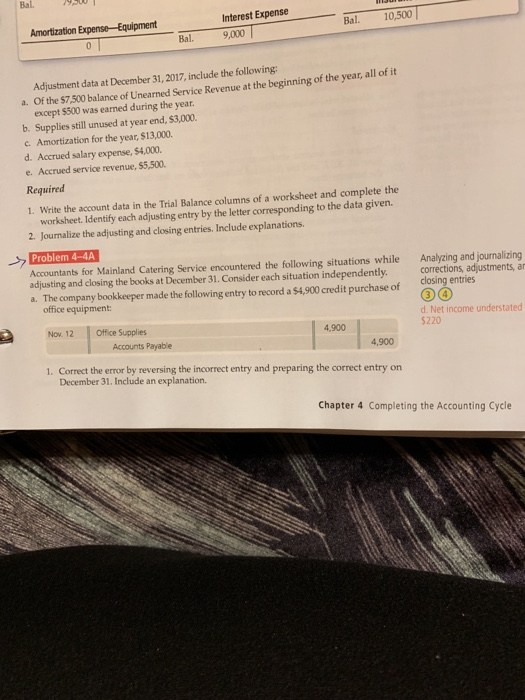

y itsetter eadsheet->> Problem 4-2A Template The unadjusted trial balance of Silber Insurance Agency at Augus sing entries SILBER INSURANCE AGENCY Unadjusted Trial Balance August 31, 2017 e, $148,500 110 Cash 120 Accounts receivable 130 Prepaid rent 140 Supplies 150 Furniture 151 Accumulated amortization-furniture 170 Building 171 Accumulated amortization-building 180 Land 210 Accounts payable 220 Salaries payable 230 Unearned commission revenue 300 C. Silber, capital 330 C. Silber, withdrawals 400 Commission revenue 510 Salaries expense 520 Rent expense 530 Utilities expense 540 Amortization expense-furniture 550 Amortization expense-building 560 Advertising expense 570 Supplies expense Total $142,800 83,360 7.740 5,400 92,100 76,800 161,600 25,440 53,400 449,400 80,000 421,520 28,800 6,600 2,460 163,800 3,900 $902,560 Adjustment data for month-end adjustments: a. Commission revenue received in advance that had not been earned at August 31, id at August 31, 52.300. (Hint: Calculate the amount of rent that was used $40,500. b. Rent still prepai up.) c. Supplies used during the month, $2,040. d. Amortization on furniture for the month, $2,220. e. Amortization on building for the month, $2,780. f. Accrue salary expense at August 31 in the amount of S2,760, Required eaccounts listed in the trial balance and insert their August 31 Open ledger accounts for the the trial unadjusted balances. Also open Su balances of the following accounts as of August 1: the Incomhe Summary account (account #340). Date the Prepaid Rent, Supplies, Furniture, Amortization- tion-Furniture, Building. Accumulated A C. Silber, Capital. Building, Unearned Commission Revenue, and c sui nf Accounting Bal. Interest Expense 0Bal. 9,000 Adjustment data at December 31, 2017, include the following a. Of the $7,500 balance of Unearned Service Revenue at the beginning of the year, all of it except $500 was earned during the year b. Supplies still unused at year end, $3,000. c. Amortization for the year, $13,000 d. Accrued salary expense, $4,000. e. Accrued service revenue, $5,500. Required 1. Write the account data in the Trial Balance columns of a worksheet and complete the worksheet. Identify each adjusting entry by the letter corresponding to the data given. 2. Journalize the adjusting and closing entries. Include explanations. Problem 4-4A Accountants for Mainland Catering Service encountered the following situations while Analyzing and journalizing adjusting and closing the books at December 31. Consider each situation independently. corrections, adjustments, ar a. The company bookkeeper made the following entry to record a $4,900 credit purchase of closing entries office equipment d. Net income understated $220 Nov. 12 Office Supplies 4,900 Accounts Payable 4,900 1. Correct the error by reversing the incorrect entry and preparing the correct entry on December 31. Include an explanation. Chapter 4 Completing the Accounting Cycle