Question

Problem 4-5A (Part Level Submission) Anya Clark opened Anyas Cleaning Service on July 1, 2017. During July, the following transactions were completed. July 1 Anya

Problem 4-5A (Part Level Submission)

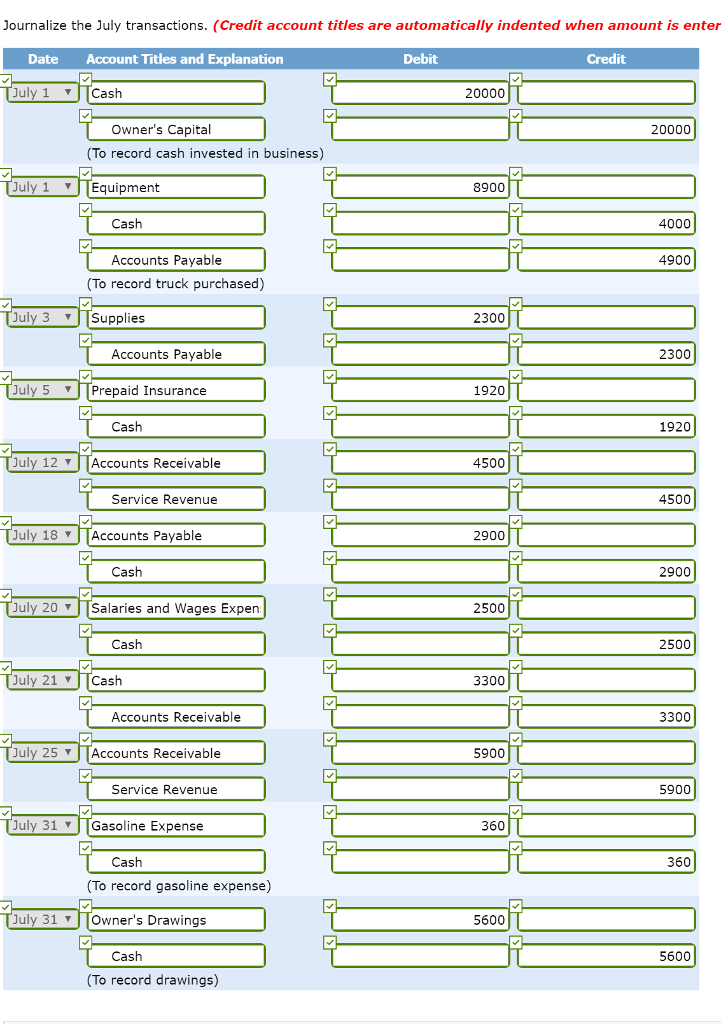

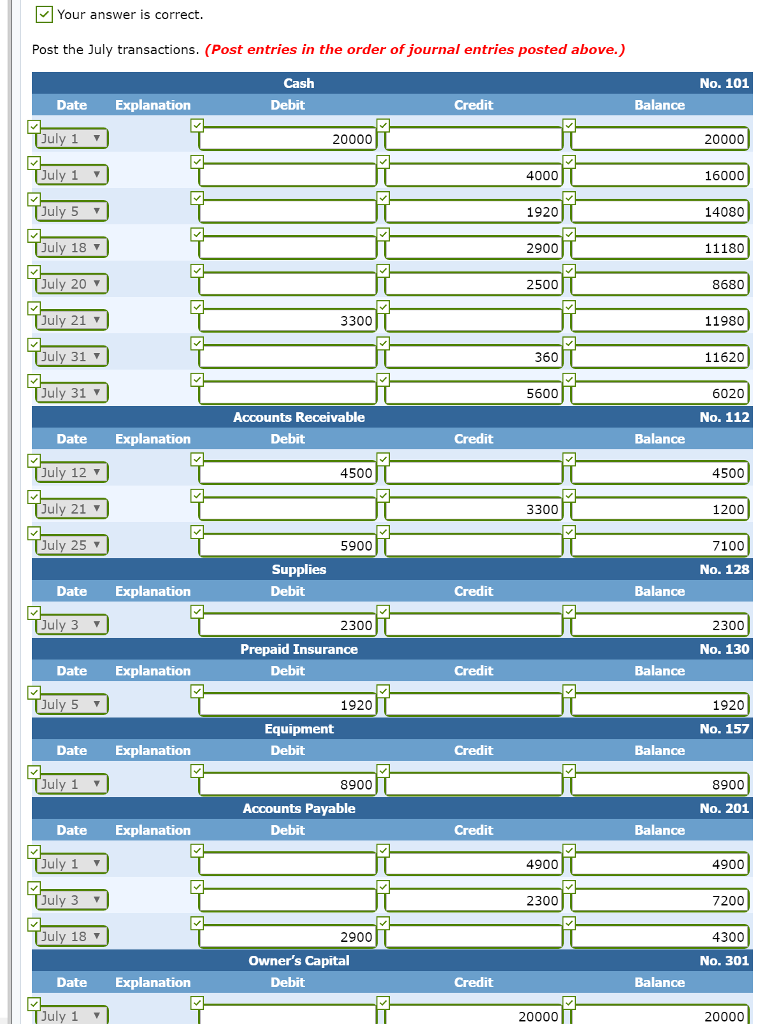

Anya Clark opened Anyas Cleaning Service on July 1, 2017. During July, the following transactions were completed.

| July 1 | Anya invested $20,000 cash in the business. | ||||||||||||||||

| 1 | Purchased used truck for $8,900, paying $4,000 cash and the balance on account. | ||||||||||||||||

| 3 | Purchased cleaning supplies for $2,300 on account. | ||||||||||||||||

| 5 | Paid $1,920 cash on 1-year insurance policy effective July 1. | ||||||||||||||||

| 12 | Billed customers $4,500 for cleaning services. | ||||||||||||||||

| 18 | Paid $1,500 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. | ||||||||||||||||

| 20 | Paid $2,500 cash for employee salaries. | ||||||||||||||||

| 21 | Collected $3,300 cash from customers billed on July 12. | ||||||||||||||||

| 25 | Billed customers $5,900 for cleaning services. | ||||||||||||||||

| 31 | Paid $360 for the monthly gasoline bill for the truck. | ||||||||||||||||

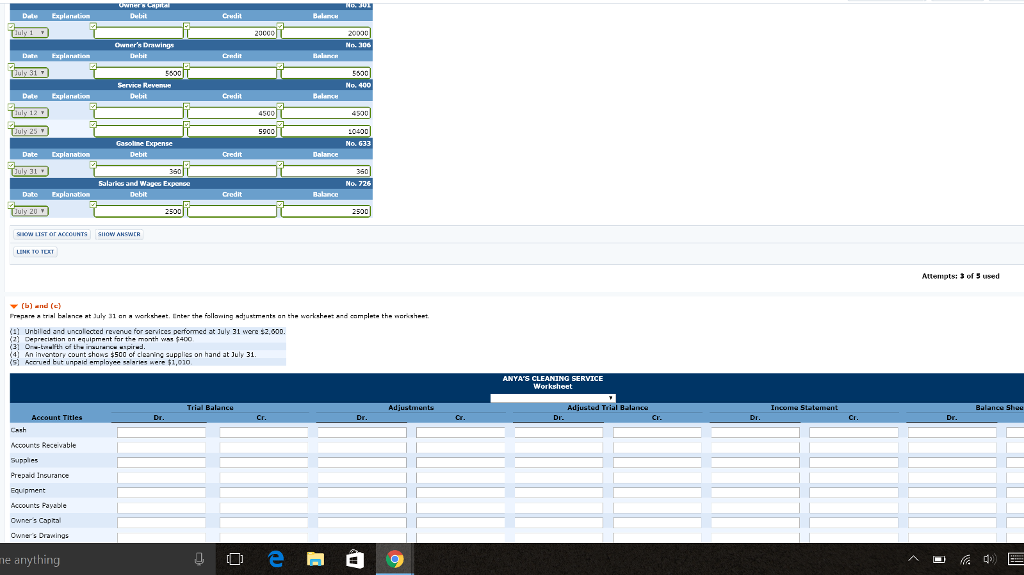

| 31 Withdrew $5,600 cash for personal use. #1 Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet.

2. Prepare an income statement for JULY 3. Prepare the owner's equilty statement for JULY I would prefer the setup being in a worksheet like format but your method is welcome! Thanks for the help! I have some images of what I've done as well so far |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started