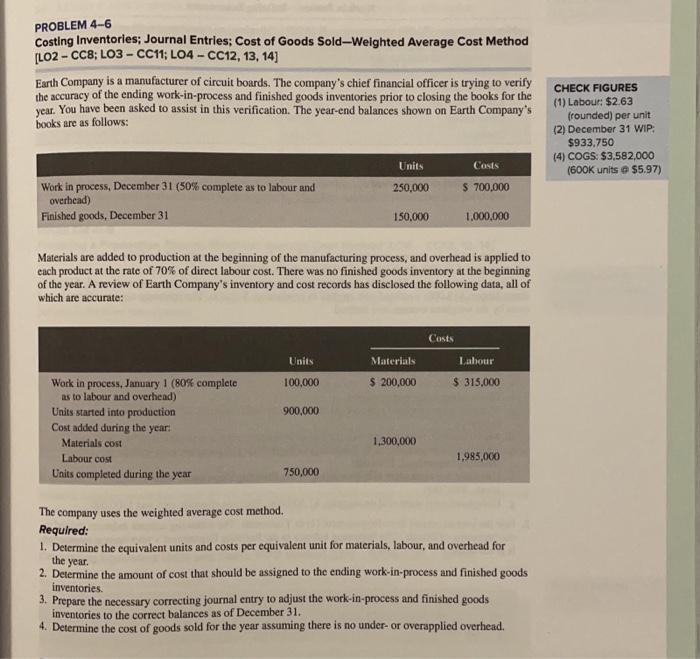

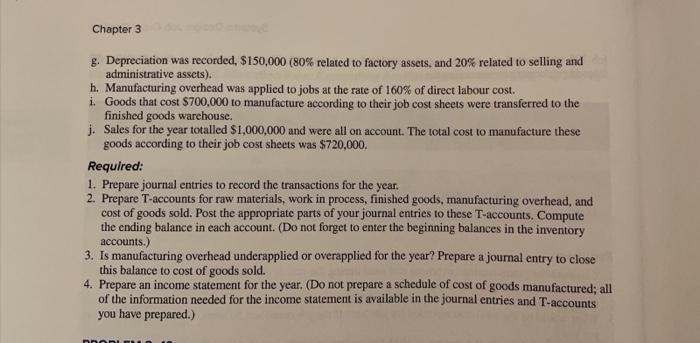

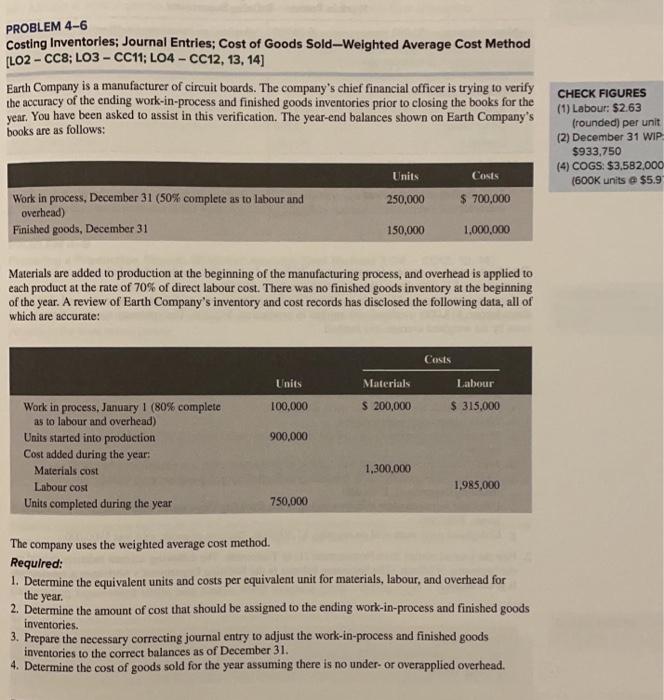

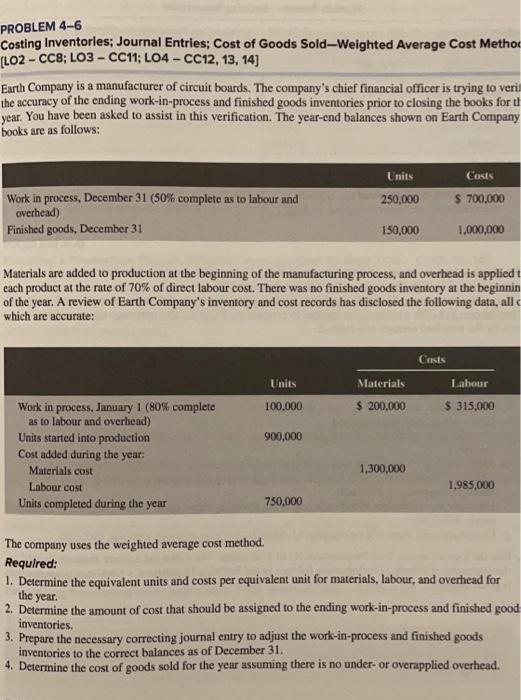

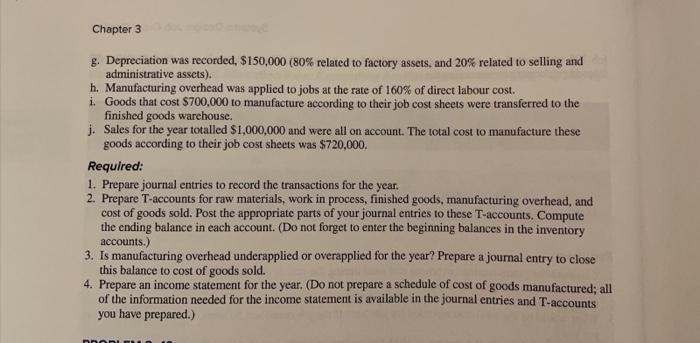

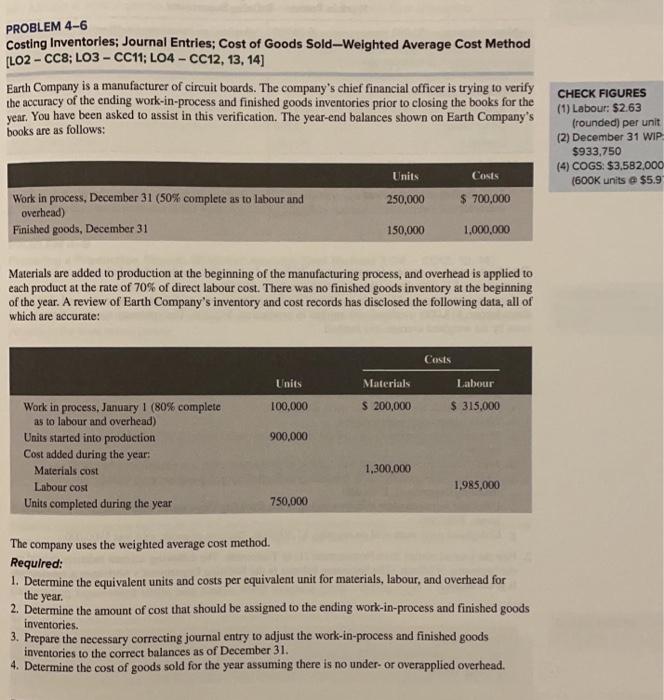

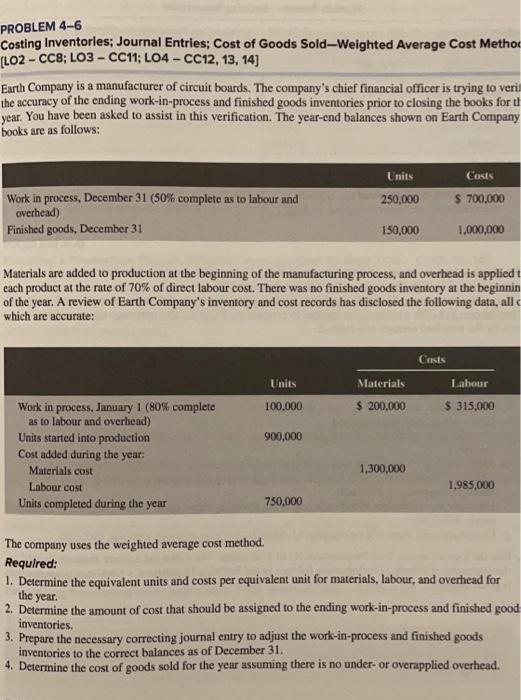

PROBLEM 4-6 Costing Inventorles; Journal Entries; Cost of Goods Sold-Weighted Average Cost Method [LO2 - CC8; L03 - CC11; L04 - CC12, 13, 14) Earth Company is a manufacturer of circuit boards. The company's chief financial officer is trying to verify the accuracy of the ending work-in-process and finished goods inventories prior to closing the books for the year. You have been asked to assist in this verification. The year-end balances shown on Earth Company's books are as follows: CHECK FIGURES (1) Labour: $2.63 frounded) per unit (2) December 31 WIP $933.750 (4) COGS: $3,582,000 (600K units $5.97) Units Costs 250,000 $ 700,000 Work in process, December 31 (50% complete as to labour and overhead) Finished goods, December 31 150.000 1,000,000 Materials are added to production at the beginning of the manufacturing process, and overhead is applied to each product at the rate of 70% of direct labour cost. There was no finished goods inventory at the beginning of the year. A review of Earth Company's inventory and cost records has disclosed the following data, all of which are accurate: Costs Units Materials Labour 100,000 $ 200,000 $ 315,000 900,000 Work in process, January 1 (80% complete as to labour and overhead) Units started into production Cost added during the year: Materials cost Labour cost Units completed during the year 1,300,000 1.985,000 750,000 the year. The company uses the weighted average cost method. Required: 1. Determine the equivalent units and costs per equivalent unit for materials, labour, and overhead for 2. Determine the amount of cost that should be assigned to the ending work-in-process and finished goods inventories 3. Prepare the necessary correcting journal entry to adjust the work-in-process and finished goods inventories to the correct balances as of December 31. 4. Determine the cost of goods sold for the year assuming there is no under-or overapplied overhead. Chapter 3 g. Depreciation was recorded, $150,000 (80% related to factory assets, and 20% related to selling and administrative assets). h. Manufacturing overhead was applied to jobs at the rate of 160% of direct labour cost. i. Goods that cost $700,000 to manufacture according to their job cost sheets were transferred to the finished goods warehouse. j. Sales for the year totalled $1,000,000 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $720,000. Required: 1. Prepare journal entries to record the transactions for the year. 2. Prepare T-accounts for raw materials, work in process, finished goods, manufacturing overhead, and cost of goods sold. Post the appropriate parts of your journal entries to these T-accounts. Compute the ending balance in each account. (Do not forget to enter the beginning balances in the inventory accounts.) 3. Is manufacturing overhead underapplied or overapplied for the year? Prepare a journal entry to close this balance to cost of goods sold. 4. Prepare an income statement for the year. (Do not prepare a schedule of cost of goods manufactured; all of the information needed for the income statement is available in the journal entries and T-accounts you have prepared.) BAB PROBLEM 4-6 Costing Inventories; Journal Entries; Cost of Goods Sold-Weighted Average Cost Method [LO2 - CC8; L03 - CC11; L04 - CC12, 13, 14] Earth Company is a manufacturer of circuit boards. The company's chief financial officer is trying to verify the accuracy of the ending work-in-process and finished goods inventories prior to closing the books for the year. You have been asked to assist in this verification. The year-end balances shown on Earth Company's books are as follows: CHECK FIGURES (1) Labour: $2.63 (rounded) per unit (2) December 31 WIP $933.750 (4) COGS: $3,582,000 (600K units @ $5.9 Units Costs 250,000 $ 700,000 Work in process, December 31 (50% complete as to labour and overhead) Finished goods, December 31 150,000 1.000.000 Materials are added to production at the beginning of the manufacturing process, and overhead is applied to each product at the rate of 70% of direct labour cost. There was no finished goods inventory at the beginning of the year. A review of Earth Company's inventory and cost records has disclosed the following data, all of which are accurate: Costs Units Materials Labour 100,000 $ 200,000 $ 315.000 900,000 Work in process, January 1 (80% complete as to labour and overhead) Units started into production Cost added during the year: Materials cost Labour cost Units completed during the year 1,300,000 1,985,000 750,000 the year. The company uses the weighted average cost method. Required: 1. Determine the equivalent units and costs per equivalent unit for materials, labour, and overhead for 2. Determine the amount of cost that should be assigned to the ending work-in-process and finished goods inventories. 3. Prepare the necessary correcting journal entry to adjust the work-in-process and finished goods inventories to the correct balances as of December 31. 4. Determine the cost of goods sold for the year assuming there is no under or overapplied overhead. PROBLEM 4-6 Costing Inventories; Journal Entries; Cost of Goods SoldWeighted Average Cost Method (LO2-CC8; L03 - CC11; L04 - CC12, 13, 14) Earth Company is a manufacturer of circuit boards. The company's chief financial officer is trying to veri the accuracy of the ending work-in-process and finished goods inventories prior to closing the books for th year . You have been asked to assist in this verification. The year-end balances shown on Earth Company books are as follows: Costs Units 250,000 $ 700.000 Work in process, December 31 (50% complete as to labour and overhead) Finished goods, December 31 150.000 1,000,000 Materials are added to production at the beginning of the manufacturing process, and overhead is applied t each product at the rate of 70% of direct labour cost. There was no finished goods inventory at the beginnin of the year. A review of Earth Company's inventory and cost records has disclosed the following data, all which are accurate: Costs Units Materials Labour 100.000 $ 200,000 $ 315.000 900,000 Work in process, January 1 (80% complete as to labour and overhead) Units started into production Cost added during the year: Materials cost Labour cost Units completed during the year 1,300,000 1.985,000 750,000 the year. The company uses the weighted average cost method. Required: 1. Determine the equivalent units and costs per equivalent unit for materials, labour, and overhead for 2. Determine the amount of cost that should be assigned to the ending work-in-process and finished good inventories. 3. Prepare the necessary correcting journal entry to adjust the work-in-process and finished goods inventories to the correct balances as of December 31. 4. Determine the cost of goods sold for the year assuming there is no under-or overapplied overhead