Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 5 - 4 8 ( LO . 2 ) Sparrow Corporation would like you to review its employee fringe benefits program with regard to

Problem LO

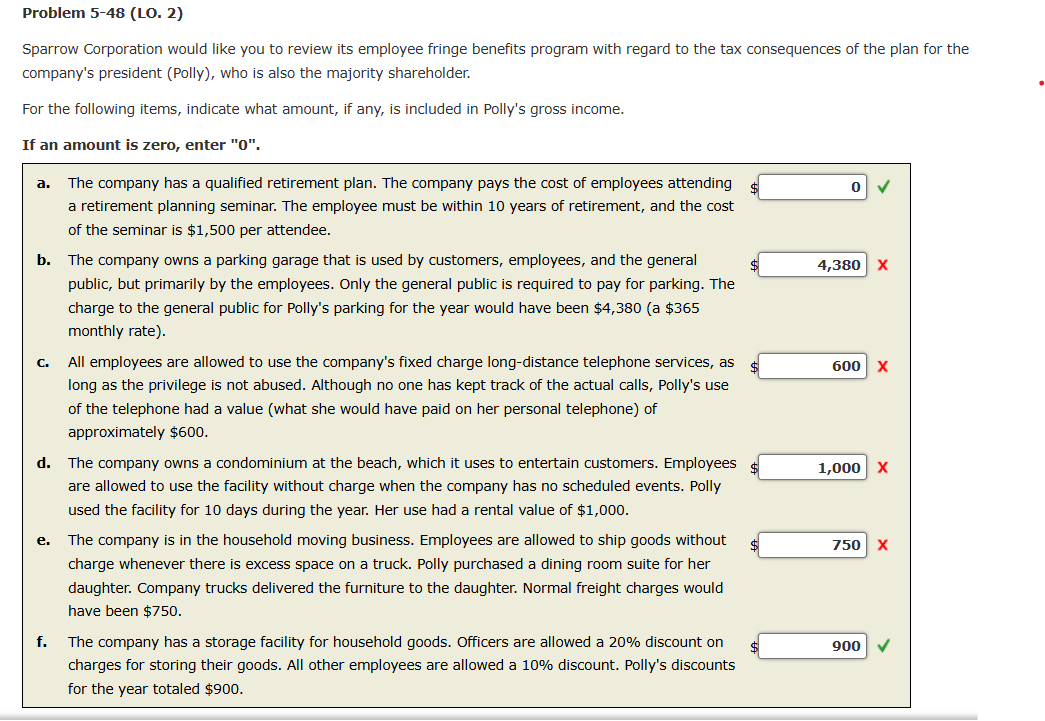

Sparrow Corporation would like you to review its employee fringe benefits program with regard to the tax consequences of the plan for the

company's president Polly who is also the majority shareholder.

For the following items, indicate what amount, if any, is included in Polly's gross income.

If an amount is zero, enter

a The company has a qualified retirement plan. The company pays the cost of employees attending

a retirement planning seminar. The employee must be within years of retirement, and the cost

of the seminar is $ per attendee.

b The company owns a parking garage that is used by customers, employees, and the general

public, but primarily by the employees. Only the general public is required to pay for parking. The

charge to the general public for Polly's parking for the year would have been $a $

monthly rate

c All employees are allowed to use the company's fixed charge longdistance telephone services, as

long as the privilege is not abused. Although no one has kept track of the actual calls, Polly's use

of the telephone had a value what she would have paid on her personal telephone of

approximately $

d The company owns a condominium at the beach, which it uses to entertain customers. Employees

are allowed to use the facility without charge when the company has no scheduled events. Polly

used the facility for days during the year. Her use had a rental value of $

e The company is in the household moving business. Employees are allowed to ship goods without

charge whenever there is excess space on a truck. Polly purchased a dining room suite for her

daughter. Company trucks delivered the furniture to the daughter. Normal freight charges would

have been $

f The company has a storage facility for household goods. Officers are allowed a discount on

charges for storing their goods. All other employees are allowed a discount. Polly's discounts

for the year totaled $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started