Answered step by step

Verified Expert Solution

Question

1 Approved Answer

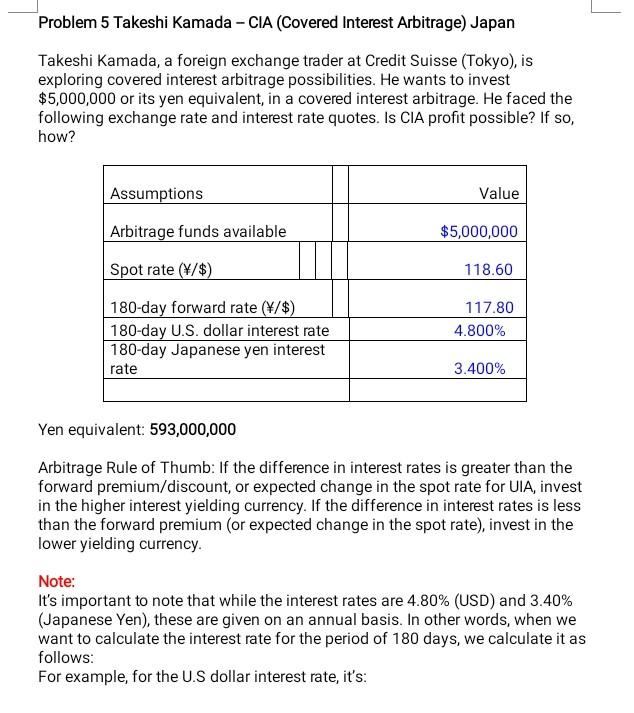

Problem 5 Takeshi Kamada - CIA (Covered Interest Arbitrage) Japan Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage

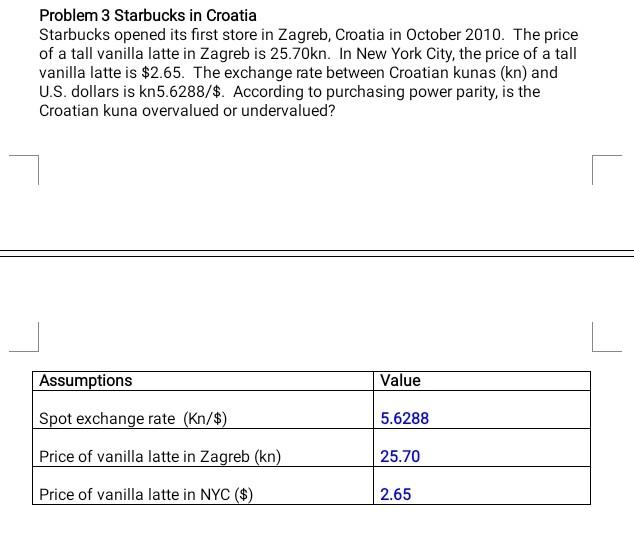

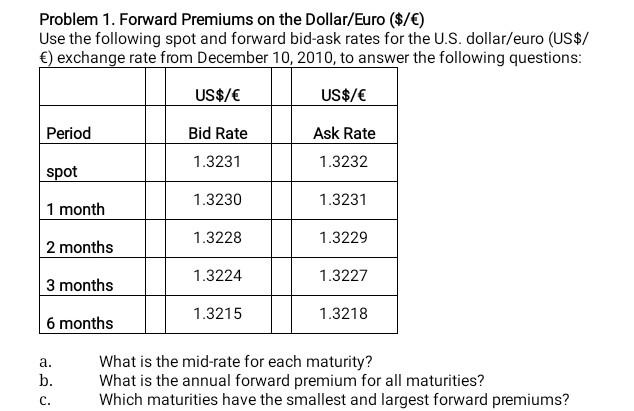

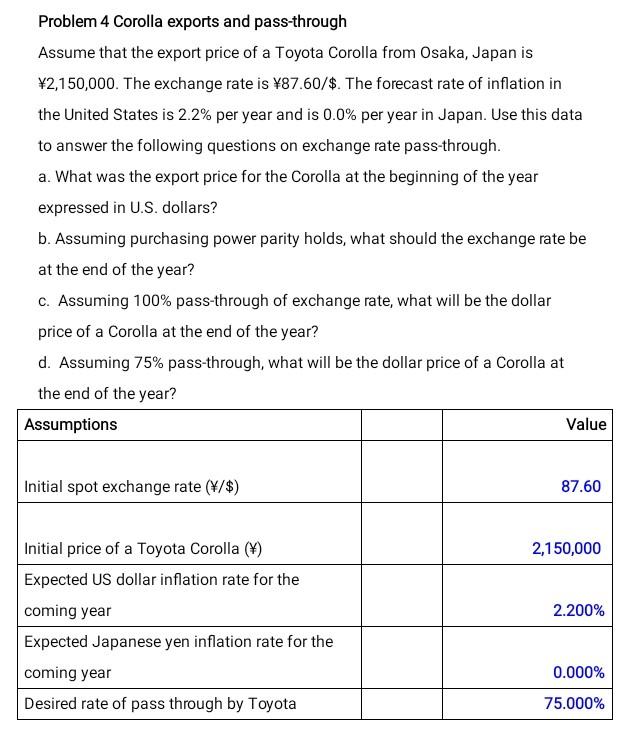

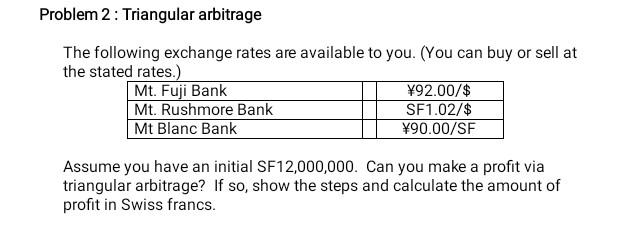

Problem 5 Takeshi Kamada - CIA (Covered Interest Arbitrage) Japan Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,000,000 or its yen equivalent, in a covered interest arbitrage. He faced the following exchange rate and interest rate quotes. Is CIA profit possible? If so, how? Yen equivalent: 593,000,000 Arbitrage Rule of Thumb: If the difference in interest rates is greater than the forward premium/discount, or expected change in the spot rate for UIA, invest in the higher interest yielding currency. If the difference in interest rates is less than the forward premium (or expected change in the spot rate), invest in the lower yielding currency. Note: It's important to note that while the interest rates are 4.80% (USD) and 3.40% (Japanese Yen), these are given on an annual basis. In other words, when we want to calculate the interest rate for the period of 180 days, we calculate it as follows: For example, for the U.S dollar interest rate, it's: Problem 3 Starbucks in Croatia Starbucks opened its first store in Zagreb, Croatia in October 2010. The price of a tall vanilla latte in Zagreb is 25.70kn. In New York City, the price of a tall vanilla latte is $2.65. The exchange rate between Croatian kunas (kn) and U.S. dollars is kn5.6288/\$. According to purchasing power parity, is the Croatian kuna overvalued or undervalued? Problem 1. Forward Premiums on the Dollar/Euro ($/) Use the following spot and forward bid-ask rates for the U.S. dollar/euro (US\$/ ) exchange rate from December 10,2010 , to answer the following questions: a. What is the mid-rate for each maturity? b. What is the annual forward premium for all maturities? c. Which maturities have the smallest and largest forward premiums? Problem 4 Corolla exports and pass-through Assume that the export price of a Toyota Corolla from Osaka, Japan is 2,150,000. The exchange rate is 87.60/$. The forecast rate of inflation in the United States is 2.2% per year and is 0.0% per year in Japan. Use this data to answer the following questions on exchange rate pass-through. a. What was the export price for the Corolla at the beginning of the year expressed in U.S. dollars? b. Assuming purchasing power parity holds, what should the exchange rate be at the end of the year? c. Assuming 100% pass-through of exchange rate, what will be the dollar price of a Corolla at the end of the year? d. Assuming 75% pass-through, what will be the dollar price of a Corolla at Problem 2 : Triangular arbitrage The following exchange rates are available to you. (You can buy or sell at the stated rates.) Assume you have an initial SF12,000,000. Can you make a profit via triangular arbitrage? If so, show the steps and calculate the amount of profit in Swiss francs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started