Answered step by step

Verified Expert Solution

Question

1 Approved Answer

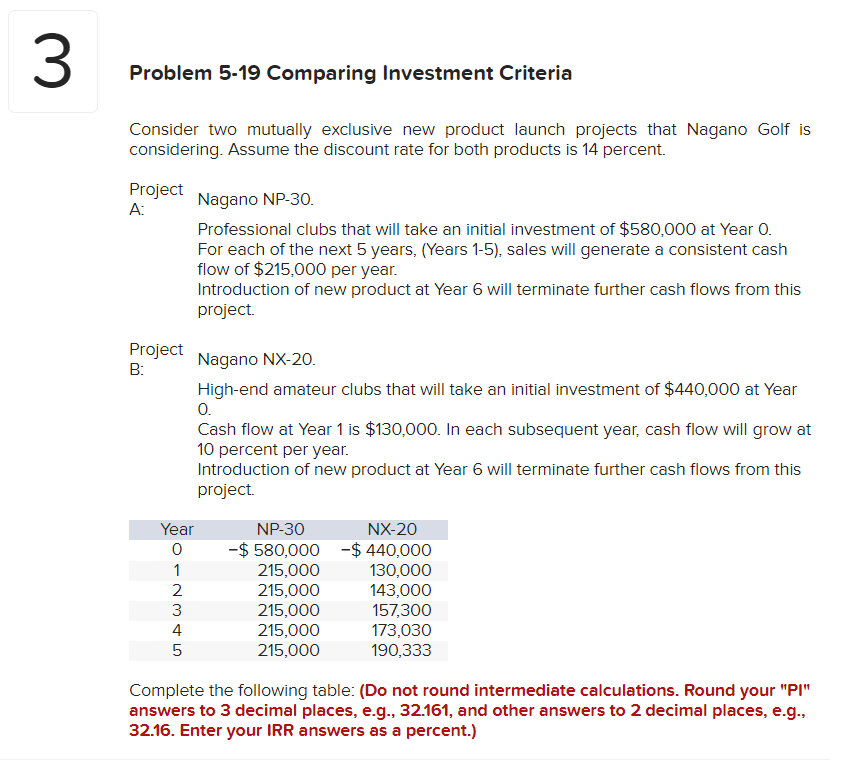

Problem 5-19 Comparing Investment Criteria Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate for both products

Problem 5-19 Comparing Investment Criteria

| Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate for both products is 14 percent. |

| Project A: | Nagano NP-30. |

| Professional clubs that will take an initial investment of $580,000 at Year 0. | |

| For each of the next 5 years, (Years 1-5), sales will generate a consistent cash flow of $215,000 per year. | |

| Introduction of new product at Year 6 will terminate further cash flows from this project. |

| Project B: | Nagano NX-20. |

| High-end amateur clubs that will take an initial investment of $440,000 at Year 0. | |

| Cash flow at Year 1 is $130,000. In each subsequent year, cash flow will grow at 10 percent per year. | |

| Introduction of new product at Year 6 will terminate further cash flows from this project. |

| Year | NP-30 | NX-20 |

|---|---|---|

| 0 | $ 580,000 | $ 440,000 |

| 1 | 215,000 | 130,000 |

| 2 | 215,000 | 143,000 |

| 3 | 215,000 | 157,300 |

| 4 | 215,000 | 173,030 |

| 5 | 215,000 | 190,333 |

| Complete the following table: (Do not round intermediate calculations. Round your "PI" answers to 3 decimal places, e.g., 32.161, and other answers to 2 decimal places, e.g., 32.16. Enter your IRR answers as a percent.) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started