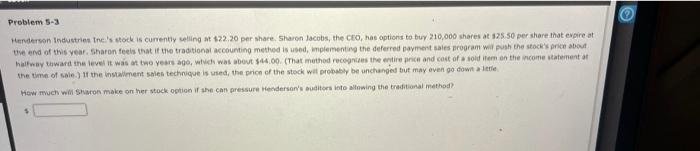

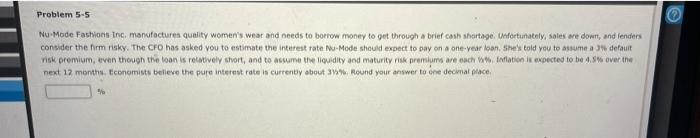

Problem 5-3 Henderson Industries Inc.'s stock is currently selling at $22.20 per share. Sharon Jacobs, the CEO, has options to buy 210,000 shares at 125.50 per share that eve at the end of this year, Sharon feels that if the traditional accounting method is used implementing the deferred payment sales program will push the stock's price about haway toward the level it was at two years ago, which was about $44.00. (That method recognizes the entire price and cost of old item on the income statement the time of sale) in the instaliment sales technique is used the price of the stock will probably be unchanged but may even go down little How much will sharon make on the stock option if she can pressure Henderson's auditors to allowing the traditional method $ Problem 5-5 Nu-Mode Fashion Inc. manufactures quality women's wear and needs to borrow money to get through a brief cash shortage. Unfortunately, sales we down, and lenders consider the firm risky. The CFO has asked you to estimate the interest rate Nu- Mode should expect to pay on a one-year loan. She's told you to assume a default visk premium, even though the loan is relatively short, and to assume the liquidity and maturity risk premiums are each Inflation is expected to be 4. over the next 12 months. tconomists believe the pure interest rate is currently about 3 Round your answer to one decimal place, Problem 5-3 Henderson Industries Inc.'s stock is currently selling at $22.20 per share. Sharon Jacobs, the CEO, has options to buy 210,000 shares at 125.50 per share that eve at the end of this year, Sharon feels that if the traditional accounting method is used implementing the deferred payment sales program will push the stock's price about haway toward the level it was at two years ago, which was about $44.00. (That method recognizes the entire price and cost of old item on the income statement the time of sale) in the instaliment sales technique is used the price of the stock will probably be unchanged but may even go down little How much will sharon make on the stock option if she can pressure Henderson's auditors to allowing the traditional method $ Problem 5-5 Nu-Mode Fashion Inc. manufactures quality women's wear and needs to borrow money to get through a brief cash shortage. Unfortunately, sales we down, and lenders consider the firm risky. The CFO has asked you to estimate the interest rate Nu- Mode should expect to pay on a one-year loan. She's told you to assume a default visk premium, even though the loan is relatively short, and to assume the liquidity and maturity risk premiums are each Inflation is expected to be 4. over the next 12 months. tconomists believe the pure interest rate is currently about 3 Round your answer to one decimal place