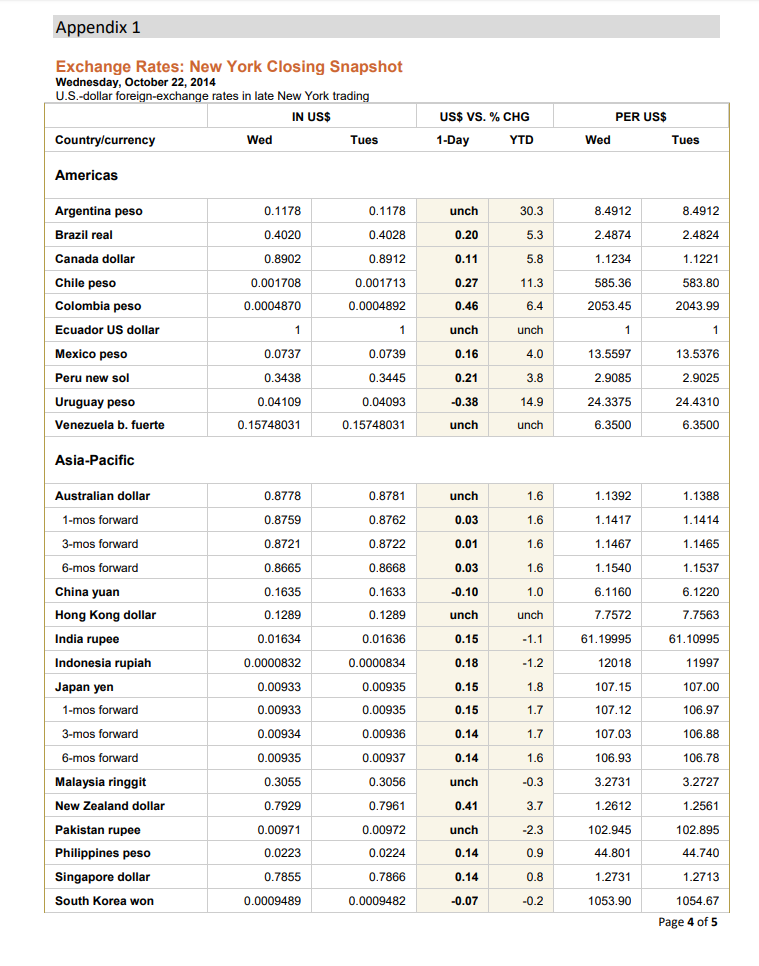

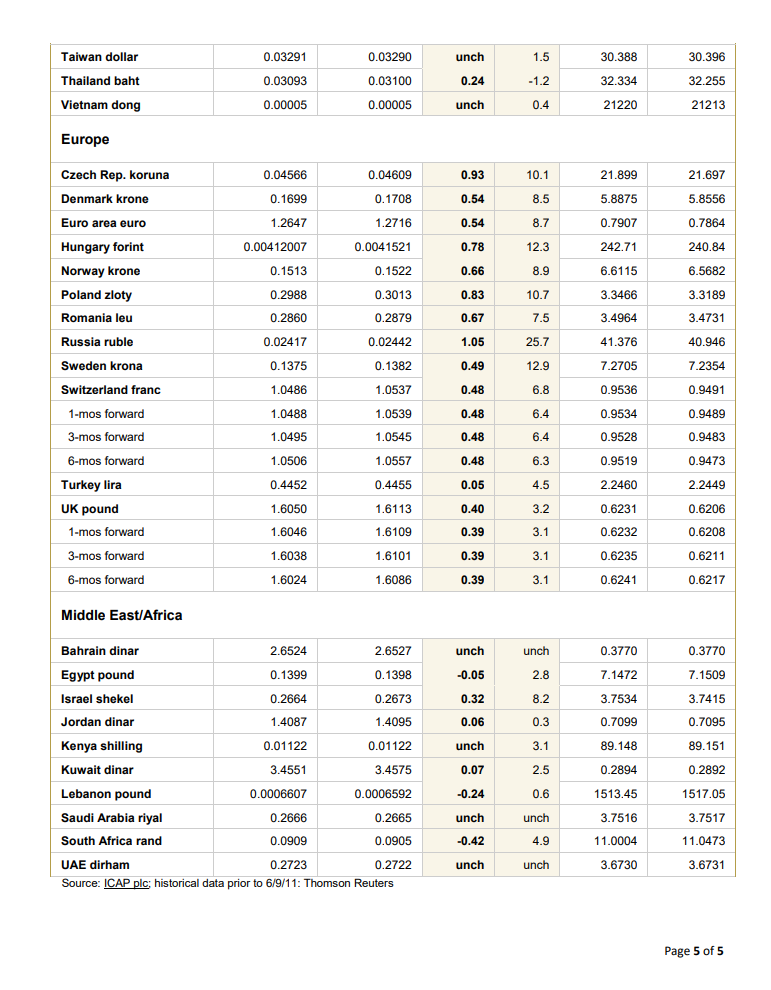

Please help me complete this problem set with work shown for each step. Thank you so much! 1. Using direct quotes (in US$) of the respective currencies for Wednesday, please compute the forward premium or discount for the British pound and Switzerland franc for the following

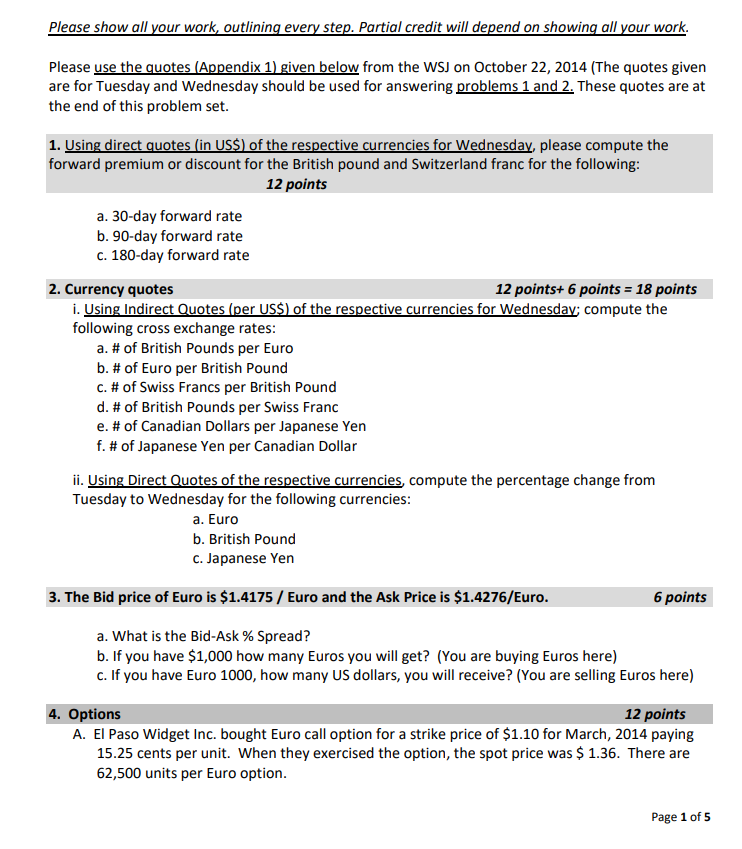

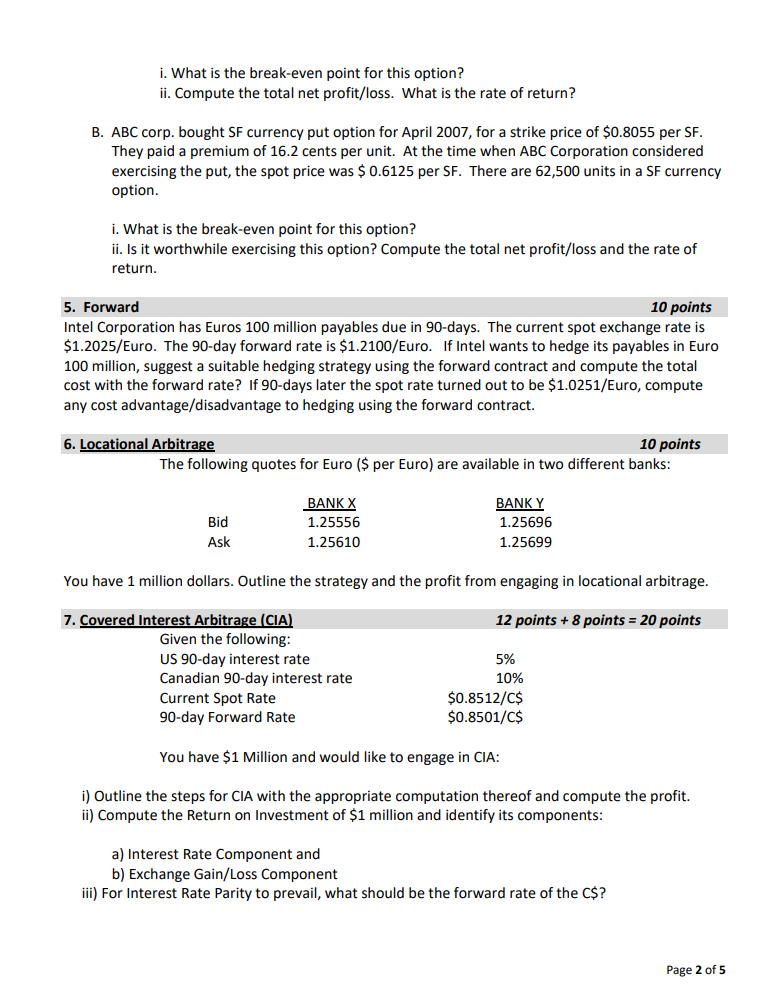

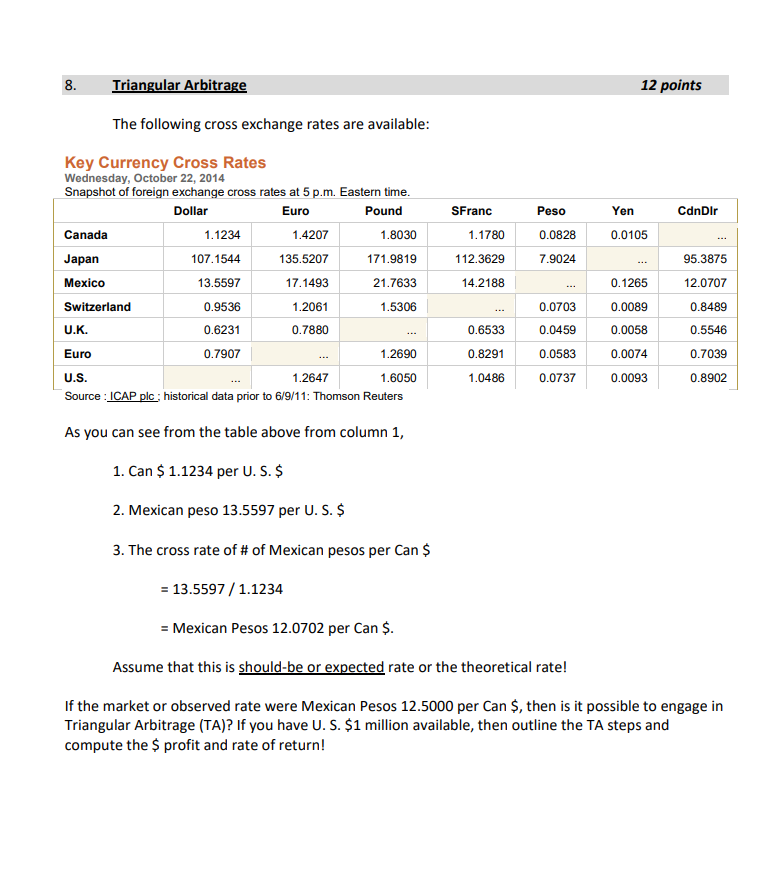

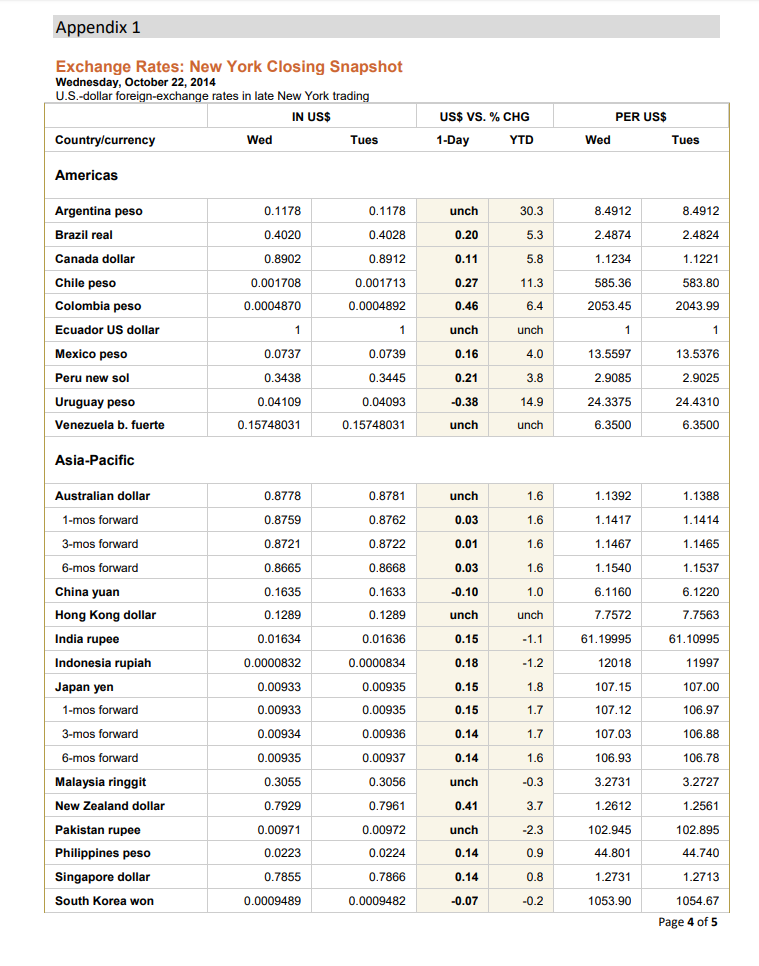

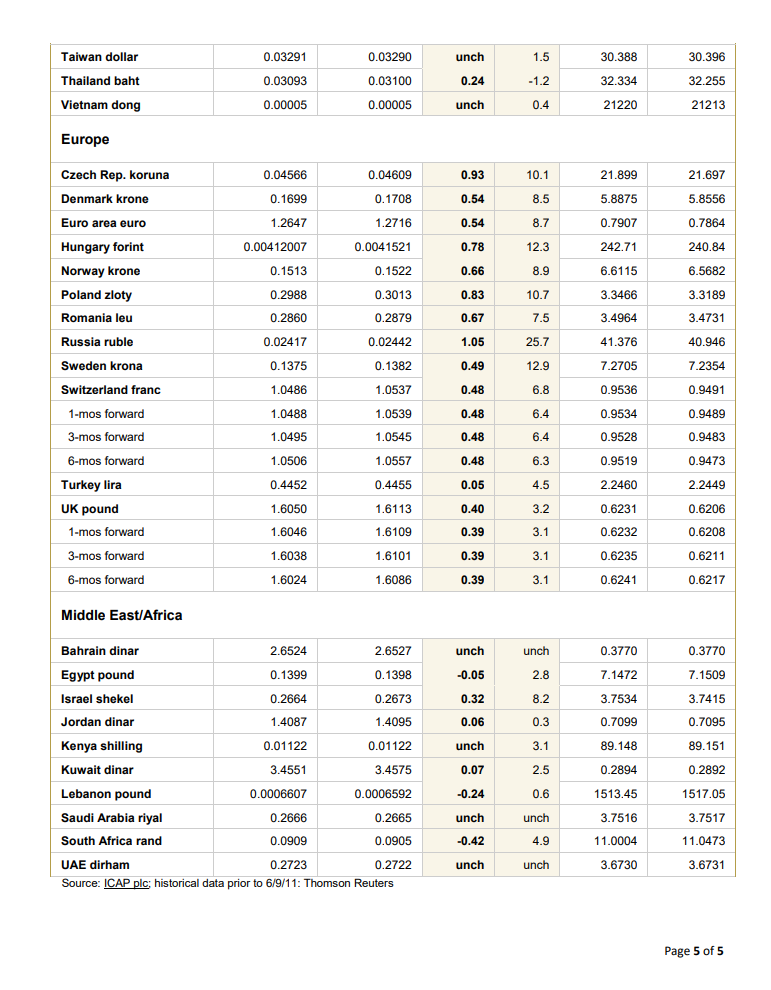

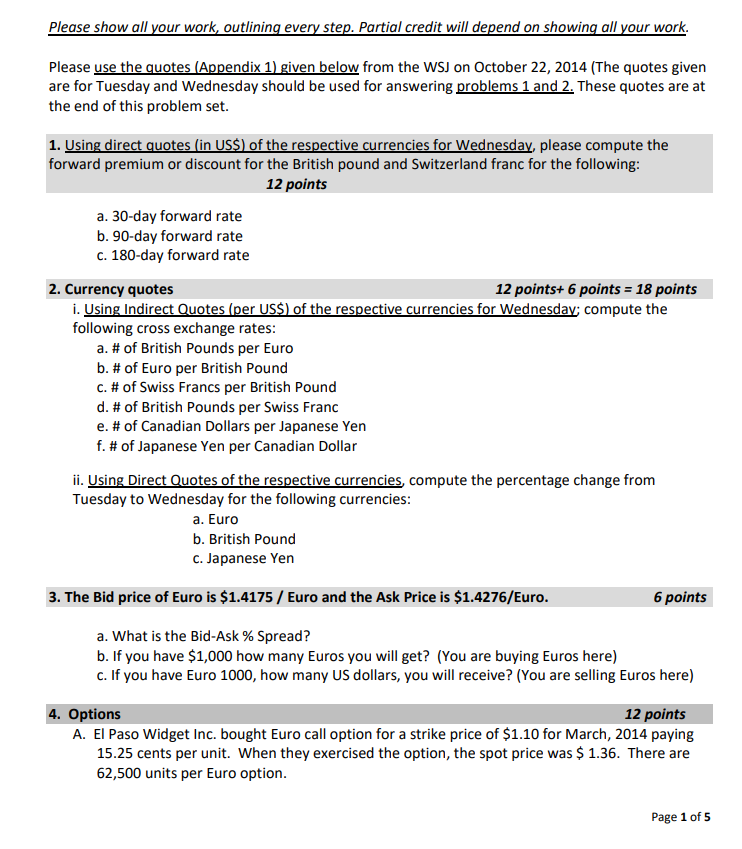

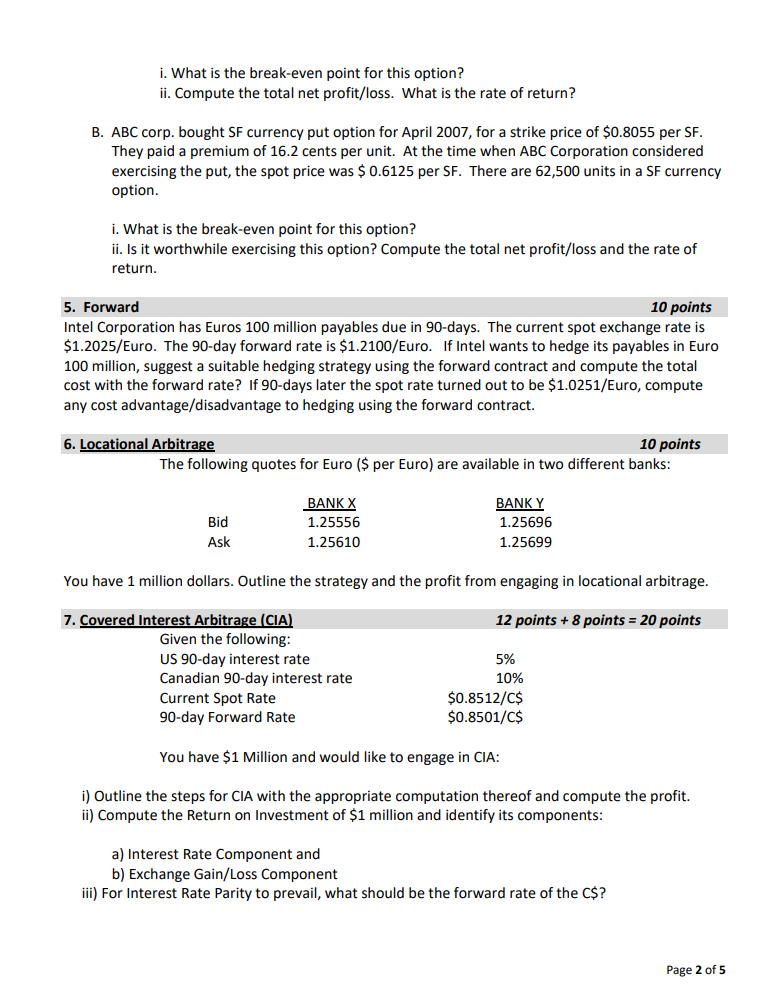

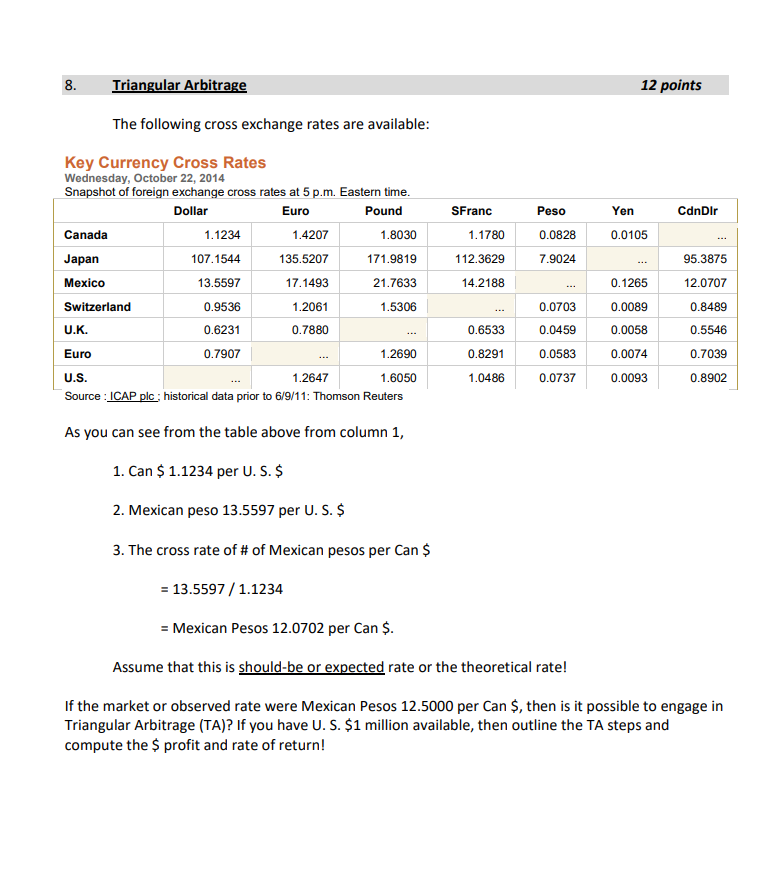

Please show all your work, outlining every step. Partial credit will depend on showing all your work. Please use the quotes (Appendix 1 given below from the WSJ on October 22, 2014 (The quotes given are for Tuesday and Wednesday should be used for answering problems 1 and 2. These quotes are at the end of this problem set. 1. Using direct quotes (in USS) of the respective currencies for Wednesday, please compute the forward premium or discount for the British pound and Switzerland franc for the following 12 points a. 30-day forward rate b. 90-day forward rate c. 180-day forward rate 2. Currency quote:s 12 points+ 6 points 18 points following cross exchange rates a. # of British Pounds per Euro b. # of Euro per British Pound C. # of Swiss Francs per British Pound d. # of British Pounds per Swiss Franc e. # of Canadian Dollars per Japanese Yen f. # of Japanese Yen per Canadian Dollar ii. Using Direct Quotes of the respective currencies, compute the percentage change from Tuesday to Wednesday for the following currencies a. Euro b. British Pound c. Japanese Yen 3. The Bid price of Euro is $1.4175/ Euro and the Ask Price is $1.4276/Euro 6 points a. what is the Bid-Ask % Spread? b. If you have $1,000 how many Euros you will get? (You are buying Euros here) c. If you have Euro 1000, how many US dollars, you will receive? (You are selling Euros here) 4. Options 12 points A. El Paso Widget Inc. bought Euro call option for a strike price of $1.10 for March, 2014 paying 15.25 cents per unit. When they exercised the option, the spot price was $ 1.36. There are 62,500 units per Euro option Page 1 of5 i. What is the break-even point for this option? ii. Compute the total net profit/loss. What is the rate of return? B. ABC corp. bought SF currency put option for April 2007, for a strike price of $0.8055 per SF They paid a premium of 16.2 cents per unit. At the time when ABC Corporation considered exercising the put, the spot price was $0.6125 per SF. There are 62,500 units in a SF currency option i. What is the break-even point for this option? ii. Is it worthwhile exercising this option? Compute the total net profit/loss and the rate of return 5. Forward Intel Corporation has Euros 100 million payables due in 90-days. The current spot exchange rate is $1.2025/Euro. The 90-day forward rate is $1.2100/Euro. If Intel wants to hedge its payables in Euro 100 million, suggest a suitable hedging strategy using the forward contract and compute the total cost with the forward rate? If 90-days later the spot rate turned out to be $1.0251/Euro, compute any cost advantage/disadvantage to hedging using the forward contract. 10 points 6. Locational Arbitra 10 points The following quotes for Euro ($per Euro) are available in two different banks Bid Ask 1.25556 1.25610 1.25696 1.25699 You have 1 million dollars. Outline the strategy and the profit from engaging in locational arbitrage 7. Covered Interest Arbitrage (CIA) 12 points+8 points 20 points Given the following US 90-day interest rate Canadian 90-day interest rate Current Spot Rate 90-day Forward Rate 10% $0.8512/C$ $0.8501/C$ You have $1 Million and would like to engage in CIA: i) Outline the steps for CIA with the appropriate computation thereof and compute the profit. i) Compute the Return on Investment of $1 million and identify its components a) Interest Rate Component and b) Exchange Gain/Loss Component ii) For Interest Rate Parity to prevail, what should be the forward rate of the C$? Page 2 of5 8. Triangular Arbitrage 12 points The following cross exchange rates are available Key Currency Cross Rates Wednesday, October 22, 2014 Snapshot of foreign exchange cross rates at 5 p.m. Eastern time Dollar Euro Pound SFranc CdnDIr Peso 0.0828 7.9024 Yen 1.1234 107.1544 13.5597 0.9536 0.6231 0.7907 1.4207 135.5207 17.1493 1.2061 0.7880 1.8030 171.9819 21.7633 1.5306 1.1780 112.3629 14.2188 Canada 0.0105 95.3875 12.0707 0.8489 0.5546 0.7039 0.8902 Japan Mexico Switzerland U.K. Euro U.S. Source :ICAP plc; historical data prior to 6/9/11: Thomson Reuters 0.0703 0.0459 0.0583 0.0737 0.1265 0.0089 0.0058 0.0074 0.0093 0.6533 0.8291 1.0486 1.2690 1.2647 1.6050 As you can see from the table above from column 1, 1. Can $ 1.1234 per U. S. $ 2. Mexican peso 13.5597 per U. S. $ 3. The cross rate of # of Mexican pesos per Can $ 13.5597/1.1234 Mexican Pesos 12.0702 per Can $ Assume that this is should-be or expected rate or the theoretical rate! If the market or observed rate were Mexican Pesos 12.5000 per Can $, then is it possible to engage in Triangular Arbitrage (TA)? If you have U. S. $1 million available, then outline the TA steps and compute the $ profit and rate of return! Appendix 1 Exchange Rates: New York Closing Snapshot Wednesday, October 22, 2014 U.S.-dollar foreign-exchange rates in late New York tradin IN US$ US$ VS. % CHG PER US$ Country/currency Tues YTD Tues Americas 0.1178 0.4020 0.8902 0.001708 0.0004870 8.4912 8.4912 2.4824 1.1221 583.80 2043.99 0.1178 Argentina peso Brazil real Canada dollar Chile peso Colombia peso Ecuador US dollar Mexico peso Peru new sol Uruguay peso Venezuela b. fuerte unch 0.20 2.4874 0.8912 0.001713 0.0004892 0.27 585.36 2053.45 unch 0.0737 0.0739 13.5597 2.9085 24.3375 6.3500 13.5376 2.9025 24.4310 6.3500 0.3438 -0.38 0.15748031 0.15748031 unch Asia-Pacific 0.8778 0.8759 0.8721 0.8665 0.1635 0.1289 0.01634 0.0000832 0.00933 0.00933 0.00934 0.00935 0.3055 0.7929 0.00971 0.0223 0.7855 0.0009489 0.8781 0.8762 0.8722 0.8668 0.1633 0.1289 0.01636 0.0000834 0.00935 0.00935 0.00936 0.00937 0.3056 0.7961 0.00972 0.0224 0.7866 Australian dollar unch 1.1392 3-mos forward 1.1467 1.1465 6-mos forward China yuan Hong Kong dollar India rupee Indonesia rupiah 7.7572 61.19995 12018 107.15 107.12 107.03 106.93 3.2731 1.2612 102.945 7.7563 61.10995 11997 107.00 106.97 106.88 106.78 3.2727 1.2561 102.895 44.740 1.2713 1054.67 Page 4 of 5 unch unch 1-mos forward 3-mos forward 6-mos forward Malaysia ringgit unch New Zealand dollar Pakistan rupee Philippines peso Singapore dollar South Korea won unch 1.2731 1053.90 Taiwan dollar Thailand baht Vietnam dong 0.03291 0.03093 0.00005 0.03290 0.03100 0.00005 unch 0.24 unch 30.388 32.334 21220 32.255 21213 Europe 0.04609 0.1708 1.2716 0.0041521 0.1522 0.3013 0.2879 0.02442 0.1382 1.0537 1.0539 21.697 5.8556 0.7864 240.84 Czech Rep. koruna Denmark krone Euro area euro Hungary forint Norway krone Poland zloty Romania leu Russia ruble Sweden krona Switzerland franc 0.04566 0.1699 1.2647 0.00412007 0.1513 0.2988 0.2860 0.02417 0.1375 5.8875 0.7907 242.71 6.6115 3.4964 41.376 7.2705 0.9536 0.9534 0.9528 0.9519 2.2460 0.6231 3.3189 3.4731 40.946 7.2354 0.9491 0.9489 1.05 1-mos 3-mos forward 6-mos forward 1.0495 1.0557 0.9473 Turkey lira UK pound 0.4452 1.6050 1.6046 1.6038 1.6024 0.4455 2.2449 1-mos 3-mos forward 6-mos forward 0.39 0.39 0.39 1.6109 0.6211 0.6241 0.6217 Middle East/Africa 2.6524 0.1399 0.2664 1.4087 0.01122 3.4551 0.0006607 0.2666 2.6527 0.1398 0.2673 Bahrain dinar Egypt pound Israel shekel Jordan dinar Kenya shilling Kuwait dinar Lebanon pound Saudi Arabia riyal South Africa rand UAE dirham Source: ICAP plc; historical data prior to 6/9/11: Thomson Reuters 0.3770 7.1472 3.7534 0.7099 unch unch 0.3770 0.32 0.7095 0.01122 3.4575 0.0006592 0.2665 unch 0.2894 1513.45 3.7516 11.0004 3.6730 0.2892 1517.05 3.7517 11.0473 3.6731 -0.24 unch unch 0.2723 0.2722 unch unch Page 5 of 5 Please show all your work, outlining every step. Partial credit will depend on showing all your work. Please use the quotes (Appendix 1 given below from the WSJ on October 22, 2014 (The quotes given are for Tuesday and Wednesday should be used for answering problems 1 and 2. These quotes are at the end of this problem set. 1. Using direct quotes (in USS) of the respective currencies for Wednesday, please compute the forward premium or discount for the British pound and Switzerland franc for the following 12 points a. 30-day forward rate b. 90-day forward rate c. 180-day forward rate 2. Currency quote:s 12 points+ 6 points 18 points following cross exchange rates a. # of British Pounds per Euro b. # of Euro per British Pound C. # of Swiss Francs per British Pound d. # of British Pounds per Swiss Franc e. # of Canadian Dollars per Japanese Yen f. # of Japanese Yen per Canadian Dollar ii. Using Direct Quotes of the respective currencies, compute the percentage change from Tuesday to Wednesday for the following currencies a. Euro b. British Pound c. Japanese Yen 3. The Bid price of Euro is $1.4175/ Euro and the Ask Price is $1.4276/Euro 6 points a. what is the Bid-Ask % Spread? b. If you have $1,000 how many Euros you will get? (You are buying Euros here) c. If you have Euro 1000, how many US dollars, you will receive? (You are selling Euros here) 4. Options 12 points A. El Paso Widget Inc. bought Euro call option for a strike price of $1.10 for March, 2014 paying 15.25 cents per unit. When they exercised the option, the spot price was $ 1.36. There are 62,500 units per Euro option Page 1 of5 i. What is the break-even point for this option? ii. Compute the total net profit/loss. What is the rate of return? B. ABC corp. bought SF currency put option for April 2007, for a strike price of $0.8055 per SF They paid a premium of 16.2 cents per unit. At the time when ABC Corporation considered exercising the put, the spot price was $0.6125 per SF. There are 62,500 units in a SF currency option i. What is the break-even point for this option? ii. Is it worthwhile exercising this option? Compute the total net profit/loss and the rate of return 5. Forward Intel Corporation has Euros 100 million payables due in 90-days. The current spot exchange rate is $1.2025/Euro. The 90-day forward rate is $1.2100/Euro. If Intel wants to hedge its payables in Euro 100 million, suggest a suitable hedging strategy using the forward contract and compute the total cost with the forward rate? If 90-days later the spot rate turned out to be $1.0251/Euro, compute any cost advantage/disadvantage to hedging using the forward contract. 10 points 6. Locational Arbitra 10 points The following quotes for Euro ($per Euro) are available in two different banks Bid Ask 1.25556 1.25610 1.25696 1.25699 You have 1 million dollars. Outline the strategy and the profit from engaging in locational arbitrage 7. Covered Interest Arbitrage (CIA) 12 points+8 points 20 points Given the following US 90-day interest rate Canadian 90-day interest rate Current Spot Rate 90-day Forward Rate 10% $0.8512/C$ $0.8501/C$ You have $1 Million and would like to engage in CIA: i) Outline the steps for CIA with the appropriate computation thereof and compute the profit. i) Compute the Return on Investment of $1 million and identify its components a) Interest Rate Component and b) Exchange Gain/Loss Component ii) For Interest Rate Parity to prevail, what should be the forward rate of the C$? Page 2 of5 8. Triangular Arbitrage 12 points The following cross exchange rates are available Key Currency Cross Rates Wednesday, October 22, 2014 Snapshot of foreign exchange cross rates at 5 p.m. Eastern time Dollar Euro Pound SFranc CdnDIr Peso 0.0828 7.9024 Yen 1.1234 107.1544 13.5597 0.9536 0.6231 0.7907 1.4207 135.5207 17.1493 1.2061 0.7880 1.8030 171.9819 21.7633 1.5306 1.1780 112.3629 14.2188 Canada 0.0105 95.3875 12.0707 0.8489 0.5546 0.7039 0.8902 Japan Mexico Switzerland U.K. Euro U.S. Source :ICAP plc; historical data prior to 6/9/11: Thomson Reuters 0.0703 0.0459 0.0583 0.0737 0.1265 0.0089 0.0058 0.0074 0.0093 0.6533 0.8291 1.0486 1.2690 1.2647 1.6050 As you can see from the table above from column 1, 1. Can $ 1.1234 per U. S. $ 2. Mexican peso 13.5597 per U. S. $ 3. The cross rate of # of Mexican pesos per Can $ 13.5597/1.1234 Mexican Pesos 12.0702 per Can $ Assume that this is should-be or expected rate or the theoretical rate! If the market or observed rate were Mexican Pesos 12.5000 per Can $, then is it possible to engage in Triangular Arbitrage (TA)? If you have U. S. $1 million available, then outline the TA steps and compute the $ profit and rate of return! Appendix 1 Exchange Rates: New York Closing Snapshot Wednesday, October 22, 2014 U.S.-dollar foreign-exchange rates in late New York tradin IN US$ US$ VS. % CHG PER US$ Country/currency Tues YTD Tues Americas 0.1178 0.4020 0.8902 0.001708 0.0004870 8.4912 8.4912 2.4824 1.1221 583.80 2043.99 0.1178 Argentina peso Brazil real Canada dollar Chile peso Colombia peso Ecuador US dollar Mexico peso Peru new sol Uruguay peso Venezuela b. fuerte unch 0.20 2.4874 0.8912 0.001713 0.0004892 0.27 585.36 2053.45 unch 0.0737 0.0739 13.5597 2.9085 24.3375 6.3500 13.5376 2.9025 24.4310 6.3500 0.3438 -0.38 0.15748031 0.15748031 unch Asia-Pacific 0.8778 0.8759 0.8721 0.8665 0.1635 0.1289 0.01634 0.0000832 0.00933 0.00933 0.00934 0.00935 0.3055 0.7929 0.00971 0.0223 0.7855 0.0009489 0.8781 0.8762 0.8722 0.8668 0.1633 0.1289 0.01636 0.0000834 0.00935 0.00935 0.00936 0.00937 0.3056 0.7961 0.00972 0.0224 0.7866 Australian dollar unch 1.1392 3-mos forward 1.1467 1.1465 6-mos forward China yuan Hong Kong dollar India rupee Indonesia rupiah 7.7572 61.19995 12018 107.15 107.12 107.03 106.93 3.2731 1.2612 102.945 7.7563 61.10995 11997 107.00 106.97 106.88 106.78 3.2727 1.2561 102.895 44.740 1.2713 1054.67 Page 4 of 5 unch unch 1-mos forward 3-mos forward 6-mos forward Malaysia ringgit unch New Zealand dollar Pakistan rupee Philippines peso Singapore dollar South Korea won unch 1.2731 1053.90 Taiwan dollar Thailand baht Vietnam dong 0.03291 0.03093 0.00005 0.03290 0.03100 0.00005 unch 0.24 unch 30.388 32.334 21220 32.255 21213 Europe 0.04609 0.1708 1.2716 0.0041521 0.1522 0.3013 0.2879 0.02442 0.1382 1.0537 1.0539 21.697 5.8556 0.7864 240.84 Czech Rep. koruna Denmark krone Euro area euro Hungary forint Norway krone Poland zloty Romania leu Russia ruble Sweden krona Switzerland franc 0.04566 0.1699 1.2647 0.00412007 0.1513 0.2988 0.2860 0.02417 0.1375 5.8875 0.7907 242.71 6.6115 3.4964 41.376 7.2705 0.9536 0.9534 0.9528 0.9519 2.2460 0.6231 3.3189 3.4731 40.946 7.2354 0.9491 0.9489 1.05 1-mos 3-mos forward 6-mos forward 1.0495 1.0557 0.9473 Turkey lira UK pound 0.4452 1.6050 1.6046 1.6038 1.6024 0.4455 2.2449 1-mos 3-mos forward 6-mos forward 0.39 0.39 0.39 1.6109 0.6211 0.6241 0.6217 Middle East/Africa 2.6524 0.1399 0.2664 1.4087 0.01122 3.4551 0.0006607 0.2666 2.6527 0.1398 0.2673 Bahrain dinar Egypt pound Israel shekel Jordan dinar Kenya shilling Kuwait dinar Lebanon pound Saudi Arabia riyal South Africa rand UAE dirham Source: ICAP plc; historical data prior to 6/9/11: Thomson Reuters 0.3770 7.1472 3.7534 0.7099 unch unch 0.3770 0.32 0.7095 0.01122 3.4575 0.0006592 0.2665 unch 0.2894 1513.45 3.7516 11.0004 3.6730 0.2892 1517.05 3.7517 11.0473 3.6731 -0.24 unch unch 0.2723 0.2722 unch unch Page 5 of 5