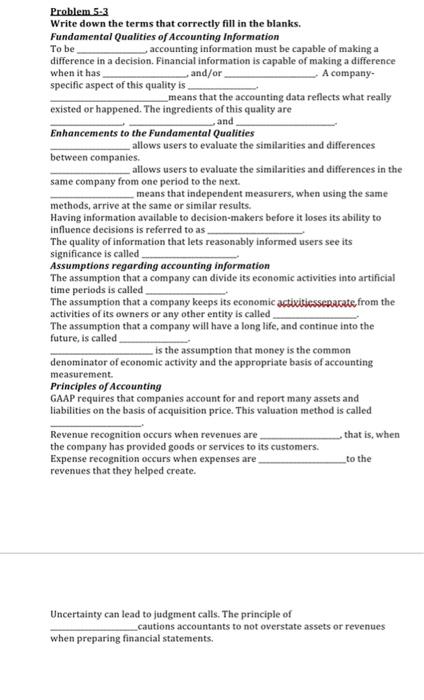

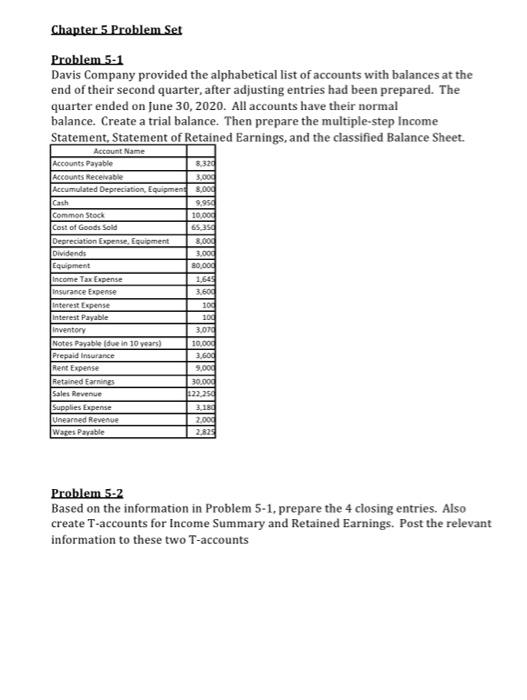

Problem 5-3 Write down the terms that correctly fill in the blanks. Fundamental Qualities of Accounting Information To be accounting information must be capable of making a difference in a decision. Financial information is capable of making a difference when it has and/or A company. specific aspect of this quality is _means that the accounting data reflects what really existed or happened. The ingredients of this quality are , and Enhancements to the fundamental Qualities allows users to evaluate the similarities and differences between companies. allows users to evaluate the similarities and differences in the same company from one period to the next. means that independent measurers, when using the same methods, arrive at the same or similar results. Having information available to decision-makers before it loses its ability to influence decisions is referred to as The quality of information that lets reasonably informed users see its significance is called Assumptions regarding accounting information The assumption that a company can divide its economic activities into artificial time periods is called The assumption that a company keeps its economic activitiesseparate from the activities of its owners or any other entity is called The assumption that a company will have a long life, and continue into the future, is called is the assumption that money is the common denominator of economic activity and the appropriate basis of accounting measurement. Principles of Accounting GAAP requires that companies account for and report many assets and liabilities on the basis of acquisition price. This valuation method is called Revenue recognition occurs when revenues are that is when the company has provided goods or services to its customers. Expense recognition occurs when expenses are revenues that they helped create. to the Uncertainty can lead to judgment calls. The principle of _cautions accountants to not overstate assets or revenues when preparing financial statements. Chapter 5 Problem Set Problem 5-1 Davis Company provided the alphabetical list of accounts with balances at the end of their second quarter, after adjusting entries had been prepared. The quarter ended on June 30, 2020. All accounts have their normal balance. Create a trial balance. Then prepare the multiple-step Income Statement, Statement of Retained Earnings, and the classified Balance Sheet. Account Name Accounts Payable 8.320 Accounts Receivable 3,000 Accumulated Depreciation Equipment 8,000 Cash 9,95 Common Stock 10,000 Cost of Goods Sold 65,350 Depreciation Expense, Equipment 8.000 Dividends 3.000 Equipment 80,000 Income Tax Expense 1,645 insurance Expense 3.600 Interest Expense 100 Interest Payable 100 inventory 3,076 Notes Payable due in 10 years) 10.000 Prepaid Insurance 3,600 Rent Expense 5,ood Retained Earnings 30.000 Sales Revenue 1:22.25 Supplies Expense 3.180 Unearned Revenue 2.000 Wapes Payable 2.82 Problem 5-2 Based on the information in Problem 5-1. prepare the 4 closing entries. Also create T-accounts for Income Summary and Retained Earnings. Post the relevant information to these two T-accounts