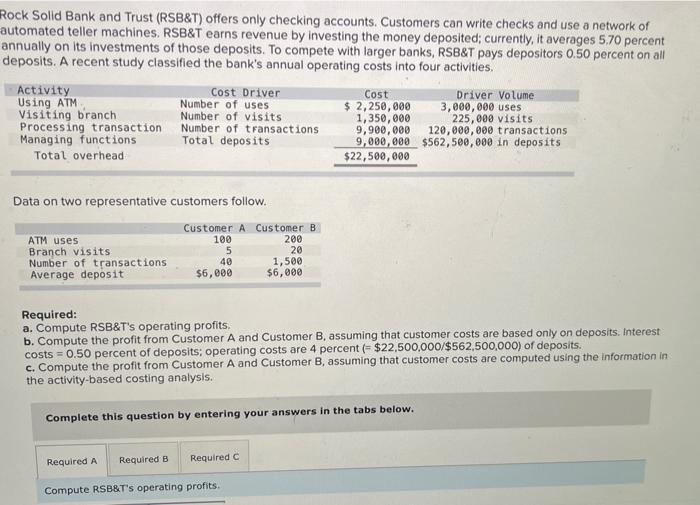

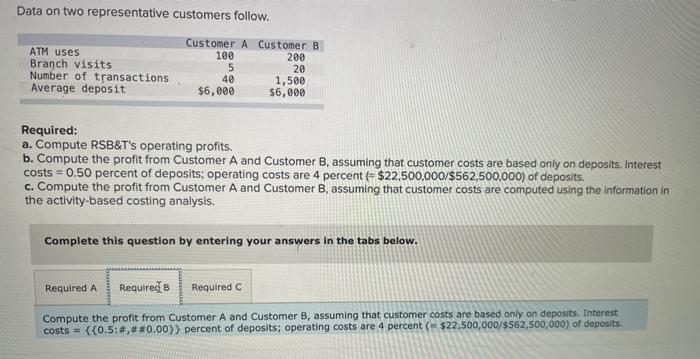

Rock Solid Bank and Trust (RSB&T) offers only checking accounts. Customers can write checks and use a network of automated teller machines. RSB&T earns revenue by investing the money deposited currently, it averages 5,70 percent annually on its investments of those deposits. To compete with larger banks, RSB&T pays depositors 0.50 percent on all deposits. A recent study classified the bank's annual operating costs into four activities. Activity Cost Driver Cost Driver Volume Using ATM Number of uses $ 2,250,000 3,000,000 uses Visiting branch Number of visits 1,350,000 225,000 visits Processing transaction Number of transactions 9,900,000 120,000,000 transactions Managing functions Total deposits 9,000,000 $562,500,000 in deposits Total overhead $22,500,000 Data on two representative customers follow. ATM uses Branch visits Number of transactions Average deposit Customer A Customer B 100 200 5 20 40 1,500 $6,000 $6,000 Required: a. Compute RSB&T's operating profits, b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs = 0.50 percent of deposits, operating costs are 4 percent (= $22,500,000/$562,500,000) of deposits. c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis. Complete this question by entering your answers in the tabs below. Required A Required B Required Compute RSBXT's operating profits. Data on two representative customers follow. ATM uses Branch visits Number of transactions Average deposit Customer A Customer B 100 200 5 20 40 1,500 $6,000 $6,000 Required: a. Compute RSB&T's operating profits. b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs = 0.50 percent of deposits: operating costs are 4 percent = $22,500,000/$562,500,000) of deposits. c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the Information in the activity-based costing analysis. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs = {{0.5:#,##0.00}} percent of deposits; operating costs are 4 percent ($22,500,000/$562,500,000) of deposits. Complete this question by entering your answers in the tabs below. Required A Required B Requirdd c Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis. (Do not round intermediate calculations. Round your answers to 2 decimal places. Los Prev 1 of 8 THE Next >