Question

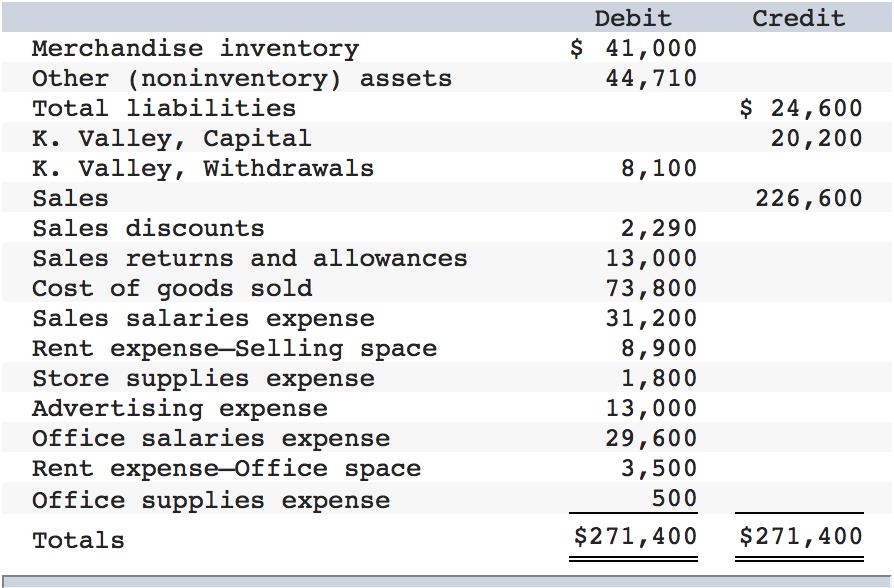

Valley Companys adjusted trial balance on August 31, 2017, its fiscal year-end, follows. On August 31, 2016, merchandise inventory was $25,800. Supplementary records of merchandising

Valley Company’s adjusted trial balance on August 31, 2017, its fiscal year-end, follows.

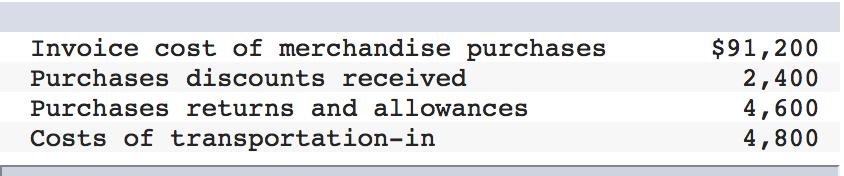

On August 31, 2016, merchandise inventory was $25,800. Supplementary records of merchandising activities for the year ended August 31, 2017, reveal the following itemized costs.

Required:

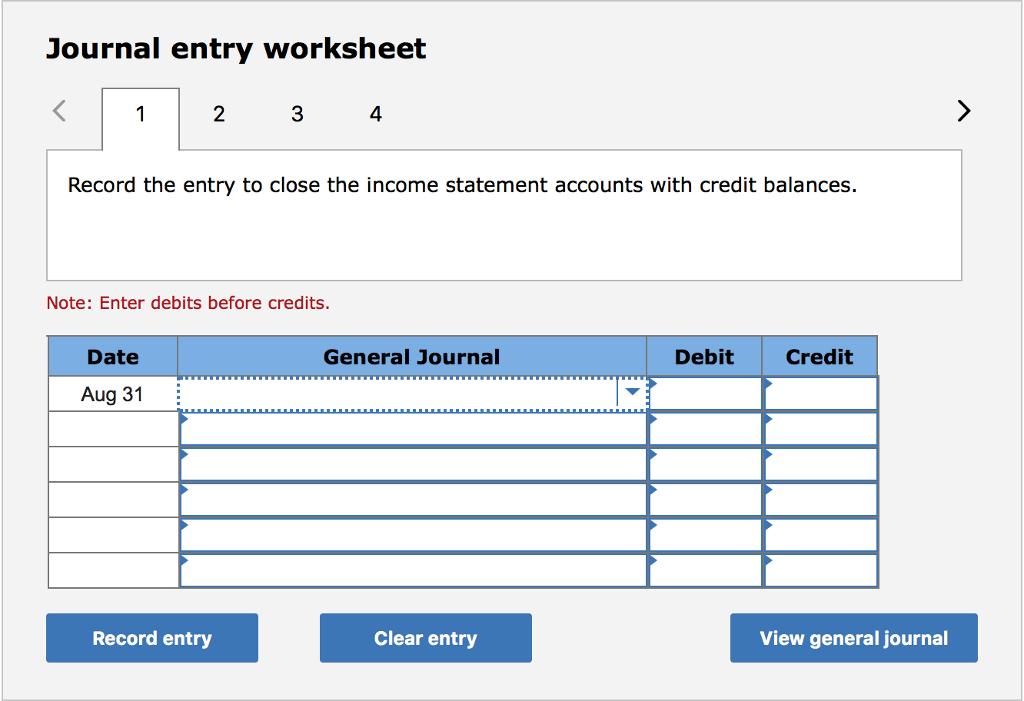

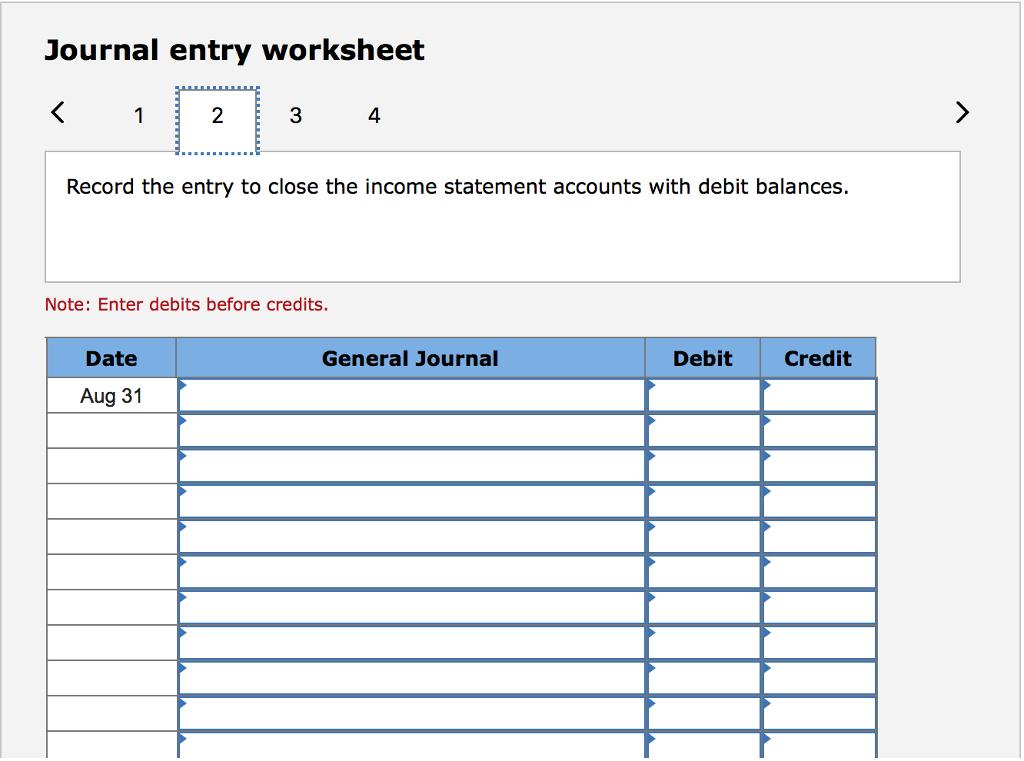

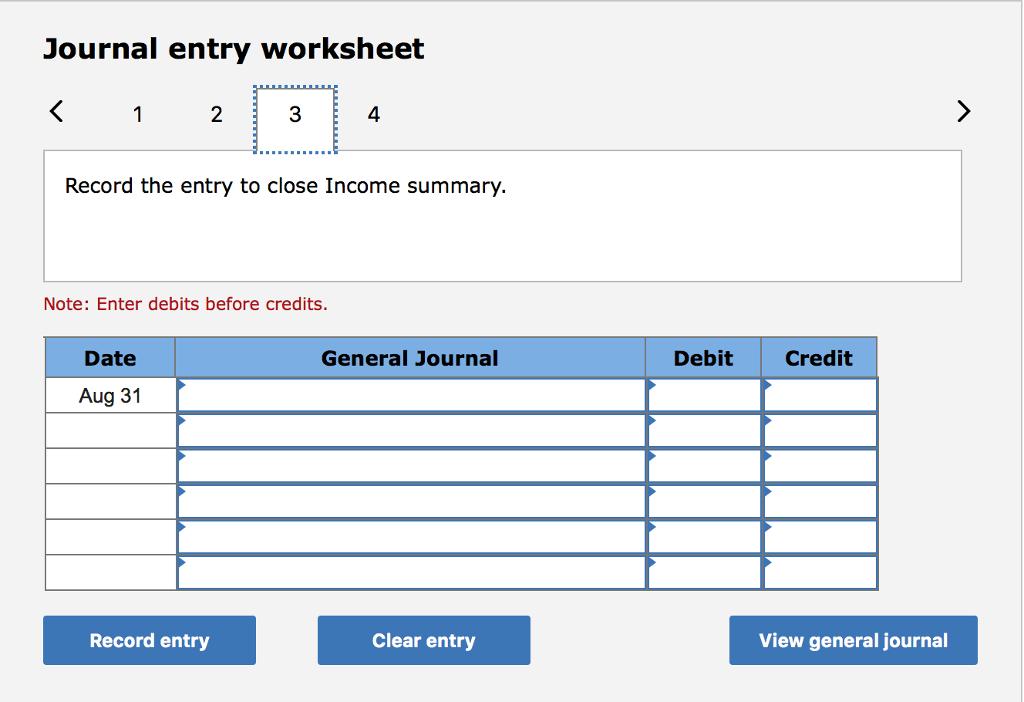

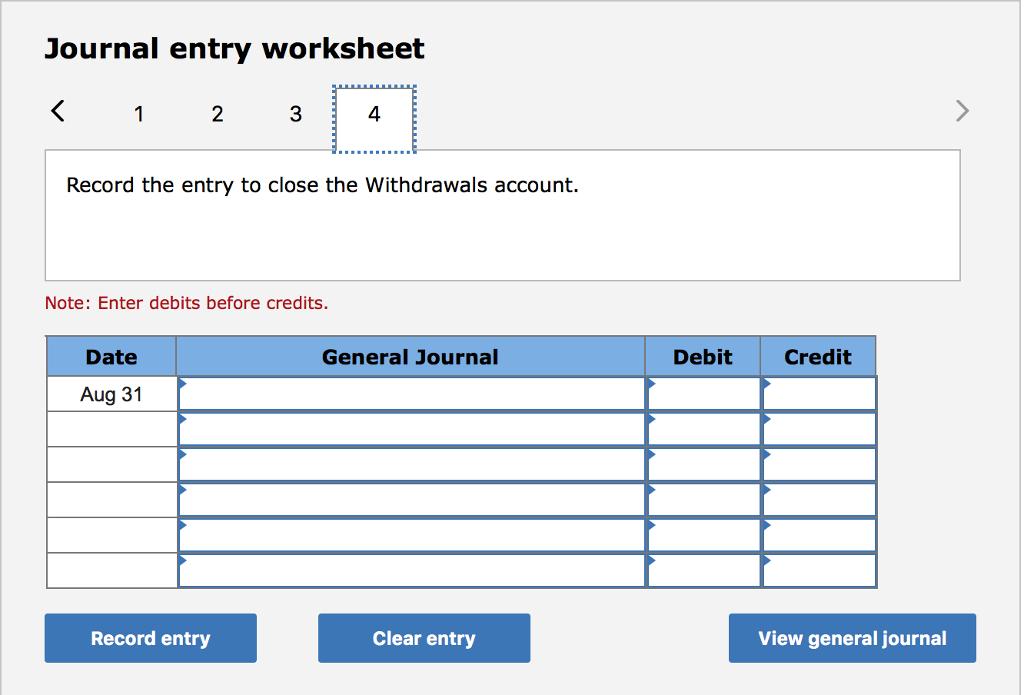

1. Prepare closing entries as of August 31, 2017 (the perpetual inventory system is used).

Here are the options:

Accounts payable

Accounts receivable

Accumulated depreciation

Additional paid-in capital

Advertising expense

Bond premium

Bonds payable

Building

Cash

Cost of goods sold

Delivery expense

Depreciation expense

Discount on bonds payable

Goodwill

Income summary

Interest expense

Interest income

Interest payable

Interest receivable

Inventory

K. Valley, Capital

K. Valley, Withdrawals

Land

Merchandise inventory

Miscellaneous expenses

Office salaries expense

Office supplies expense

Rent expense—Office space

Rent expense—Selling space

Sales

Sales discounts

Sales returns and allowances

Sales salaries expense

Store supplies expense

Merchandise inventory Other (noninventory) assets Total liabilities K. Valley, Capital K. Valley, Withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense Office salaries expense Rent expense-Office space Office supplies expense Totals Debit $ 41,000 44,710 8,100 2,290 13,000 73,800 31, 200 8,900 1,800 13,000 29,600 3,500 500 $271,400 Credit $ 24,600 20,200 226,600 $271,400

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Closing entries as of August 31 2017 the perpetual inventory system are as follows a Record the en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started