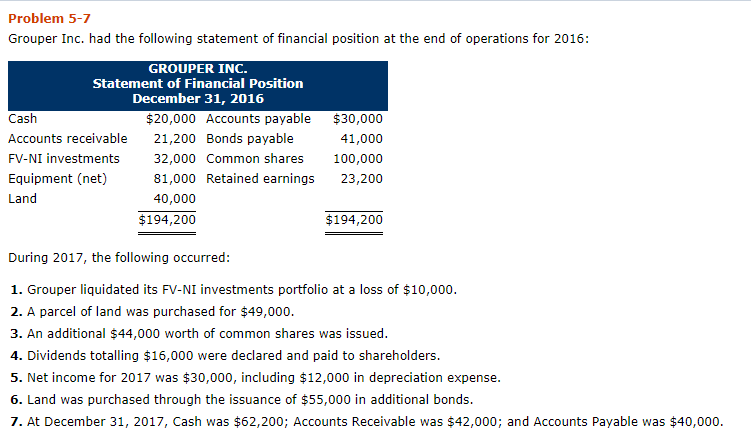

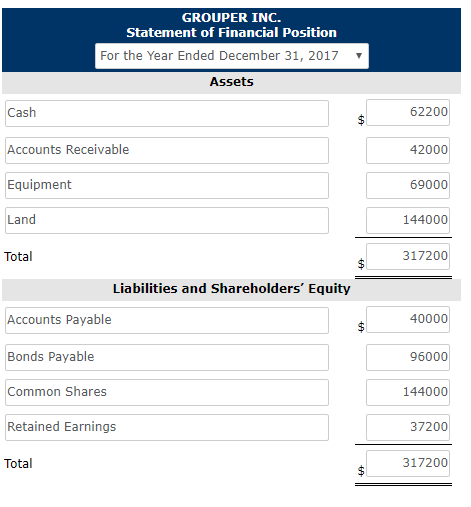

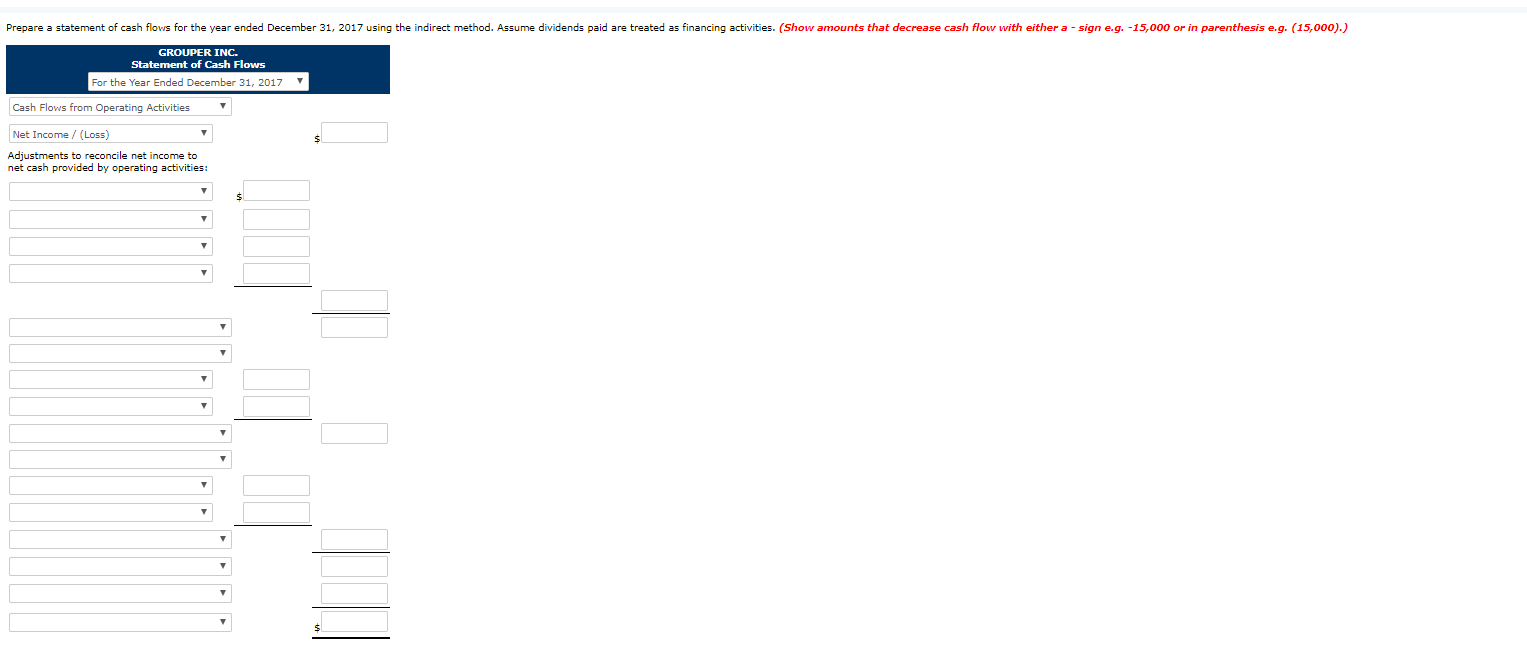

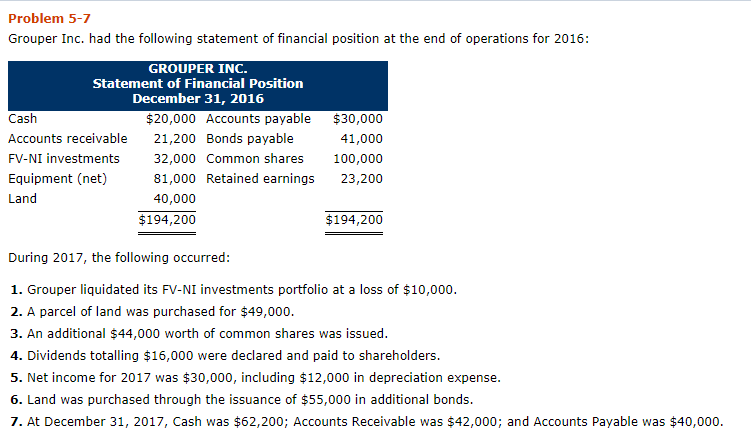

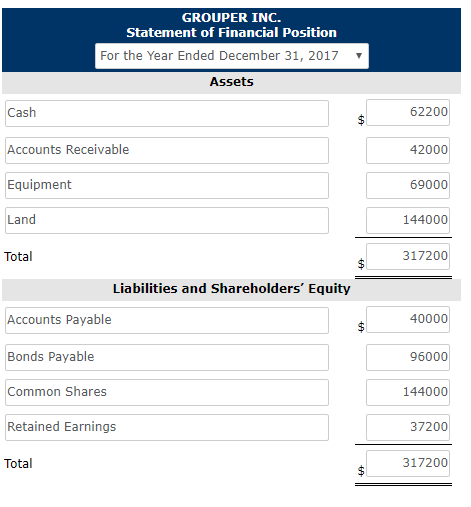

Problem 5-7 Grouper Inc. had the following statement of financial position at the end of operations for 2016: GROUPER INC. Statement of Financial Position December 31, 2016 Cash $20,000 Accounts payable Accounts receivable 21,200 Bonds payable FV-NI investments 32,000 Common shares Equipment (net) 81,000 Retained earnings Land 40,000 $194,200 $30,000 41,000 100,000 23,200 $194,200 During 2017, the following occurred: 1. Grouper liquidated its FV-NI investments portfolio at a loss of $10,000. 2. A parcel of land was purchased for $49,000. 3. An additional $44,000 worth of common shares was issued. 4. Dividends totalling $16,000 were declared and paid to shareholders. 5. Net income for 2017 was $30,000, including $12,000 in depreciation expense. 6. Land was purchased through the issuance of $55,000 in additional bonds. 7. At December 31, 2017, Cash was $62,200; Accounts Receivable was $42,000; and Accounts Payable was $40,000. GROUPER INC. Statement of Financial Position For the Year Ended December 31, 2017 Assets Cash 62200 Accounts Receivable 42000 Equipment 69000 Land 144000 Total 317200 Liabilities and Shareholders' Equity Accounts Payable 40000 Bonds Payable 96000 Common Shares 144000 Retained Earnings 37200 Total 317200 Prepare a statement of cash flows for the year ended December 31, 2017 using the indirect method. Assume dividends paid are treated as financing activities. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) GROUPER INC. Statement of Cash Flows For the Year Ended December 31, 2017 Y Cash Flows from Operating Activities Net Income / (Loss) Adjustments to reconcile net income to net cash provided by operating activities: Calculate the current and acid test ratios for 2016 and 2017. (Round answers to 2 decimal places, e.g. 52.75.) 2017 2016 Current ratio Acid test ratios SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT Calculate Aero's free cash flow and the current cash debt coverage ratio for 2017. (Round current cash debt coverage ratio to 2 decimal places, e.g. 52.75. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Free cash flow Current cash debt coverage ratio SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT