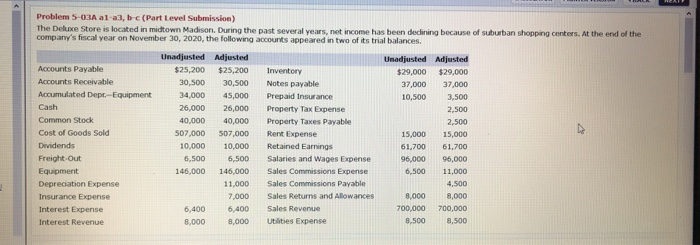

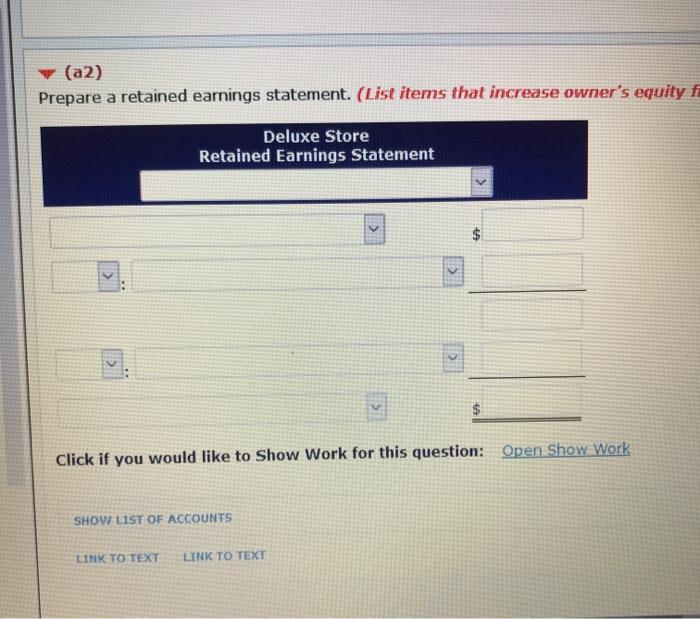

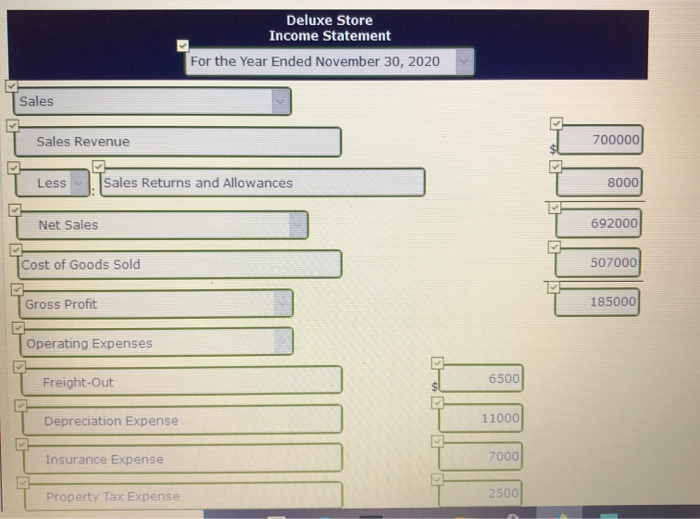

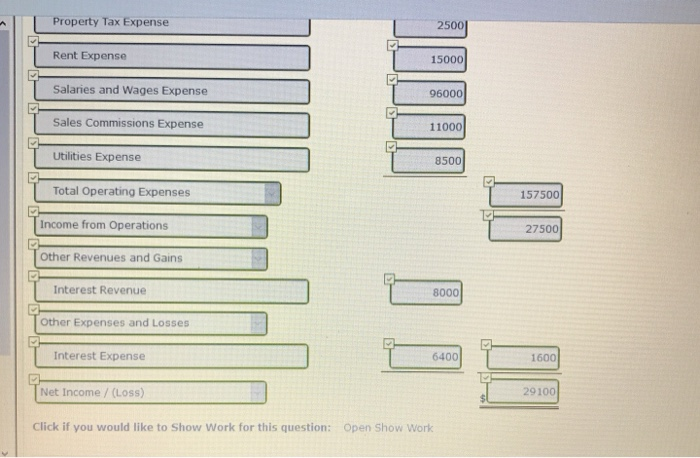

Problem 5-OTA al alb (Part Level Submission) The Deluxe Store is located in midtown Madison. During the past several years, net income has been decirung because of suburban shopping centers. At the end of the company's fiscal year on November 30, 2020, the following accounts appeared in two of its trial balances Umadjusted Adjusted Unadjusted Adjusted Accounts Payable $25,200 $25,200 inventory $29,000 $29,000 Accounts Receivable 30,500 30,500 Notes payable 37,000 37,000 Accumulated Depr.-Equipment 34,000 45,000 Prepaid Insurance 10,500 3.500 Cash 25,000 26,000 Property Tax Expense 2.500 Common Stock 40.000 40.000 Property Taxes Payable 2,500 Cost of Goods Sold 507,000 507,000 Rent Expense 15,000 15,000 Dividends 10.000 10.000 Retained Earnings 61,700 61,700 Freight-Out 6,500 6,500 Salaries and Wages Expense 96.000 96,000 Equipment 146,000 146,000 Sales Commissions Expense 6.500 11,000 Depreciation Expense 11,000 Sales Commissions Payable 4.500 Insurance Expense 7,000 Sales Returns and Allowances 8.000 3.000 Interest Expense 6.400 6,400 Sales Revenue 700,000 700,000 Interest Revenue 8.000 8.000 Utilities Expense 8.500 8,500 v (a2) Prepare a retained earnings statement. (List items that increase owner's equity f Deluxe Store Retained Earnings Statement Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Deluxe Store Income Statement For the Year Ended November 30, 2020 Sales Sales Revenue 700000 | Less Sales Returns and Allowances 8000 Net Sales 692000 Cost of Goods Sold 507000 Gross Profit 185000 Operating Expenses Freight-Out 6500 Depreciation Expense 11000 Insurance Expense T 7000 Property Tax Expense 2500 Property Tax Expense 25001 Rent Expense 15000 | Salaries and Wages Expense 960001 Sales Commissions Expense 11000 | Utilities Expense Expense 8500 Total Operating Expenses 157500 Income from Operations 27500 Other Revenues and Gains Interest Revenue 8000 Other Expenses and losses Interest Expense 1600 Net Income / (Loss) 29100 Click if you would like to Show Work for this question: Open Show Work