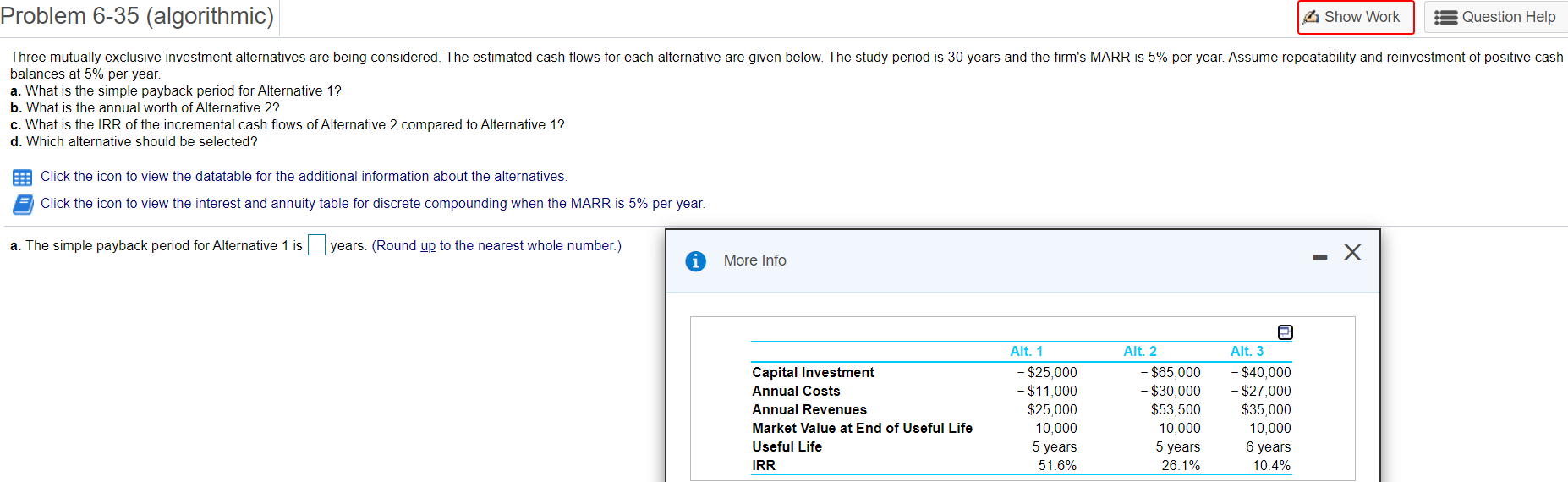

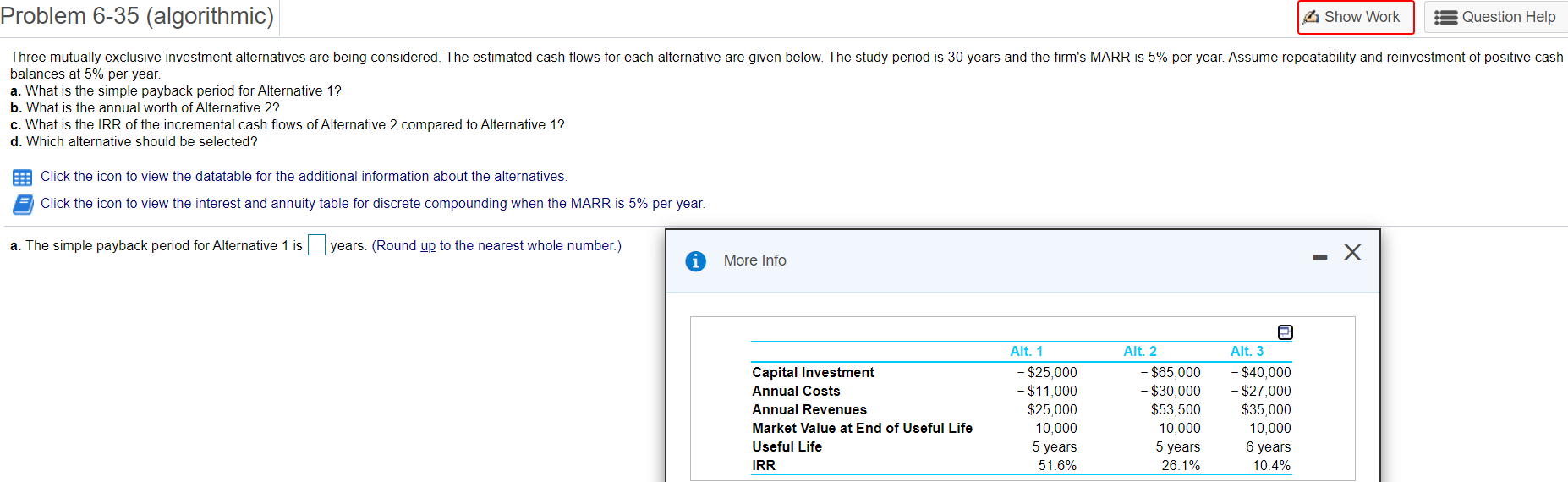

Problem 6-35 (algorithmic) Show Work Question Help Three mutually exclusive investment alternatives are being considered. The estimated cash flows for each alternative are given below. The study period is 30 years and the firm's MARR is 5% per year. Assume repeatability and reinvestment of positive cash balances at 5% per year. a. What is the simple payback period for Alternative 1? b. What is the annual worth of Alternative 2? c. What is the IRR of the incremental cash flows of Alternative 2 compared to Alternative 1? d. Which alternative should be selected? Click the icon to view the datatable for the additional information about the alternatives. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 5% per year. a. The simple payback period for Alternative 1 is years. (Round up to the nearest whole number.) More Info Capital Investment Annual Cos Annual Revenues Market Value at End of Useful Life Useful Life IRR Alt. 1 - $25,000 $11,000 $25,000 10,000 5 years 51.6% Alt. 2 - $65,000 $30,000 $53,500 10,000 5 years 26.1% e Alt. 3 - $40,000 - $27,000 $35,000 10,000 6 years 10.4% Problem 6-35 (algorithmic) Show Work Question Help Three mutually exclusive investment alternatives are being considered. The estimated cash flows for each alternative are given below. The study period is 30 years and the firm's MARR is 5% per year. Assume repeatability and reinvestment of positive cash balances at 5% per year. a. What is the simple payback period for Alternative 1? b. What is the annual worth of Alternative 2? c. What is the IRR of the incremental cash flows of Alternative 2 compared to Alternative 1? d. Which alternative should be selected? Click the icon to view the datatable for the additional information about the alternatives. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 5% per year. a. The simple payback period for Alternative 1 is years. (Round up to the nearest whole number.) More Info Capital Investment Annual Cos Annual Revenues Market Value at End of Useful Life Useful Life IRR Alt. 1 - $25,000 $11,000 $25,000 10,000 5 years 51.6% Alt. 2 - $65,000 $30,000 $53,500 10,000 5 years 26.1% e Alt. 3 - $40,000 - $27,000 $35,000 10,000 6 years 10.4%